The Stablecoin Wars!

.png-a616dc52961c1edd72b0c1fdf5f47e7a.png-d44bdfd9b52d9f76131f38376a1fe385.png) Kraken - See What Crypto Can Be with Kraken

Kraken - See What Crypto Can Be with Kraken

Dear Bankless Nation,

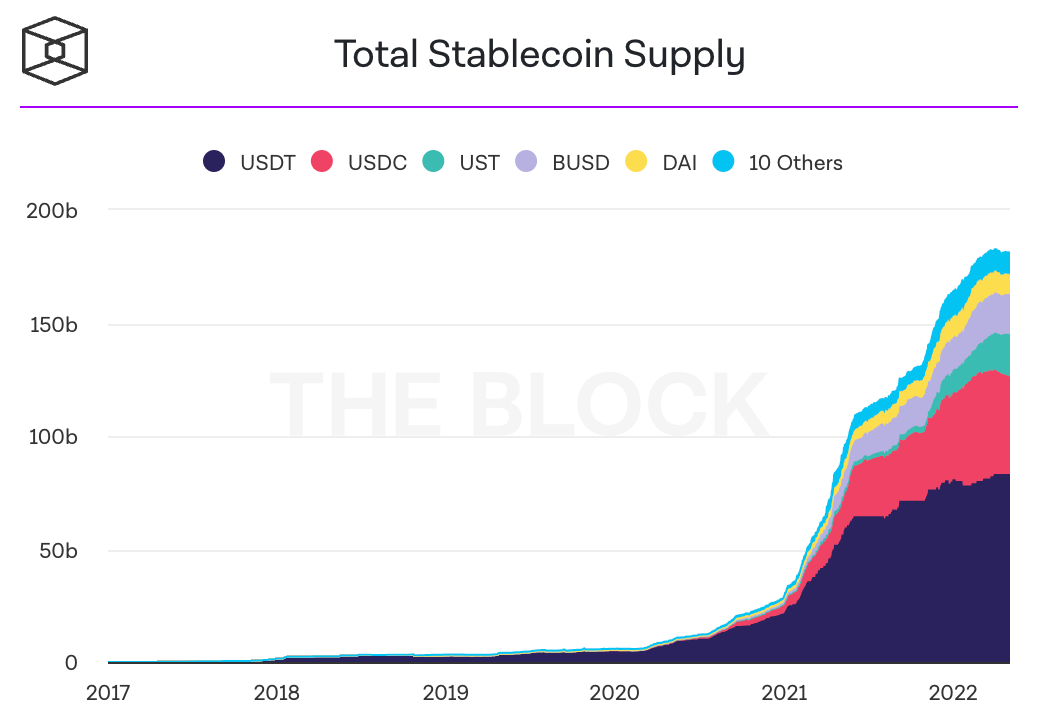

While NFTs, DeFi, and DAOs have taken center stage in crypto over the past few years, stablecoins have been quietly growing in the background.

In the last year, the stablecoin market has grown by over 100%. 👀

In the last 2 years, it’s been 1,700%. 🤯

While this sector was originally dominated by major players like USDT, USDC, and DAI, there are new competitors entering the market and making a name for themselves.

Protocols like FEI, UST, FRAX, and others all have their own unique designs and take different go-to-market strategies.

Now the competition is getting fierce.

Everybody wants to become the reserve stablecoin of the multi-trillion dollar crypto economy.

So who’s winning it?

Ben gives you the answer by analyzing the on-chain data.

- RSA

Brace yourselves—the stablecoin wars are here.

Stablecoins have emerged as one of crypto’s largest and fastest-growing sectors, with a total market cap of more than $180 billion—a figure which has increased ~109% over the past year and 1748% over the past two.

The stakes are incredibly high within this sector of the crypto-economy. The addressable market for stablecoins sits in the trillions, while as a form of money, these assets benefit from substantial network effects that come from liquidity. Because of this, early winners can become easily entrenched as incumbents.

This of course begs the question: Who is winning the stablecoin wars? Which are growing at the fastest rates? And which are the most liquid and adopted for a variety of use cases on-chain?

Let’s find out.

The Major Participants

Before diving into some data to see the state of the stablecoin wars, let’s briefly go through seven of the major stablecoin/currency issuers so we can get a high level understanding of how they work, as well as some of the drivers behind their success.

For our purposes, we’ll be touching on USDC, USDT, BUSD, UST, DAI, FRAX, FEI, and although it is not a stablecoin, but rather a non-pegged currency, OHM.

While not necessarily the largest by market cap, these seven (for reasons outlined below) are best positioned to maintain or grow their market share and in one of DeFi’s most fiercely competitive verticals.

Centralized Stablecoins

USDC, USDT, and BUSD

USDC, USDT, and BUSD are the three largest centralized stablecoins. Issued by off-chain entities, the trio are each (allegedly) backed 1:1 by fiat (i.e. “real” USD) collateral.

While more opaque and entirely centralized, this design has proven itself to be far and away the most scalable among stablecoins, as the three have a combined circulating supply of $144.2 billion - an ~80% share of the entire sector. Although the three cannot be audited on-chain, each has, to varying degrees, released attestations of their reserves, with issuers Circle and Tether holding low-risk, short duration assets such as commercial paper in order to generate revenue for themselves.

The deep liquidity of USDT and USDC in particular have allowed the two to build out substantial network effects, with the latter serving as the most widely adopted stablecoin on-chain (more on that later).

Decentralized Stablecoins (UST, DAI, FRAX, FEI, OHM)

UST

UST is a decentralized, algorithmic, dollar-pegged stablecoin.

UST utilizes a simple mint and burn mechanism to maintain stability. To mint UST, a user must burn LUNA, the native asset of the Terra blockchain on which the stablecoin is natively issued, in an amount that is equal to the amount of units they wish to mint (i.e. 1:1). Similarly, users can redeem their LUNA by burning an equal amount of UST.

As we can see, UST is not backed by any exogenous collateral - instead it relies on arbitrage to maintain its stability, with market participants incentivized to expand supply and lower price by minting new units when UST is trading above peg, and vice versa when it's trading below. However, Terra, through the Luna Foundation Guard (LFG) has recently raised a reserve fund of BTC and Avalanche's native token AVAX (worth a combined ~$1.75 billion) to help support the peg of UST, making the stablecoin at current prices roughly 9.3% backed.

While this design comes with its own set of significant risks, it has enabled UST to scale at a rapid rate to a circulating supply of more than $18.65 billion, good for third among all stablecoins and more than 2x its next closest decentralized competitor in DAI.

DAI

DAI is decentralized, dollar-pegged stablecoin by Maker DAO. DAI is overcollateralized, with users able to deposit different forms of collateral, such as ETH, into vaults to mint the stablecoin. A user must keep their position over collateralized, as when it falls below a set collateralization ratio, which varies by asset, it can be liquidated.

DAI is one of DeFi’s oldest and most battle tested stablecoins, with Maker known for its robust, decentralized governance system and best in-class risk management policies. This, along with widespread integrations across a variety of DeFi protocols, has enabled DAI to grow to a market cap of more than $8.13 billion, placing them fifth among all stablecoins and second among decentralized ones.

FRAX

FRAX is a decentralized, dollar-pegged stablecoin. As its name suggests, the stablecoin is both partially collateralized and algorithmic with the amount of collateral in the system, known as the collateral ratio (CR), dynamically changing and set by the market based on supply and demand for FRAX. Similar to UST, a portion (i.e. 1 - CR) of the stablecoins is uncollateralized, with stability maintained through FXS, the seigniorage and governance token of the protocol, which is burned when new FRAX are created and minted to service redemptions.

Frax also uses what are known as algorithmic market operations (AMOs) to enact monetary policy. These AMOs allow the protocol to deploy FRAX and its reserves into various DeFi protocols such as Curve, Uniswap, and Aave to generate yield and help pursue strategic objectives

FRAX’s “best of both worlds” design, along with the use of AMOs and numerous partnerships, have allowed the stablecoin to scale its supply to more than $2.6 billion, good for 7th among all stablecoins, and at the second highest growth rate of the seven listed in this section over the past six months.

FEI

FEI is decentralized, dollar-pegged, and issued by Fei Protocol. The stablecoin is fully-backed, with users able to mint new units by depositing various assets which can at any time be redeemed 1:1.

FEI only accepts decentralized collateral, with ETH and LUSD making up the vast majority of its backing.

FEI helped to popularize the concept of protocol controlled value (PCV), as its reserves are managed by TRIBE token holders through decentralized governance (and in the future via a managed Balancer pool). This PCV is deployed into various DeFi protocols to earn yield, while the protocol itself can mint FEI, known as protocol-owned FEI, (POF) against excess reserves to provide liquidity to venues of their choosing.

Despite FEI being “just” the 11th largest stablecoin with a market cap of $566 million, the protocol has a warchest of $878 million when accounting for the combined value of the PCV and POF. This, along with synergies from their merger with Rari Capital (the team behind the permissionless money market protocol Fuse) to form the Tribe DAO, should provide Fei with the resources they need to grow their market share.

OHM

OHM is a fully-backed, free-floating currency issued by Olympus DAO. This means that OHM is not a stablecoin, but instead allows its price to be determined by the open market.

Olympus utilizes bonding and staking mechanisms to accumulate assets for its treasury and to issue OHM. For the former, the protocol sells discounted OHM, which vest over the course of a few days, in exchange for various assets, such as stablecoins or OHM-paired LP tokens. For the latter, OHM holders can stake their tokens to receive new issuance of OHM, which helps to minimize the dilution from bonding.

While these rebases have had a significant effect on its price, the model Olympus pioneered has allowed the protocol to own 99.2% of OHM liquidity, and enabled them to accumulate a treasury worth north of $337 million. Like Fei and FRAX, OHM holders can control the deployment of these reserves into various venues to generate income or further strategic ends.

This warchest should enable Olympus to continue to have significant influence over the stablecoin sector, and in the long run help to push its market cap past its current $368 million mark.

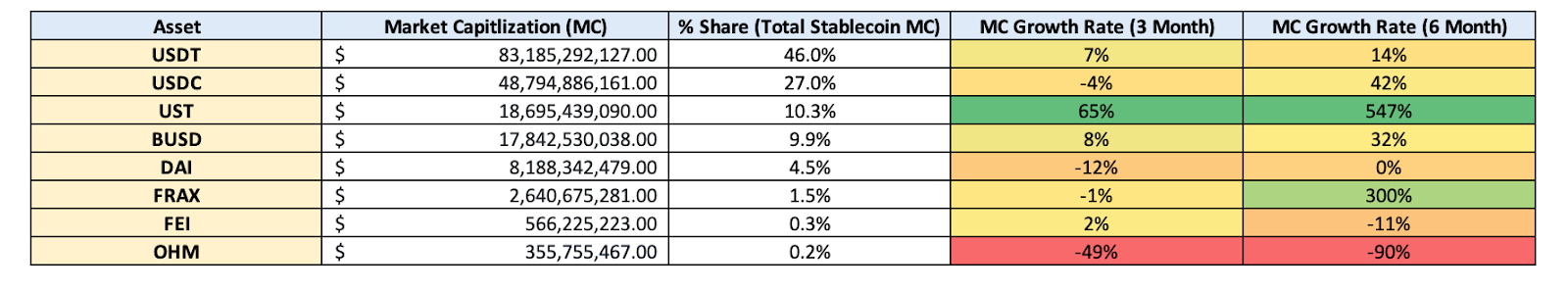

Notes on Stablecoin Market Cap, Market Share & Growth Rates

As mentioned above, UST and FRAX were the fastest growers over the past six months, with their supply’s increasing 547% and 300, respectively, over the last two quarters. UST has continued to expand at the fastest rate over the past three months, with 65% growth in market cap. This had led UST to see its share of the total stablecoin supply nearly 5x since November 2021 from 2.08% to 10.34%.

Furthermore, the above-average growth rates of UST and FRAX relative to the overall stablecoin market are another illustration of the increased ease at which stablecoins with algorithmic components, due to being more capital efficient, can scale. The two may continue to see outsized growth through collaborating with each other, such as with the 4Pool, a partnership between Frax and Terra to create a pool of UST, FRAX, USDC, and USDT on Curve in the hopes of becoming the base trading pair on the DEX.

Growth Rates Ranking

🥇 UST

🥈 FRAX

🥉 USDC

The Battlegrounds

Now that we’ve gone over the key players in the stablecoin wars, let’s visit the fronts on which they are competing to see where each stands.

To do so, we’ll be comparing the eight assets discussed above (USDC, USDT, BUSD, UST, DAI, FRAX, FEI, and OHM) as well as MIM and LUSD, the sixth and twelfth largest stablecoins by market cap.

To assess the adoption and usage of each stablecoin, we'll look at the composition of liquidity and deposits on decentralized exchanges, money markets, and cross-chain bridges. In addition, we'll examine the stablecoin holdings on DAO balance sheets and also see which have been most used as backing for other stablecoins to assess their desirability and adoption as a reserve asset.

1. Liquidity on DEXs

DEXs are at the heart of DeFi, facilitating the exchange of assets and the flow of liquidity throughout an ecosystem. As indicated by the wild popularity of the Curve Wars, DEXs are a critical battleground for stablecoins as deep liquidity on exchanges helps to strengthen their peg, and entrench a given stablecoin as a popular trading pair for other assets.

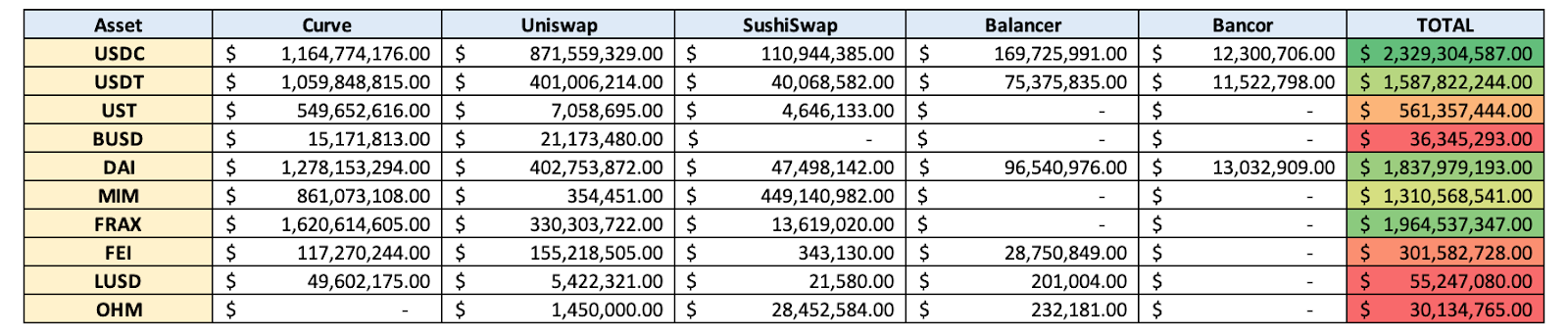

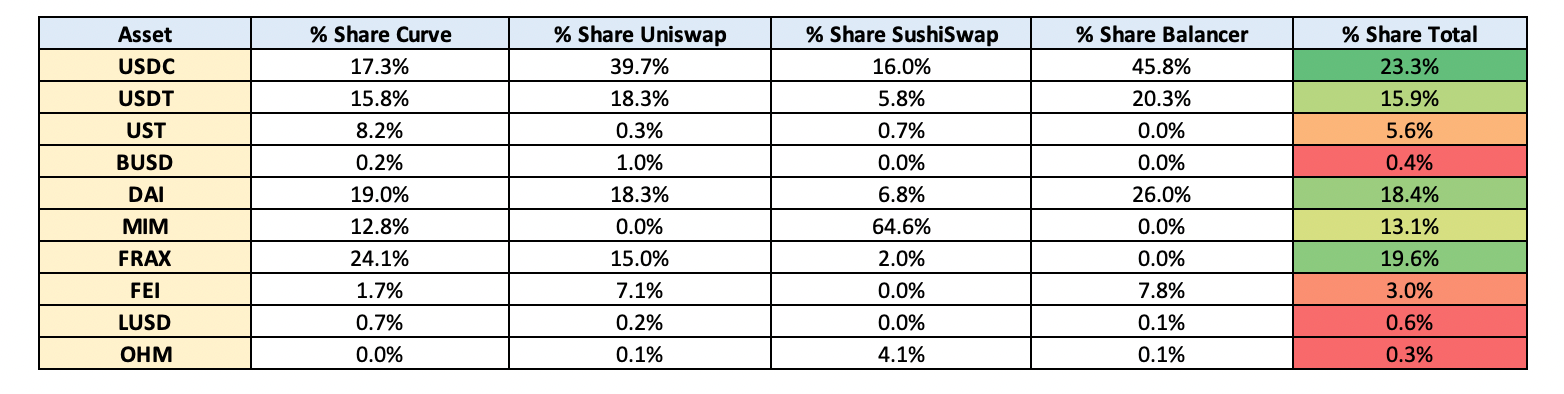

Let’s take a look at the composition of stablecoin liquidity on Ethereum’s five largest DEXs by TVL (Curve, Uniswap, Balancer, SushiSwap, and Bancor), to see the competitive landscape among our ten selected stablecoins.

As we can see, USDC is the most liquid at $2.32 billion, a 23.3% share of the total $10 billion in stablecoin liquidity among the five DEXs, followed by FRAX (19.6%) and DAI (18.4%) which clock in at $1.96 billion and $1.83 billion, respectively.

Diving into the composition of stablecoin liquidity per exchange, we can see that USDC is by far the most liquid on Uniswap and Balancer, with a 39.7%, and 45.8% share of stablecoin liquidity on the two respectively.

Unsurprisingly, Curve has been the most competitive of the DEXs with no single protocol accounting for more than a quarter of stablecoin liquidity on the exchange.

FRAX as the leader on Curve, while perhaps somewhat surprising, makes sense, as the protocol is the largest holder of CVX, the governance token of Convex Finance (which controls a plurality of the CRV supply, therefore token emissions on the DEX) and has paid out tens of millions in bribes to CVX holders in order to direct further liquidity to FRAX-paired pools.

On-Chain Liquidity Ranking

🥇 USDC

🥈 FRAX

🥉 DAI

2. Deposits on Money Markets

Along with DEXs, money markets are one of the most crucial building blocks of an on-chain financial system, helping to facilitate borrowing and lending, pricing risk, and quenching the (at times) insatiable thirst for leverage among degens.

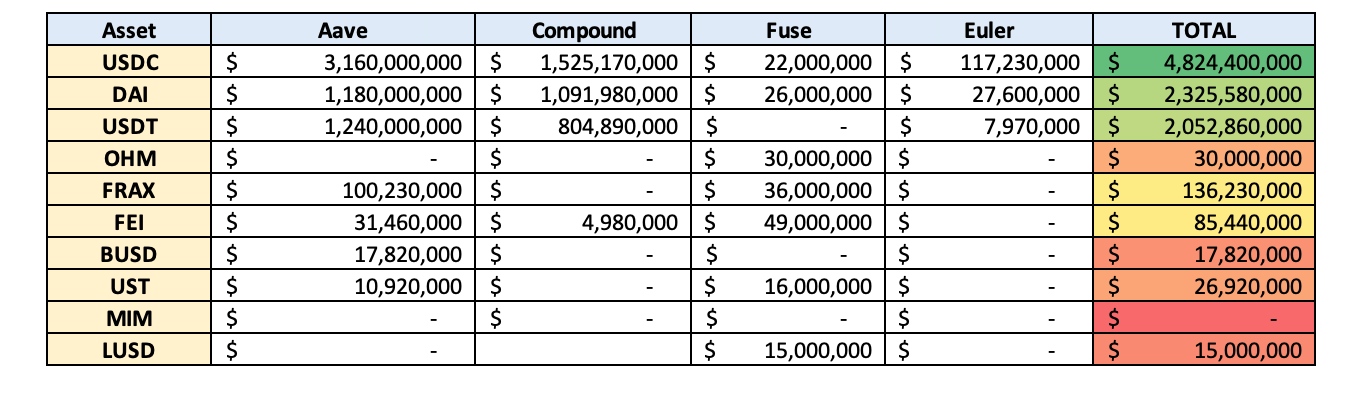

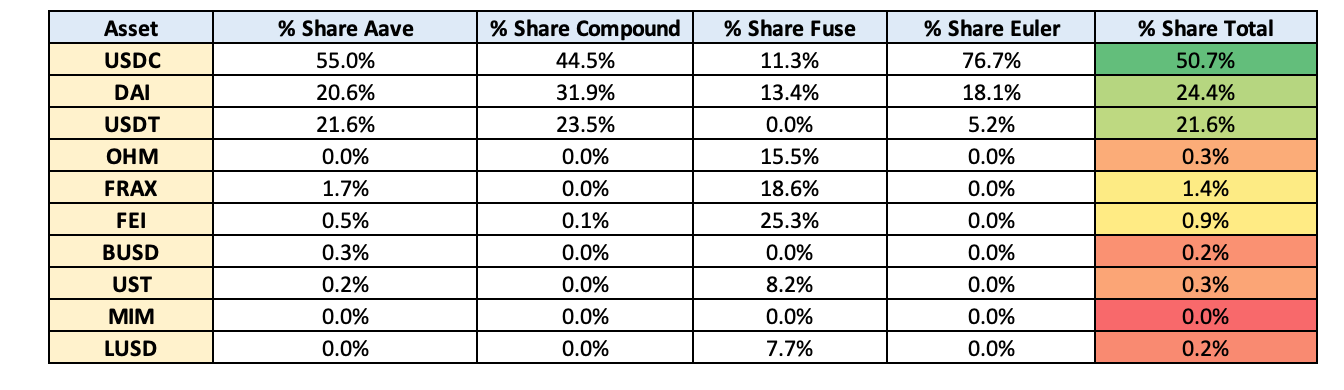

Let’s take a look at the deposits on four of Ethereum’s largest money markets, Aave, Compound, Fuse, and Euler, in order to see how each stablecoin stacks up relative to one another.

As we can see, USDC is the most deposited stablecoin at more than $4.82 billion—a 50.7% share of the $9.51 billion in total stablecoins locked across the four platforms.

DAI and USDT slot in at second and third place, with $2.32 billion (24.4%) and $2.05 billion (21.6%) in deposits, respectively.

Fuse has shown to be the most competitive market among stablecoins, as FEI, FRAX, and OHM have the three largest shares of deposits on the platform. This is not particularly surprising given the nature of the protocol in that there are numerous, isolated and specialized pools as well as extreme ties between Fei and Fuse, as both projects sit under the umbrella of the Tribe DAO.

Money Market Rankings

🥇 USDC

🥈 DAI

🥉 USDT

3. Liquidity and Value Locked in Bridges

Bridges are fast becoming one of the most important pieces of infrastructure within the multichain crypto-economy. While each has its own unique risk profile and set of trust assumptions, bridges have exploded in popularity alongside the rise of alternative L1s and L2s by providing a quick, relatively straightforward way for users to transfer their assets between networks.

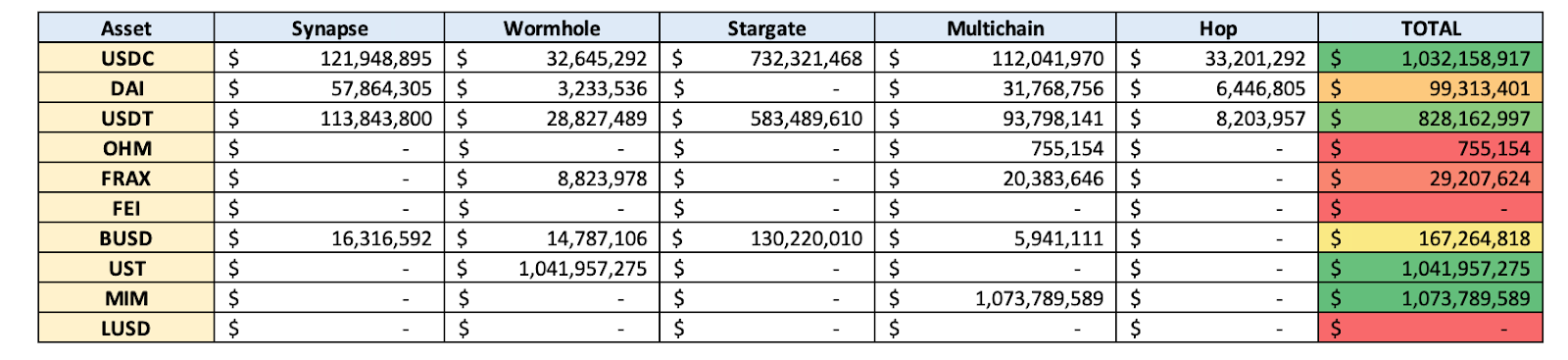

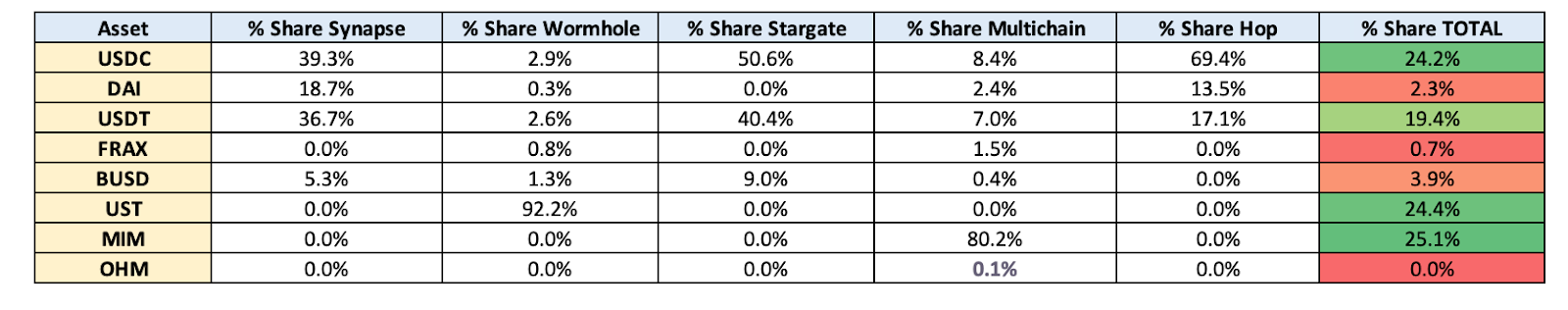

With that in mind, let’s see which stablecoins are the most liquid, and/or have been the most deposited, on five popular bridging protocols (Synapse, Wormhole, Stargate, Multichain, and Hop) so we can get a sense of which are the most liquid and utilized among these multi-chain nexuses.

In a bit of an unexpected twist, MIM is the most popular stablecoin among the five bridges, followed closely by UST and USDC, with $1.07 billion, $1.04 billion, and $1.03 billion in liquidity/value locked, respectively.

However, a closer look reveals these numbers to be a bit skewed, as MIM and UST are each only supported by one of the five bridges. Furthermore, we can see that despite placing third overall, USDC has the largest market share on Stargate, Synapse, and Hop, and the second largest on Wormhole and Multichain.

Multichain Rankings

🥇 MIM

🥈 UST

🥉 USDC

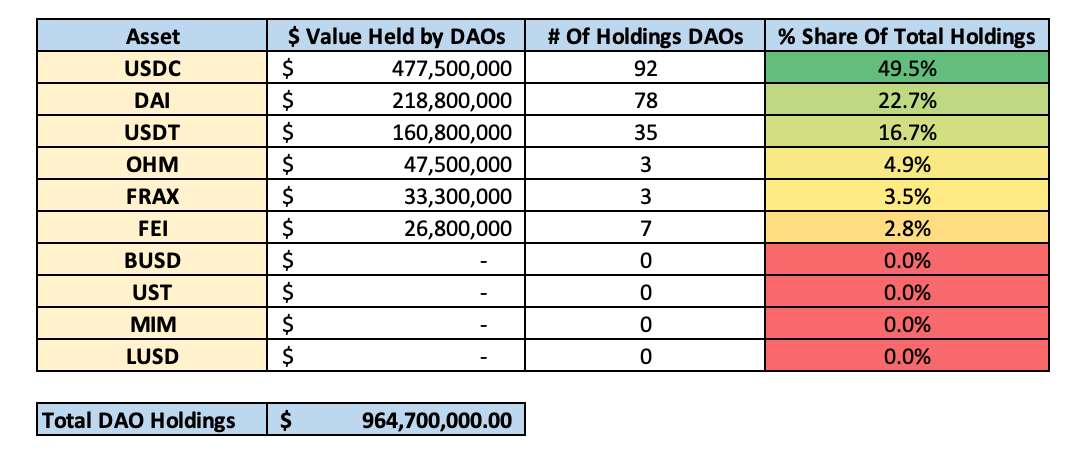

4. DAO Treasury Holdings

Another important use case for measuring the adoption of a stablecoin is its use as a treasury asset. While many protocols have a majority of their balance sheets in their native governance token, DAOs have increasingly diversified their holdings into less volatile assets.

Let’s see how our ten stablecoins fare on this front by looking at the composition of stablecoin holdings among DAOs.

As we can see, USDC accounts for 49.5% of the total value of stablecoin holdings among the tracked DAOs, with $477.5 million of the stablecoin on their balance sheets. USDC is also held among the greatest number of individual DAOs at 92. DAI and USDT place second in both categories, with 22.7% and 16.7% shares respectively.

Among assets other than USDC, DAI, or USDT, OHM reigns supreme, with three DAOs having a combined $47.5 million in value on their balance sheets, while FEI is held by the most individual entities at 7.

Smart Money Rankings

🥇 USDC

🥈 DAI

🥉 USDT

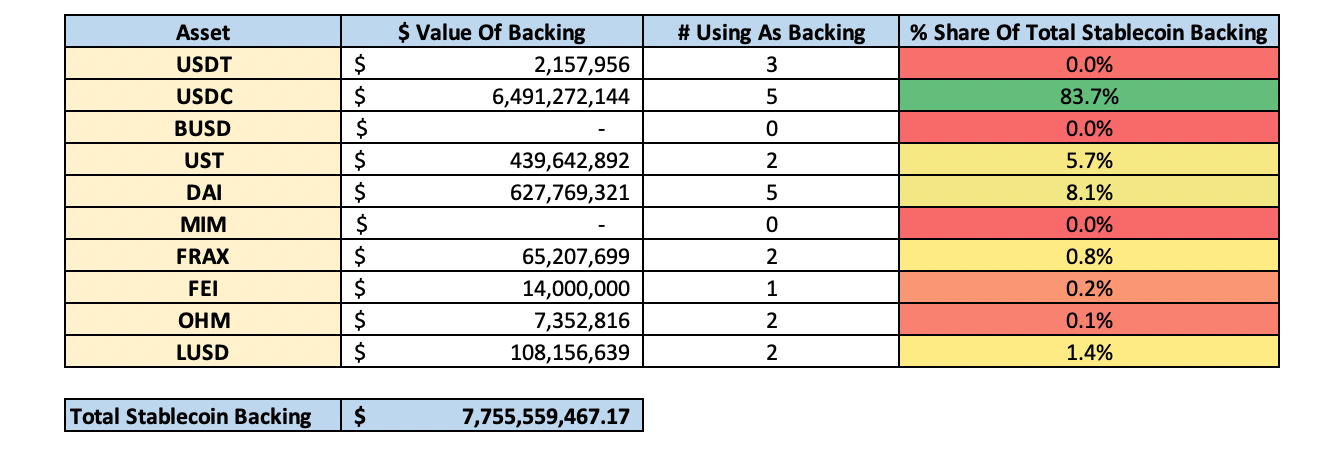

5. Currency Reserves

A final, critical function of stablecoins is to act as backing for other currencies. As they have become increasingly battle-tested, stablecoins have become more widely adopted as reserves for their competitors, with their lack of volatility increasing the ease at which risk can be managed, while also serving to align incentives and encourage collaboration among issuers.

With that in mind, let’s see how our ten stablecoins shake out on this front by looking at the reserves and collateral backing for eight decentralized currencies: DAI, FRAX, FEI, OHM, alUSD, MAI, agEUR, and UST.

Although there are numerous other prominent decentralized stablecoins, this should still give us some sense of how desirable each stablecoin is as reserves among its peers.

As we can see, USDC is overwhelmingly the most popular choice of stablecoin backing, accounting for an 83.7% share of the total stablecoins used as reserves.

Among the rest, DAI and UST, and LUSD are the most widely utilized, with 8.1%, 5.7%, and 1.4% shares respectively.

Reserve Rankings

🥇 USDC

🥈 DAI

🥉 UST

The Stablecoin Wars are here

🏆 Winner: USDC

As the most liquid on DEXs, the most deposited into money markets, the third most liquid on cross-chain bridges, and the stablecoin most widely utilized for DAO treasuries and asset backing, it’s clear that despite being the second-largest by market USDC is by far the most utilized on-chain stablecoin in crypto.

While smaller players have been able to take market share on individual venues, such as FRAX on Curve, FEI on Fuse, and UST on Wormhole, USDC as of now is the clear “winner’ of the stablecoin wars.

However, there is some hope for those rooting for decentralized challengers. Two decentralized alternatives, UST and FRAX, albeit at a smaller market cap, are growing at rates that far exceed USDC.

That’s not to mention the arrival of new challengers, such as L1-algorithmic stablecoins like Near’s USN and Tron’s USDD, as well as CPI-pegged stablecoins like Frax’s FPI and Volt Protocol’s VOLT which may shake up the competitive landscape.

While USDC may have the early lead, we’re only in the early innings of a long game.

Ben Giove

Ben Giove

.png-a616dc52961c1edd72b0c1fdf5f47e7a.png-8359976fdb0656215e306b0de9208da8.png)