The wild future of synthetic assets

Dear Bankless Nation,

No one could have predicted unboxing videos, Twitch Streams, or literally anything that goes viral on TikTok (including investment advice 🌶️)

But this is what happens when you democratize content creation. Before the internet, if you wanted to create a video or a movie, you needed a production studio. Wanted to write something? You needed a publisher.

You had to be big to make it big.

But the internet drove content creation costs virtually to zero. Anyone with a phone could now create a video, upload it, and that content could be distributed to millions of people—no production studio required.

What the internet did to content, crypto is doing to assets.

DeFi democratizes the creation of financial assets. Before crypto, creating a financial asset was gatekept by banks and institutions. You needed millions of dollars to launch a new asset. No longer!

Like the internet, DeFi drives the cost of asset issuance and distribution toward zero. A teenager could build the next multi-billion dollar synthetic from their college dorm room.

And what if the asset you build makes it big? What if it goes viral?

What does the world look like when anyone can build a new financial asset? What strange things might people start adding to their portfolios?

Maybe you’d want price exposure to Bankless twitter follower count?

Let’s peer into the future and see what’s possible. Hart explores today.

- RSA

P.S. Dharma is a step towards this future—deposit money from U.S. bank accounts directly into DeFi in a few mins. Why have your money earning nothing when you can earn >8%??

TOKEN THURSDAY

Guest Writer: Hart Lambur, Founder of UMA Protocol

Inventing New Sh*t: The Case For Long-Tail Synthetic Assets

TDLR: After defining what a synthetic asset is, I argue that synthetic assets will allow DeFi to invent "new shit" that’s impossible in TradFi. In the same way YouTube allowed new forms of long tail video content to flourish (think unboxing videos, or Twitch streams), synthetic assets will enable new types of financial products we haven't even imagined yet.

A common question we get asked at UMA is how to define a "synthetic asset".

On the Bankless podcast earlier this year, David, Ryan and I fleshed out a simple model: synthetic assets are alchemy. Synthetics convert one asset type into another.

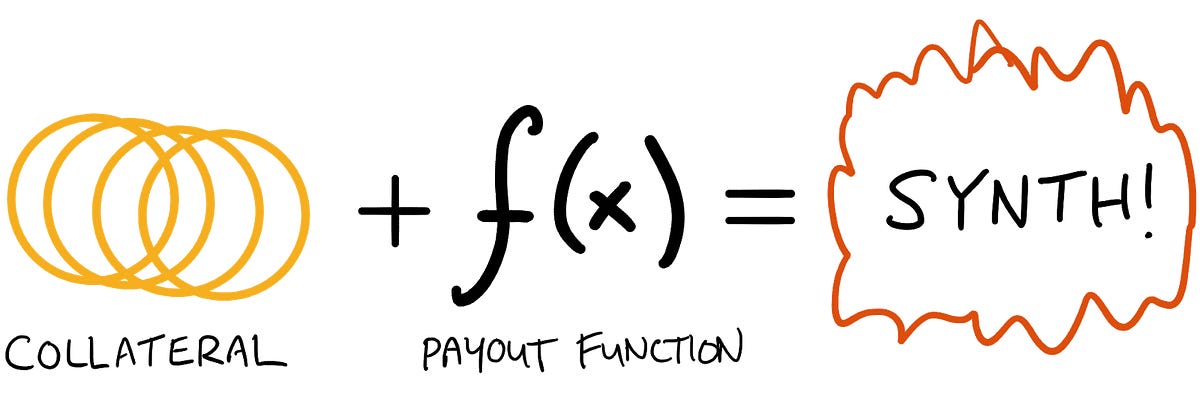

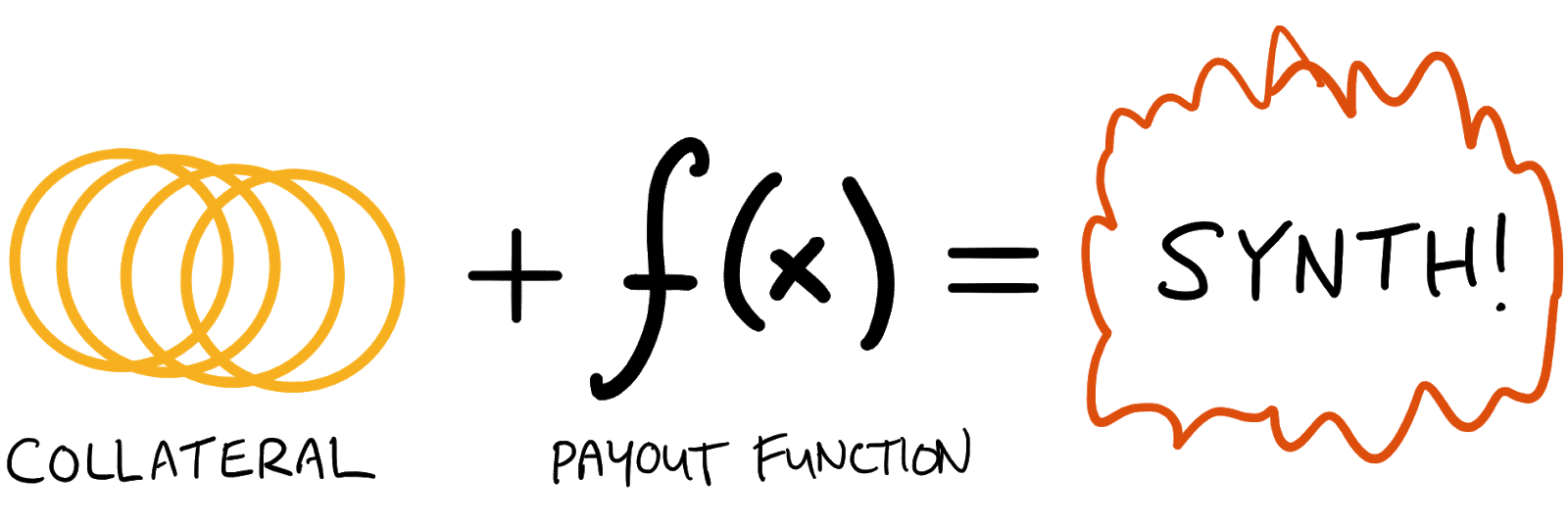

Specifically, this alchemy process looks like:

It boils down to this: collateral combined with a payout function creates a synthetic asset. For example, this is a what Maker's DAI looks like:

When you step back and generalize this concept, it becomes insanely powerful. What happens if you take ANY collateral and ANY arbitrary payout function?

Well you can make a synthetic asset for ANYTHING.

In other words: ANY Collateral + ANY Payout Function = ANY Synthetic Asset

Some examples of synths

Want to build synthetic gold? Easy.

- Collateral (USDC) + Payout Function (USDC * 1oz gold) = Synthetic Asset ($GLD)

Token to track Bankless Twitter followers? Sure.

- Collateral (USDC) + Payout Function (USDC * Number Bankless Twitter followers) = Synthetic Asset ($BNKLES)

Synthetic NFT index tracking token? Done.

- Collateral (ETH) + Payout Function (ETH * NFT Index Value) = Synthetic Asset ($NFTINDEX)

This is the true power of synthetic assets on Ethereum—you can literally create a financial asset for anything. This was an actual real explosion that occurred on the livestream when Ryan fully absorbed this information:

What makes this possible?

The magic trick in this alchemy process lives in what I've called the "payout function" above. The payout function is what defines your synthetic asset, which means your ability to create any possible synthetic asset is limited only by what this payout function can spit out.

This is where the UMA protocol shines—UMA allows developers to define pretty much any payout function they can dream up.

This is because UMA contracts are written "pricelessly," meaning that no on-chain price data is required. UMA's design only requires on-chain price data when there is a "dispute"—which is very rare. (Fun fact: in the 10 months that UMA has been live, we've only experienced 6 disputes, which means only 6 on-chain price requests have been required to secure >$200mm in TVL).

In other words, UMA lets you define pretty much any arbitrary payout function, without needing to push any data to the blockchain. This means you can build pretty much any type of synthetic asset in an afternoon.

Synths built today and synths you could (should) buidl

I like to group synthetic assets into four categories. The fourth category is the wildcard category because there are things being built that surprise me every day.

1) Stablecoin or stablecoin related synthetics

Maker's DAI is a synthetic asset designed to track $1. All non-fiat backed stablecoins also fall into this bucket, including the recent waves of algorithmic stablecoins (ESD, FEI, RAI, etc). These types of synthetic stablecoins have obvious utility that many people in crypto care about and have significant demand today.

A similar (but not identical!) product is zero-coupon bonds, also known as yield dollars. To follow the format above, they look something like this:

- Collateral (ERC20 Asset) + Payout Function (USD / ERC20 ASSET) = Synthetic USD

The result of creating synthetic dollars is that you take any collateral type and allow users to borrow against it.

This is a powerful way to enable lending on ERC20 assets: For example, the team at BadgerDAO is using UMA synths to build CLAWS, a synthetic asset that is backed by Badger vaults. This enables Badger stakers to borrow against their holdings. These products can be built backed by LP tokens, vault tokens, or really any ERC20 token out there.

2) Crypto Related

I define "crypto related" synthetics as products that help users trade, hedge, and lever crypto exposure.

My favorite example: call options on altcoins. UMA has been used to create call options on $UMA, $BAL, $UNI, and $xSUSHI. The applications here are pretty endless, and I expect demand for these option types to grow significantly as volatility markets in altcoin develop.

Another is BTCDOM. Domination.finance launched this product which allows you to express a position on the relative dominance of Bitcoin compared to the rest of the market. One more to consider is uGas by Degenerative.finance (a brand by YAM finance) which lets you hedge against Ethereum network gas costs.

Another wild example: ethVIX. Using UMA, you can buy a token that tracks Ethereum volatility.

I also lump synthetic crypto in this bucket, like a synthetic version of Bitcoin on Ethereum. Many existing approaches (like renBTC, WBTC) rely on locking up actual bitcoin, but it's completely possible to create a fully synthetic BTC or other crypto coin.

An example here is the YouMyChicFila team created Mario.cash, which is fully synthetic Bitcoin Cash on Ethereum.

3) Real-world synthetics

Synthetic assets are often associated with real-world assets: aka synthetic gold, synthetic crude oil, or synthetic S&P 500. Many people get really excited about this idea of bringing traditional investment products onto the blockchain this way.

My hot take: I think real-world assets are kind of boring.

People in crypto today don't actually care about trading gold on the blockchain—anything that moves less than 10% per day is just too stable for today’s degens. Exceptions are examples like uSTONKS by the Yam Finance team: this is a token that tracks the top 10 stocks on Reddit's WallStreetBets.

4) "Other things"

This is where things get fun. My view is that synthetic assets will empower builders to invent new sh*t that just doesn't exist in traditional finance.

Consider what YouTube has done for content creators. Before YouTube, producing a film or tv show was absurdly expensive. You had to be a Hollywood studio. YouTube made it cheap for users to distribute their own videos, which spawned an entire long tail of video content that never previously existed.

No one could have predicted that unboxing videos or Twitch streams would have been a thing, or really anything that goes viral on TikTok these days. User generated content invented some new shit that no one could have guessed.

YouTube is open and permissionless. In no universe would a Hollywood studio have come up with these shows that capture millions of eyes. This kind of entertainment is “emergent,” which is to say that no single top-down entity could have created it.

My view is that the same thing will happen with DeFi and synthetic assets. UMA and other DeFi protocols makes the cost of building a financial asset < $1k. This compares to the millions and millions of dollars it costs Wall Street banks to launch new financial products.

This sets the stage for "user generated financial products.” Builders in this space will invent new sh*t that we can't predict today.

Here are some wilder ideas that I’ve thought about:

- Tokens to track important crypto metrics like the total value locked in DeFi, or the total market cap of all NFTs.

- Tokens to incentivize collective action, especially between governments and citizens. I previously suggested creating a token to track human excrement sightings in San Francisco. The idea: the city of SF could issue "shit coins" to credibly commit to fixing the homelessness problem (and earn a profit if they succeed); residents of the city of SF could buy shit coins as an "emotional hedge" and make money if the problem gets worse. Could “collective action” tokens be used to combate rainforest deforestation, ocean pollution, or other tricky global problems? I’d love to try.

- Tokens to incentivize Covid vaccines. A casino in Vegas is paying out up to $1mm if 80% of their staff received a vaccine by May 1. The DeFi version of this could be built with a KPI option token.

- Tokens to incentivize hiring and referrals. UMA recently launched a “talent referral options” program where the referrer receives a token that pays out $25k if their referral joins the UMA core dev team and stays for 1 year. It is an attempt to decentralize recruiting.

Innovation is what I get most excited about.

If the costs of building a financial product are close to zero, what will the internet dream up?

I’m excited to find out.

Want to build a synthetic? Join UMA’s Discord at http://discord.umaproject.org or ping me on Twitter @hal2001

Action steps

- Brainstorm some crazy synthetic assets

- Start building new financial assets on UMA

Author Bio

Hart Lambur is the founder of UMA Protocol, a synthetic asset protocol built on Ethereum. He previously founded Openfolio and traded at Goldman Sachs before jumping into the world of crypto and DeFi.

Bankless

Bankless