What if ETH had a fee burn 5 years ago?

Cartesi - Build app-specific rollups with Web2 tooling!

Cartesi - Build app-specific rollups with Web2 tooling!

Level up your open finance game five times a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

To celebrate Ethereum’s 5th we ran a fun experiment.

The scenario: how would Ethereum issuance look if Ethereum had a fee burn similar to the one described in EIP 1559 starting 5 years?

More than a fun exercise…this is a glimpse into the future. While EIP 1559 is slowly moving toward implementation in Eth1, a version EIP 1559 with fee burn will be present in Eth2 at the start.

Which could eventually result in something very interesting.

ETH with negative issuance.

A commodity money that gets more scarce as its underlying economy is used.

More trustless economic bandwidth for Ethereum? We think so.

So happy 5th Birthday Ethereum! 🎂

And…just as important…happy 5th Birthday Ether!

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

THURSDAY THOUGHT

Guest Post: Lucas Campbell, Analyst for Bankless and Growth for DeFi Rate

The Case for Negative ETH Issuance

EIP 1559 is one of the most highly anticipated changes to the Ethereum Economy.

In short, every time a transaction on Ethereum is executed, a portion of the transaction fee is burnt in ETH. This does two key things for ETH as an asset:

- It cements ETH as the network’s reserve asset and prevents any sort of economic abstraction for paying fees

- It effectively creates a universal dividend to all ETH holders when demand for the network is high.

So rather than paying validators all transaction fees (because they’re subsidized with issuance instead), fee burns ultimately pay all ETH holders equally as every holder’s percentage share of the network increases.

And while EIP 1559 has its economic benefits, it has much broader implications that make this implementation so elegant.

The most important piece is the UX improvements in gas management. EIP 1559 creates a “market rate” for block inclusion known as the BASEFEE. The BASEFEE improves the user experience as people no longer have to worry about how much to pay in gas. Instead, everyone automatically pays the BASEFEE depending on demand for blockspace at that time. If you want to jump the line, you can tip the validators to process your transaction first.

Equally as important, EIP 1559 adds to the security of the network.

Rather than relying on transaction fees as the primary revenue source, having native issuance gives validators a reliable revenue stream in perpetuity in return for securing the network. Additionally, in Ethereum 2.0, the scarcity increase from fee burns also adds value to ETH. And the more valuable ETH is, the more secure the network becomes under PoS as it requires more capital to attack the network.

So at the end of the day, the implementation of EIP 1559 serves as a critical piece to the Ethereum Economy. It improves UX, security, creates equitable profit sharing, and cements ETH’s core value proposition as the network’s reserve asset. We even consider it the final piece to the puzzle.

While the community is patiently waiting for EIP 1559, which has a strong chance of appearing in Eth 1.x, it’s interesting to consider it’s past implications on the supply schedule. So what better way to celebrate Ethereum’s 5th birthday than to see the hypothetical impact of one of the most anticipated mechanisms for the Ethereum ecosystem.

Let’s get into it.

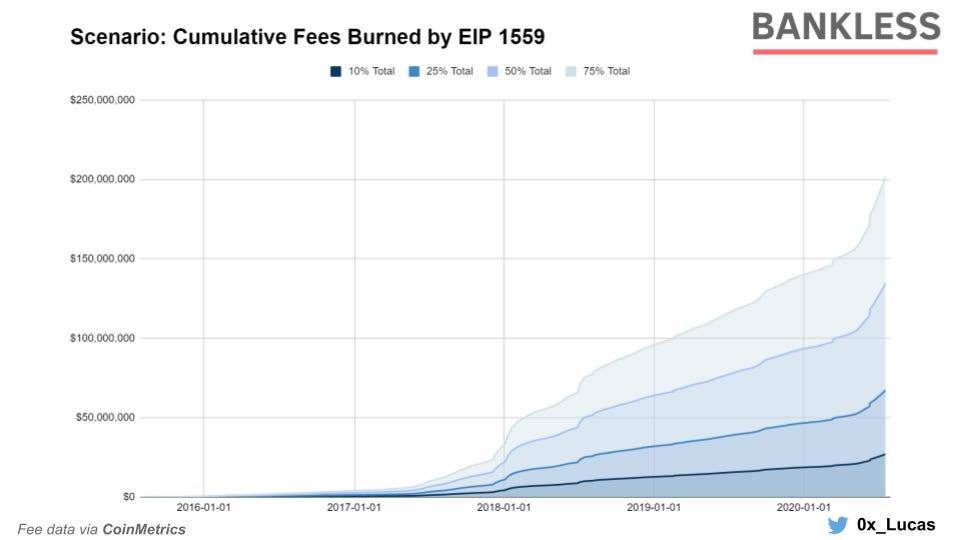

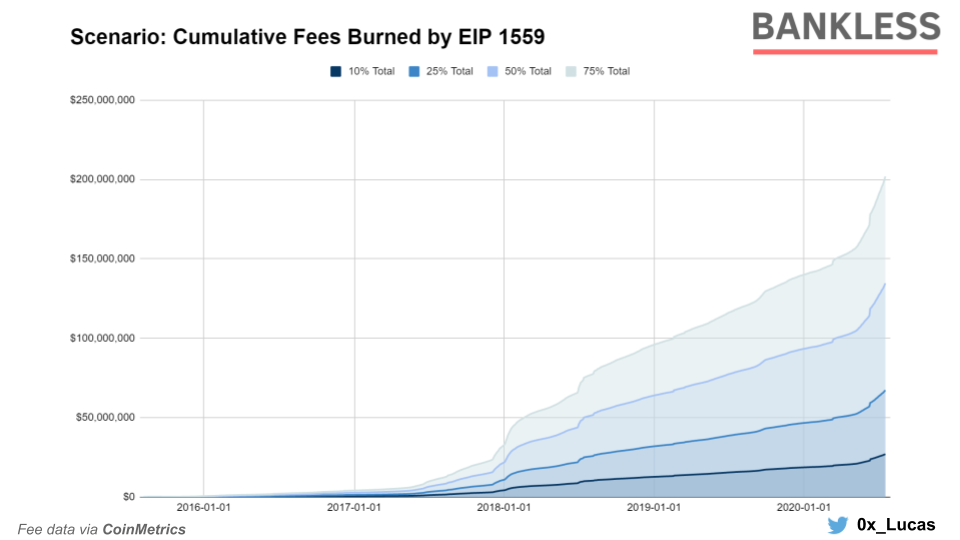

Up to $259m would have been burned in ETH1? 😯

It’s important to recognize that EIP 1559 is fairly nuanced as the BASEFEE adjusts based on congestion. Therefore, it’s a bit complicated to model actual historical burns for the amount of time I have right now (which is not much). So for simplicity’s sake, we’ll just take a basic look by asking “what if x% of total fees were burned”.

💰 All USD Prices are calculated at an ETH price of $315.

ETH Burned from EIP 1559 based on assumed percentages. Data via CoinMetrics

Since inception, Ethereum transaction fees have generated over $288M in revenue to miners at today’s prices.

If 10% of all transaction fees were burned, Ethereum would have paid out $28.8M to holders via burns (~92,800 ETH). Not much, but it’s honest work.

If we bump that burn rate up to 25% of all transaction fees ever paid, we’re now looking at $72.1M or 229,000 ETH in total burned. Still a negligible amount.

But the current plan is for the BASEFEE to represent a majority of the fees paid. So how about 50% of all fees paid? Now we’re looking at $144.2M in total burns or 0.39% of ETH’s market cap.

Ok - not mind-blowing, but we’re getting somewhere. 75% of all transaction fees burns? It results in $216M in precious ETH burnt and gone forever.

Finally, if you want to be really optimistic and speculate that 90% of all transaction fees would be burned under EIP 1559, it would end up with $259M or 824,500 Ether in the Nether (you see what I did there?).

ETH feeding into The Nether (Minecraft) to be burned, never to return again

Future burn rate of $132m per year? 🤯

Ok - so this doesn’t really sound like much. In the best case scenario, we’re looking at 0.74% of all ETH burned since inception with the implementation of EIP 1559.

But guess what? A substantial amount of the fees generated have been in 2020. The demand for Ethereum’s blockspace has never been higher as people are paying a substantial premium in order to access any of the attractive opportunities available in DeFi.

This year alone accounts for 35.3% of all fees earned since inception as Ethereum is averaging nearly $500K in revenue per day. At the average rate of 1,534 ETH in daily transaction fees, the network is on track to generate $176M in annualized revenue to miners (but will probably distribute way more as the rate has increased substantially in the past 90 days).

If 75% of that was burned, the next year alone would result in $132M in ETH burned, nearly half of all transaction fees ever paid since inception or ~0.5% of the total supply.

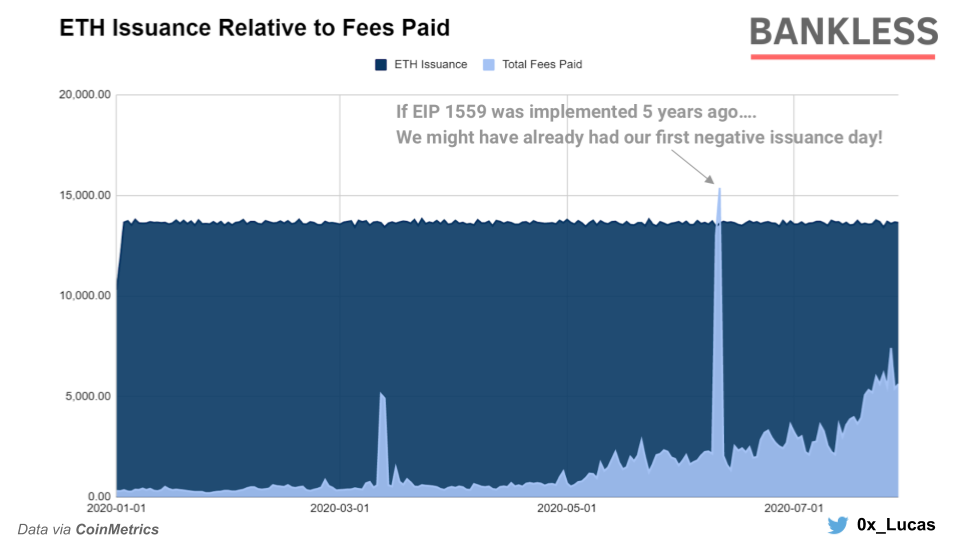

Above ETH issuance relative to transaction fees paid in 2020. Data via CoinMetrics

Let’s take a more granular look.

In July 2020, roughly 394,881 ETH was generated through issuance while 115,634 ETH was paid out to miners, driving transaction fees to account for ~30% of the issuance. This means that at the 75% target burn rate, 21.9% of Ether’s current issuance would be eaten up by usage via EIP 1559 as calculated by July’s usage.

Let me repeat...

If every month was like July then 22% of future annual issuance would have been burnt in Eth 1.x.

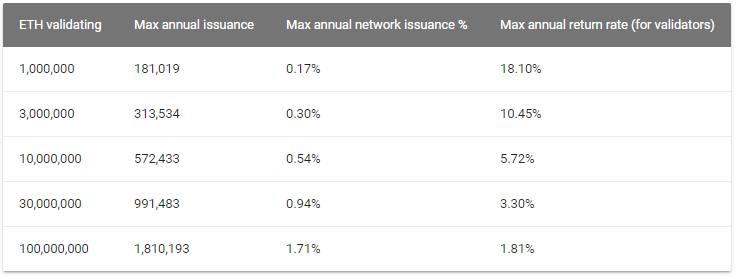

Negative .06% Issuance in Eth2? 😱

The cherry on top here is that issuance drops a substantial amount in Ethereum 2.0.

In the above scenario, where 115.6K ETH is paid out to miners/validators per month and a 75% burn rate, Ethereum would be burning over 1M ETH per year - enough to eat the annual issuance rate if 30M ETH is staked in the network.

Boom. Negative issuance rate.

Not fixed cap...Ether supply actually getting smaller each year.

Table via EthHub

How fun was that?

While fees accrued since inception seem relatively marginal, Ethereum has been kicking into high gear as DeFi and yield farming drives a premium for blockspace.

In our blue skies and sunshine scenario, there’s a strong case for a negative issuance rate when we factor in current demand for blockspace and future issuance under proof of stake.

The model isn’t perfect. It’s overly simplistic and it could be better. But hopefully, this serves as a basic thought experiment on the future implications of EIP 1559 on the day of Ethereum’s 5th year in existence.

Happy Birthday, Ethereum. Here’s to the next 5! 🎂

Action steps

Consider what it would require for EIP 1559 to drive a negative issuance rate

Research EIP 1559 with previous Bankless readings

Author Bio

Lucas Campbell is an Analyst for Bankless and leads Growth at DeFi Rate. Lucas also engages in token economic & DAO advisory via 🔥_🔥 Raid Guild.

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.

Lucas Campbell

Lucas Campbell