The Token Maximalist Thesis

Cartesi - Build app-specific rollups with Web2 tooling!

Cartesi - Build app-specific rollups with Web2 tooling!

Level up your open finance game five times a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

I love to hear other investors articulate their core thesis.

It helps me sharpen my own thoughts.

The token maximalist thesis from Lasse and Christopher is one such thought-sharpener. They describe it today in their words.

You may find elements here you agree with. Maybe some elements you don’t. That’s perfect. The exercise today is to critically parse through another investor’s view of the world. Weigh it against your own mental models of crypto.

That’s how you level-up.

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

Writer’s Corner

Guest Writers: Lasse Clausen and Christopher Heymann Founding Partners of 1kx

The Token Maximalist

I’m sure many of you know what Blockchains are, but allow me to quickly summarize again to help us establish our thesis.

Blockchains are actually a simple technology. A blockchain is just a database.

But anyone can download a copy and participate...

...and the participants agree on how entries are added to the database.

Additionally, the entire system is open, transparent, and can be inspected and verified by anyone, at any time. This is important because the result is trust:

The verifiability of the system establishes trust that the system undeniably does what it says it does, and the consensus of participants about the information in the database establishes an unquestionable truth.

And for some perspective on how important trust is for society: 35% of US employment is to establish trust (attorneys, law enforcement, auditors, etc.). If you were to extrapolate that to global GDP, you get a somewhat imperfect but still a meaningful $28tn opportunity.

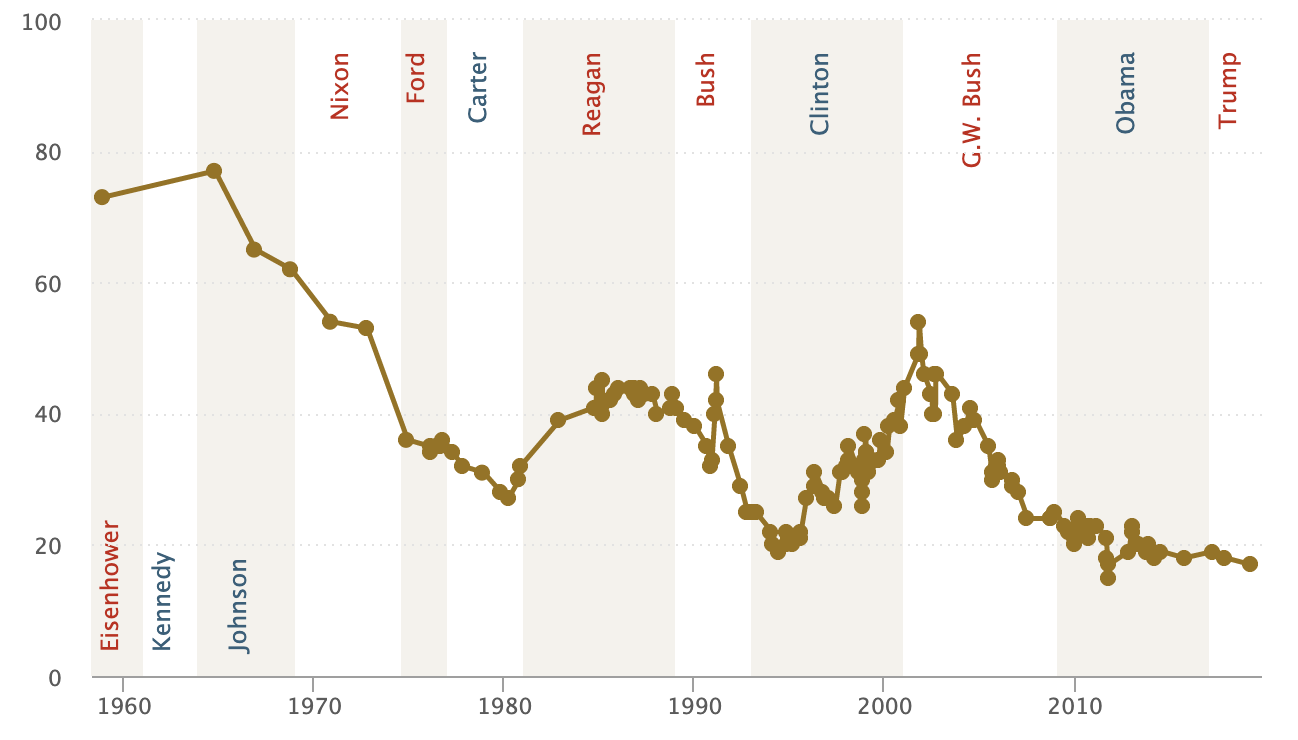

And we believe the market for trust is up for grabs. Trust in governments is at historic lows. Trust in media plunged to all-time lows. Trust in NGOs and business is declining. Only 15% of citizens globally believe that the current system is working.

(Above) Public Trust in US Government by PEW Research Center 2019

If you think about Trust, Trust is omnipresent, intangible and affects almost every aspect of society and commerce.

Imagine: How much blind trust is assumed just in everyday life? Take traffic light crossings as an example. You trust your life that traffic light technology always works. You trust that the 30 other people around you obey the system exactly as expected too.

How much trust is involved when eating in a restaurant? You trust that health and hygiene regulations are enforced in the restaurant and all the way through the supply chain.

And the delicate balance of trust is far bigger than food poisoning. It was only ten years ago, when trust in the financial system broke down, pushing the global economy to the brink of collapse.

Currently, the world is witnessing what happens when trust in one’s government breaks down as in Venezuela, Hong Kong, and Chile.

Now because trust is so omnipresent yet intangible, and the feature of blockchains is trust, there are seemingly limitless applications and outcomes from applying blockchain technology to a number of different industries. Which also means that there is a lot of confusion.

You've probably noticed, blockchain means a lot of different things to a lot of different people.

Below we will outline the core themes that excite us most about what we call “crypto”, and we’ll go into a bit of depth afterward with sector examples.

The Internet Of Value

One of our investment themes is the internet of value.

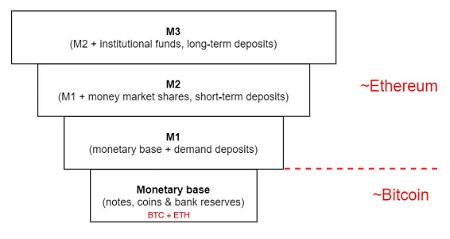

The value of money is based on trust. And since we now have systems that can create trust, these systems can also create money. These types of new money are now programmable and connected in an internet of value.

Incentives

Programming incentives into blockchain networks can have a powerful effect on behavior. One of the most impactful innovations in human history was the limited liability corporation, which redefined incentives.

I can now run a business while reducing the risk of that venture to the sum of my explicit investment in that venture, whereas before angry customers could burn down my house and everything else I owned. And that subtle change in incentives changed how the world worked, the dominant form of organization in the world today is the limited liability company.

Likewise, we can now program incentives and therefore desired behavior into a network. This is very powerful...

Digital Cooperatives

...because it has enabled the biggest business model innovation for networks since the beginning of the limited liability corporation.

To take a step back, we actually think that the incentive structure of a for-profit company is fundamentally flawed. Take Uber for example: Their main goal is to charge the passenger as much as possible while paying the drivers as little as possible. The incentives of the stakeholders are directly opposed.

Blockchain or “crypto” networks establish a non-profit foundation, rather than a for-profit company. Access to use the network as a customer, or the right to work as a supplier, is represented in a digital token, which itself is also an investable and tradeable asset.

This business model has the potential to be better than free because the token may appreciate in value and grant voting rights and therefore some sovereignty over important decisions that could have serious consequences for the stakeholders.

So, it’s worth emphasizing, these crypto networks are not companies. And we actually have statements from the SEC that they understand and acknowledge this concept of decentralized networks. Namely when they declared that Ethereum is not a security (essentially meaning it’s not a company) because of its decentralization.

This new “token business model” allows these blockchain networks or protocols to operate without proprietary assets: in fact, in order to create the required trust for the network, the asset/codebase actually must be open-source, transparent and inspectable.

That also means that the network (or business) is built once and re-used by thousands because anybody can take open source code and copy it for their own use.

Imagine anyone could have taken Uber’s technology from day 1, innovated on it, and created a thousand other transportation networks. Every village would have its own ridesharing service without Uber and Lyft pocketing $3bn a year from the system.

Open Source Innovation 🚀

Open source explains why innovation is occurring in crypto at a speed unlike anything before.

In the “legacy economy”, consider how many companies are currently working in parallel on duplicate/competitive products and technologies, behind closed doors. What a colossal waste of resources. Again, in crypto, it’s built once, and then anybody else can reuse it, learn from it and innovate on it.

Some Specific Sectors

Now I’d like to go into some more specific sectors that are starting to emerge within the crypto economy.

Open Finance (DeFi)

With open finance, also called “DeFi” for decentralized finance, we are seeing the emergence of a frictionless global financial ecosystem with near-zero tx costs, open-source financial instruments, and zero intermediary fees.

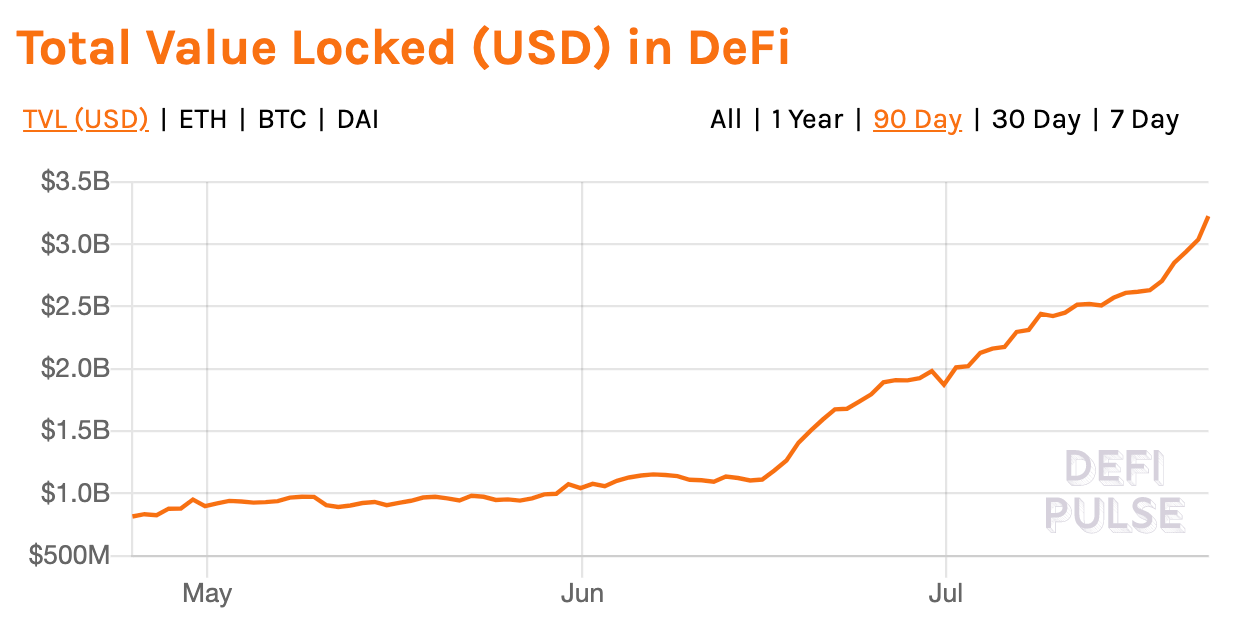

This financial system grew quickly to over $3bn in value. It’s an example of the explosive growth these networks can experience.

Popular applications are Maker, a decentralized reserve bank that lets you mint a stable coin from your collateral, Compound, a decentralized money markets protocol and Futureswap, a futures exchange.

Again, all of these are open source (and therefore trusted) and without fees but instead indirectly financed by utility and governance tokens.

DeFi even has its own mutual insurance, which allows buying covers against the technology risk of the above financial protocols.

Nexus Mutual is also an open-source, fee-less network where the value accrues entirely to the participants via the token. All the funds are held transparently on the blockchain and claim assessments and payouts are also public for everyone to inspect, and for token holders in the mutual to vote on.

Our first investment exposure to the DeFi ecosystem was Nexus Mutual, because no matter which one of the applications mentioned previously wins, a portion of the value of this new financial system will be insured via Nexus Mutual’s prevalent insurance protocol.

Web 3

Another exciting sector is called Web3.

Decentralization is not just a buzzword, it’s a means to an end: security and sovereignty.

Software is eating the world and becoming ever more important. For large scale software networks of high public importance, the classic vertical corporation isn’t suited anymore, for two reasons:

One, the complexity. Vertical organizations have a limit of software complexity they can handle. As an example, you can see with Equifax that after a certain size some very serious mistakes happen, often with serious consequences.

And two, the incentives. A for-profit company ultimately needs to sell the cheapest things for the highest price in the quickest way. In the specific case of Boeing, it tried to beat Airbus to the market while outsourcing critical software functionality to temporary developers as a cost-cutting tactic, which is attributed to the fatal 737Max crashes.

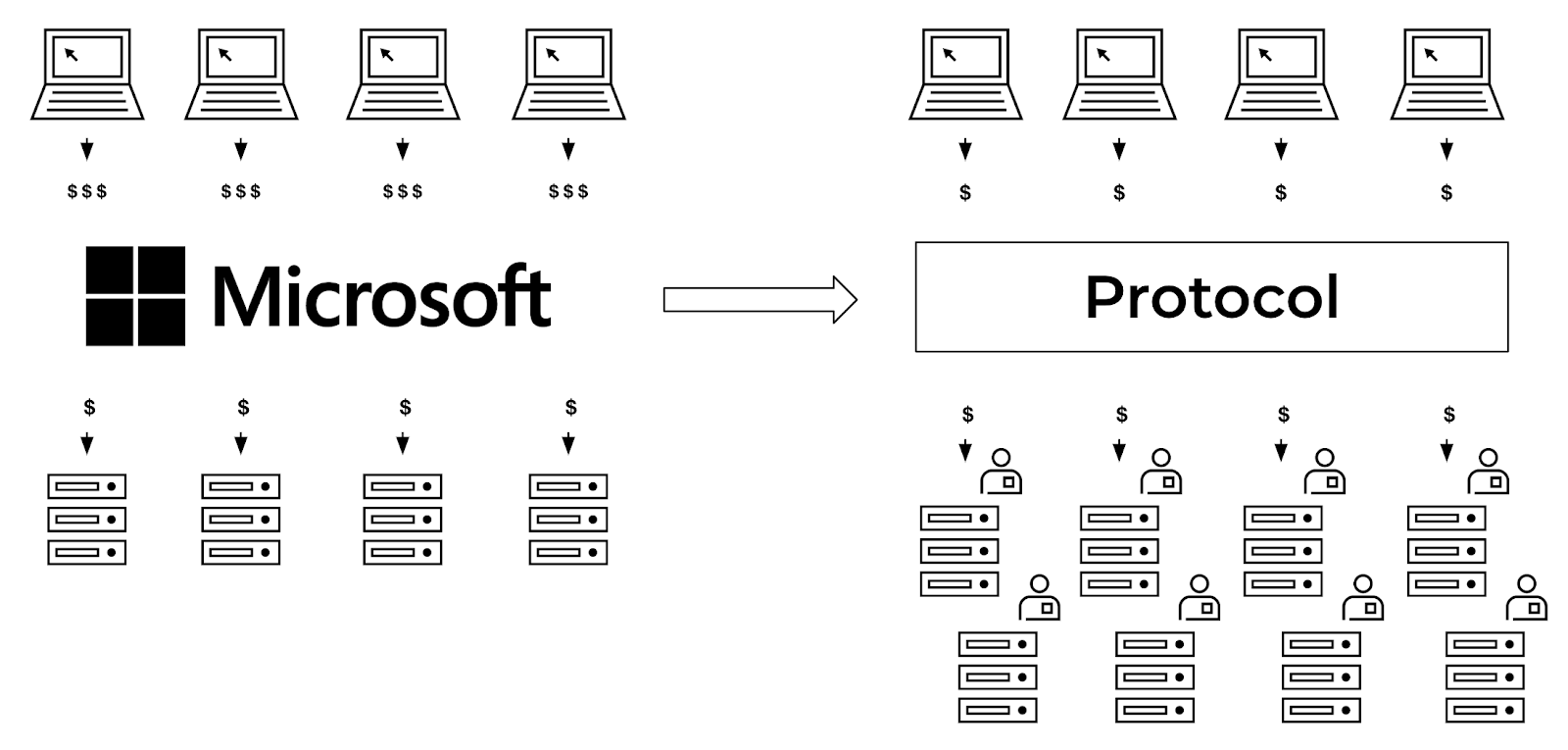

More specifically, web 3 enables protocol marketplaces to replace monolithic service providers like Amazon Web Services and Microsoft Cloud. Instead of a company, an open-source, fee-less protocol coordinates the supply of computing and data storage resources.

A most exciting aspect is the perfect competition and innovation that is enabled on the supply side. Anybody can become a supplier within hours as there are no negotiations and agreements to sign. Transaction costs are near zero, and since all the rules and possible behaviors are encoded in the protocol, no trust costs are incurred for monitoring and enforcing against malicious behavior.

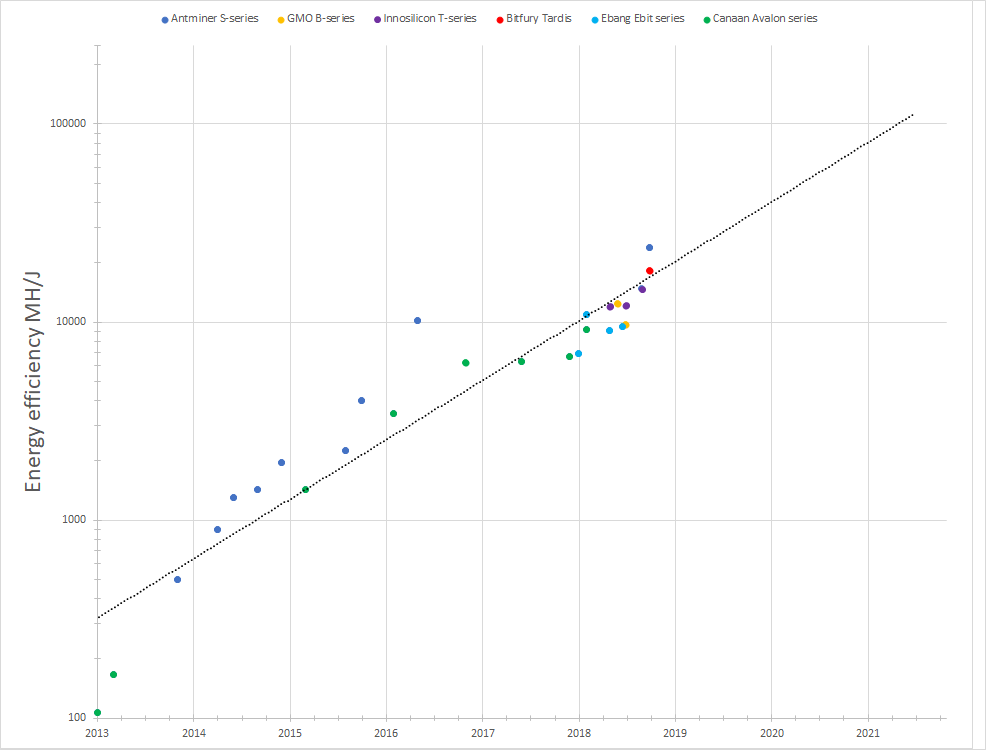

Supply-side driven innovation has already proven itself in one market, which experienced an unprecedented surge from innovation and competition: Bitcoin mining. The global competition in bitcoin’s proof of work computation, which is open to anyone in the world to participate and innovate, has increased mining efficiency 130 fold in only 6 years.

(Above) Logarithmic chart of efficiency in Megahashes per Joule of various popular sha256 miners

We expect this open and permissionless innovation on the supply side to be a game-changer for cloud computing, and for web 3.0 protocols to completely disrupt and disintermediate the current market.

Payments

Another interesting sector ripe for blockchain disruption is payments. It is estimated that the total economic and social costs of payment processing culminate to 2% of the United States’ GDP, which is close to half a trillion dollars a year.

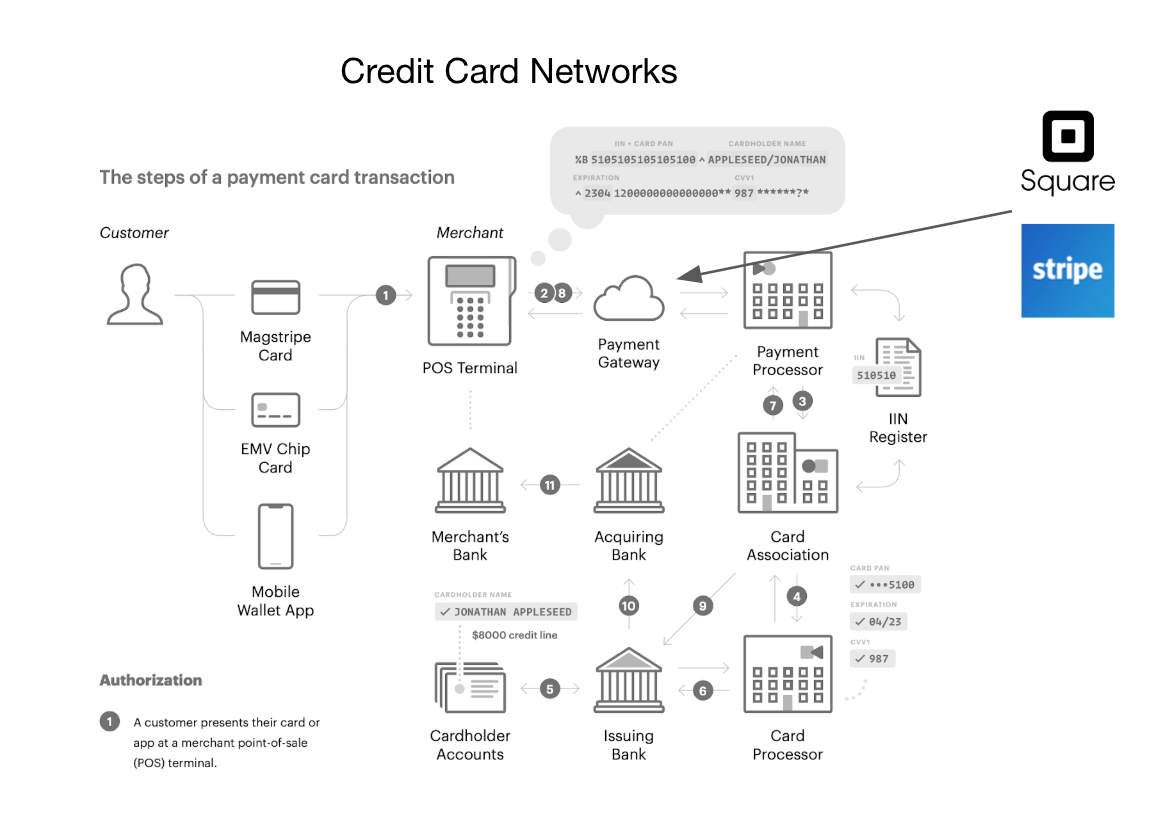

This massive inefficiency is driven by the legacy credit card networks’ outdated technology, bloated ecosystem, and pricing power over merchants. Considered a financial innovation when introduced in the 1950s, credit card transactions now involve 11 different parties.

Interestingly, Stripe and Square, both billion-dollar companies and considered “payments innovators” by the public, are actually just one of those 11 parties needed to complete a transaction.

(Above) US credit card networks

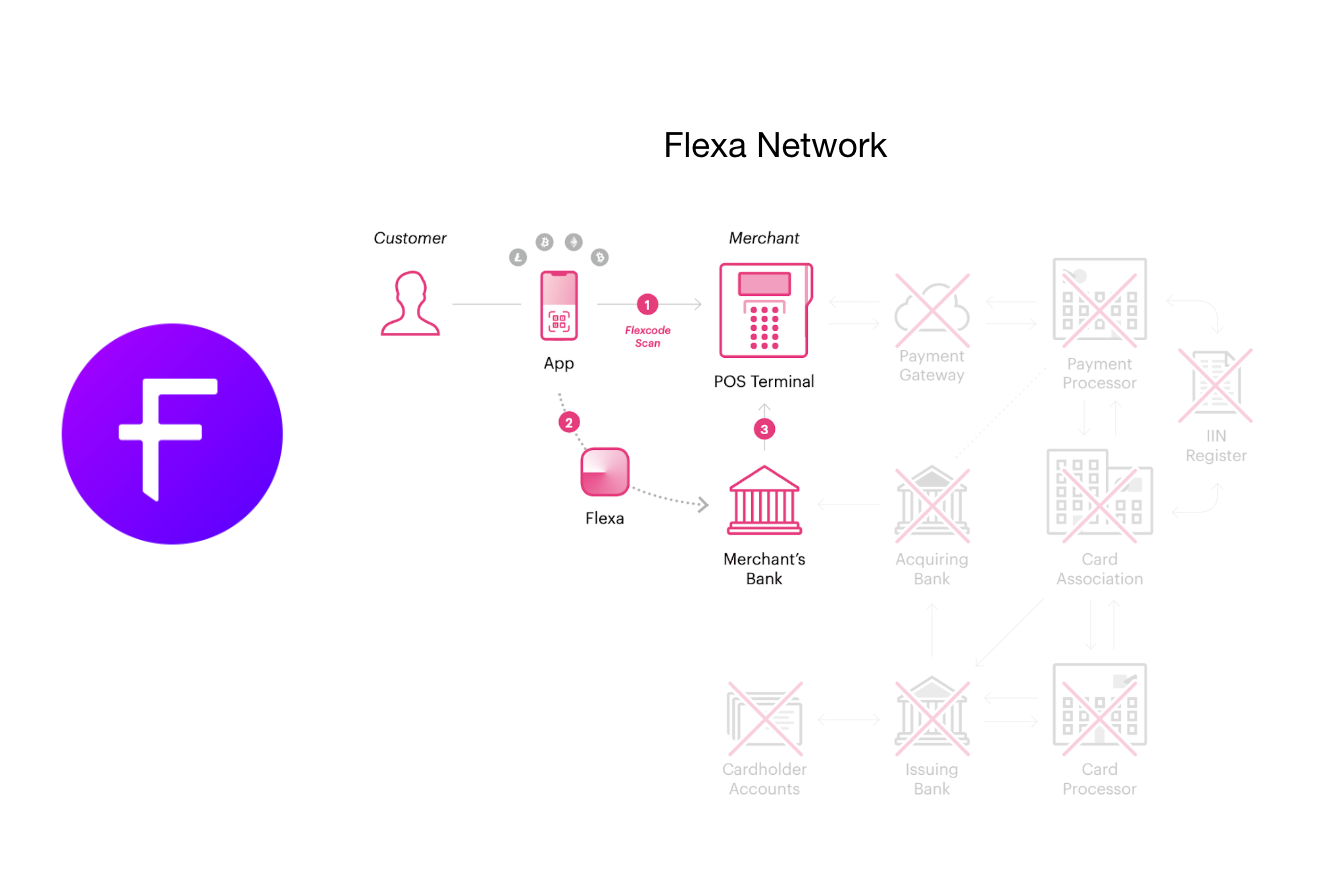

However, below is what the payments industry looks like with Flexa.

Flexa is a 1kx investment that capitalizes on cryptocurrencies as a payment technology and removes all of these intermediaries while reducing the merchant payment processing costs to 1%, with next day settlement to the merchant.

Ease of adoption and low switching costs is Flexa’s second competitive advantage over today’s payment processors. Merchants can onboard Flexa without buying new hardware or software and no employee training is required. Flexa is a game-changer for retail payments.

(Above) The Flexa payment network

Terra, also in 1kx’s portfolio, takes a similar approach with a focus on e-commerce payments in Korea and Southeast Asia. Blockchain technology is used to reduce payments costs down to a range of 10 - 60 basis points with a cap of $1 and next-day settlement.

For e-commerce merchants, who operate on razor-thin margins while paying 1.8-2.5% in credit card fees and are starving for working capital, Terra is a lifesaver.

Thesis

As you can see, blockchain is a simple technology with profound implications across all industries. On top of that complexity, blockchain represents a financial system estimated to transact 25x faster than the legacy financial system, with the volatility that would make natural gas day traders dizzy.

So how do we navigate this space as an investor?

We felt that we needed a simple yet strong thesis that would give us flexibility for this fast-changing space but also a strong conviction when the markets temporarily turn against us.

Token Maximalist

The best way to summarize our thesis is that we’re token maximalists.

We just have a hard time seeing how for-profit companies are going to compete with open-source token networks in the long-term. Simply put, “Imagine Bitcoin or Ethereum had been private companies”. Nobody would have cared.

Here are three specific advantages that crypto networks hold over for-profit corporations:

1: Better than free. As explained before, the access/work token converts me to a stakeholder instead of just a customer or supplier, with quasi-free unlimited use of the network, potential financial benefit, and a sense of sovereignty through governance participation.

2. Permissionless innovation. Since there are no gatekeepers and the public is encouraged and incentivized to innovate on top of the network without obtaining permission, a wealth of experiments is carried out that no closed permissioned system can compete with in terms of numbers. And innovation is a numbers game: the more experiments, the likelier a game-changing use case is discovered. For every 10,000 apps in the app store, only one is successful.

3. Trust. If you want to build a large network, you need buy-in from many different parties: users, suppliers, regulators, the media. With trust in business declining, it is much easier for decentralized networks to gather the buy-in from a diverse set of stakeholders. You can see the example of how aggressively the regulators stepped in against Facebook the second it announced their global coin. We were actually surprised how many politicians immediately understood the difference between a decentralized network and a corporate network like Libra.

We’d like to end with this quote, which we think is good to keep in mind when navigating a groundbreaking technology such as blockchains.

After all, we strongly believe that 1kx returns are possible when investing in such a massively disruptive force, but having a seat at the table of one of the most exciting asset classes in history does require skill and patience.

Action steps

- Consider: do you agree with the Token Maximalist thesis?

- What is your thesis for crypto?

Author Bio

Lasse Clausen and Christopher Heymann are the founding partners of 1kx, a token network fund with the thesis of embedding crypto-economic incentives into everything: transactions, computation, storage, prediction, power.

Introducing the newest Bankless Youtube show—Meet the Nation!

A series focused on short interviews with new projects within Ethereum and DeFi.

📺Let’s Meet Ampleforth —The Elastic Supply Protocol with Co-Founder Brandon Iles

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.

Ryan Sean Adams

Ryan Sean Adams