The Essential Guide to Arbitrum

Mantle - Mass adoption of token-governed tech

Mantle - Mass adoption of token-governed tech

Dear Bankless Nation,

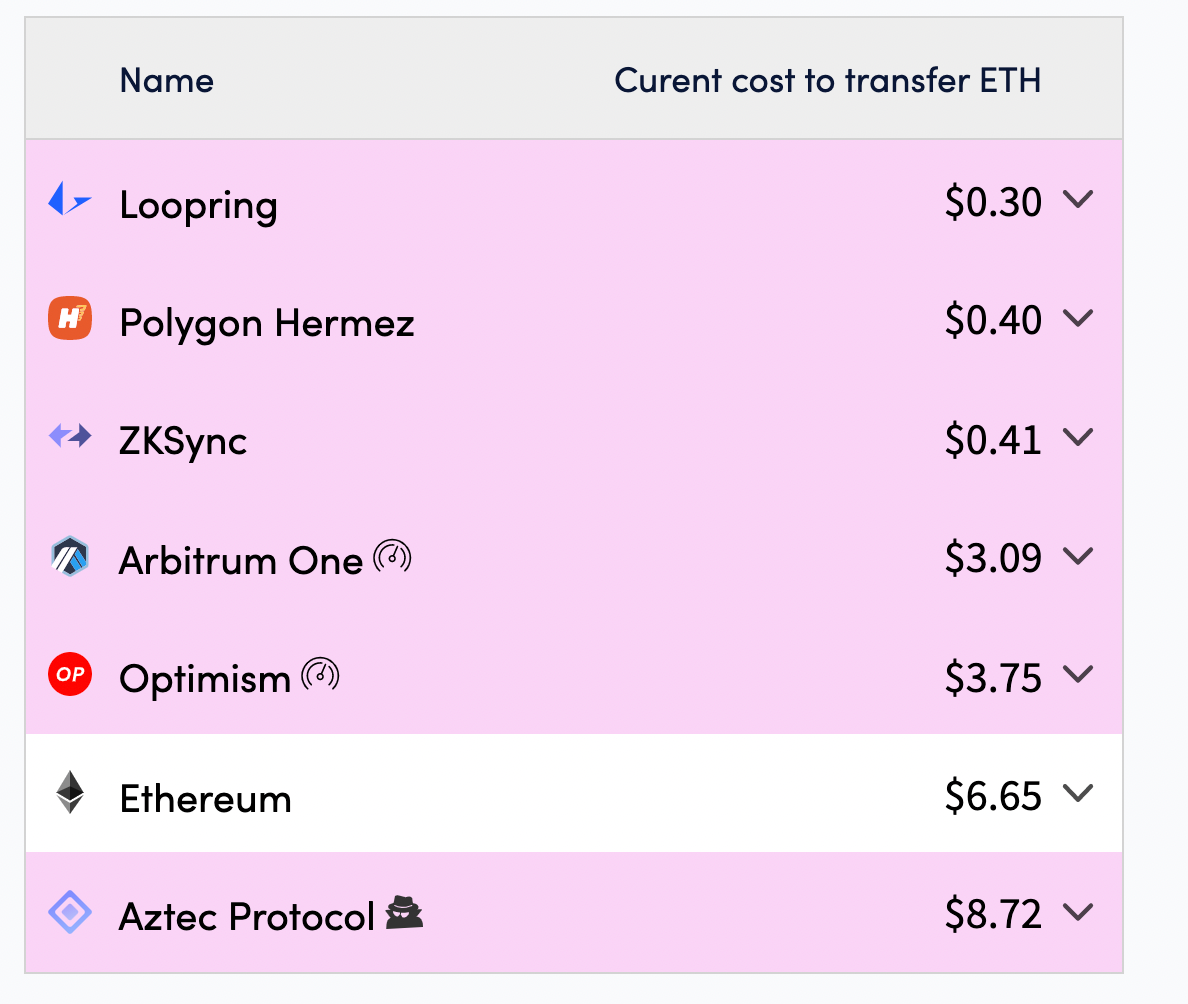

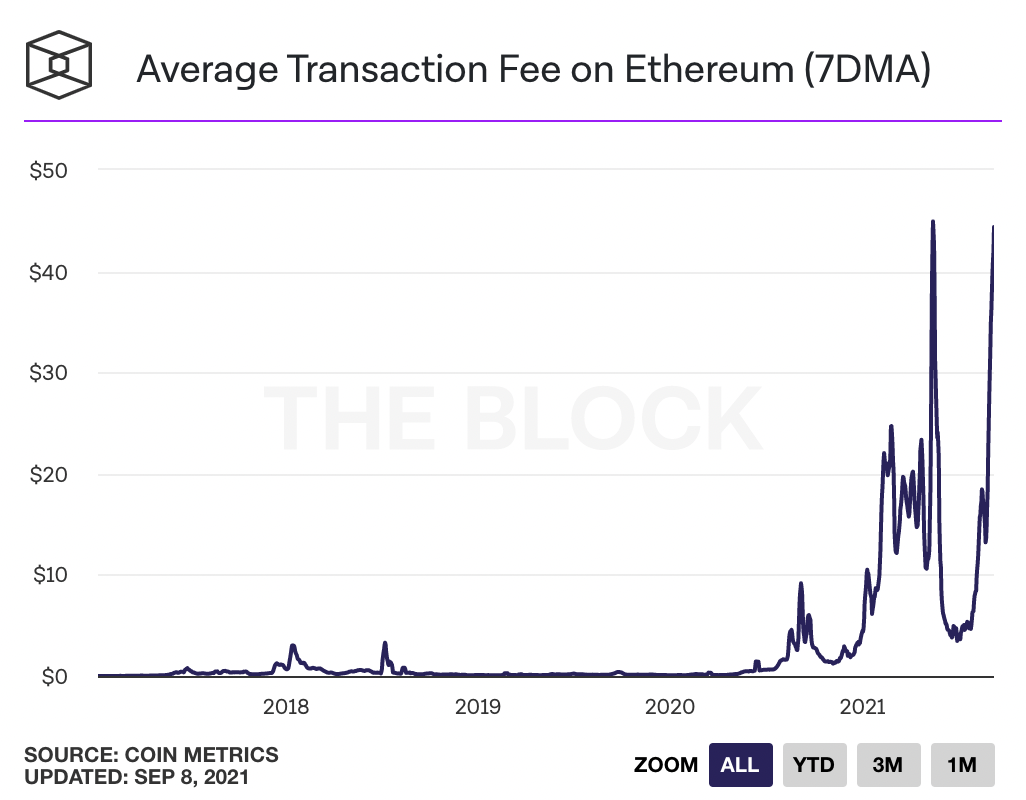

Gas fees on mainnet are painful right now.

Anyone with $5,000 or less is paying >1% of their portfolio in fees to use DeFi.

It’s getting too expensive to live in Manhattan. And I don’t expect Manhattan to suddenly get cheaper—in fact, I expect mainnet transactions to continue increasing in economic density (e.g. higher cost + higher value transactions).

But right now this situation is pricing out users and sending them to more centralized ecosystems. I don’t blame them—no one should have to pay a material amount of their portfolio to swap tokens.

DeFi needs to be accessible for everyone, not just the crypto rich.

But help is here. 🏇

Last week marked the launch of Arbitrum, a promising Layer 2 scaling solution built on optimistic rollups (ORU).

Like other Layer 2 rollups, Arbitrum inherits Ethereum’s security guarantees. This makes it just about as secure as the base layer.

Arbitrum is here, but the training wheels are still on. Fees are lower than Ethereum, but they’ll get with increased usage (watch this). Eventually the training wheels come off and Arbitrum will become fully decentralized—just not yet.

Arbitrum and Ethereum blockchain.View Profile" class="stubHighlight">Optimism now. Then EVM zk-rollups. And then eventually Ethereum data sharding will massively boost the throughput of all Layer 2. 🚀

I’m convinced Ethereum has the best scaling roadmap in crypto.

Why?

Cause it doesn’t sacrifice decentralization.

No shortcuts.

Here’s our first essential guide to Arbitrum.

- RSA

We’re all feeling the squeeze. As market activity picks up and the NFT mania rages on, gas fees have soared to record highs, making Ethereum inaccessible to all but the wealthiest users.

You don’t need me to tell you this is a problem. Not only does it massively degrade the user experience, but it also drives new users to other ecosystems.

Thankfully, help is on the way.

While it may be a bit late to call it “L2 summer,” scaling has arrived with the much-anticipated launch of Arbitrum. A true layer-two that inherits Ethereum’s security and compliments it with lightning-fast transaction speeds, the optimistic rollup is sorely needed to alleviate the congestion on L1 and reduce fees for end users in order to make Ethereum accessible to a wider swath of the population.

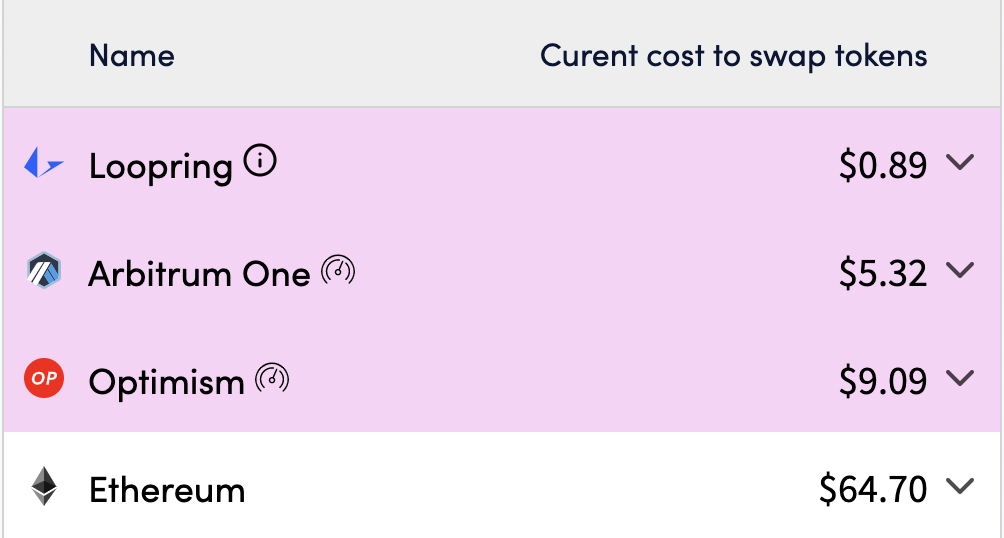

Despite launching less than two weeks ago, Arbitrum has already begun to see significant traction: there is already $96 million in value locked on the network. In addition, we’ve begun to get a glimmer of the tantalizing potential of layer two, as even with artificially reduced capacity, the average gas fee for a token swap is reduced by 12x on Arbitrum compared to Ethereum L1.

Want to experience the bleeding edge of Ethereum scalability for yourself?

Here’s how to onboard to Arbitrum, along with some of the market opportunities that are ready and waiting for your arrival.

Trust Assumptions & Other Details

Before we walk through the process of bridging funds to Arbitrum and earning yield, it’s important to understand the trust assumptions users make when using the network in its current state.

Although Arbitrum intends to be fully decentralized, right now the team has significant control over the network. This is not dissimilar to approaches taken by other Etheruem scaling solutions such as Polygon and Optimism, which each have their own unique set of safeguards in the wake of their respective launches.

For instance, the Arbitrum team can modify many of the key contracts within the system using a proxy contract that is controlled by a single private key (Unclear who is in possession of this key and how it is managed).

The contracts that fall under the purview of the proxy include the token bridge from Ethereum, the sequencer contracts (the entity that batches transactions), the rollup contracts on mainnet, and several others. While it is critical to note that this safeguard has put in place to ensure the stability of the network in its early days, it does represent a major centralization vector in that one entity has the control over the network, including the ability to shut it down. (It is also worth mentioning that the team has made clear they may halt network activity in the event of a technical or security issue).

Along with these centralization vectors, the team has also put in place what’s known as a “speed limit.” This acts as a cap on the capacity of the network, and is currently at a level that brings the network’s capacity in line with that of Ethereum L1. This is why transaction fees may seem high on the surface. Gas fees will initially be elevated, with the potential to rise further as usage of the network increases. However, the team has also stated that they plan to raise the speed limit and increase network capacity over time.

Finally, like all Optimistic Rollups, Arbitrum users are subject to a seven-day withdrawal period. This is another factor for users to consider when deciding whether to migrate funds to Arbitrum, though it is worth noting that there are third-party services which allows users to work around this issue. For instance, Hop Protocol is planning to launch support for Arbitrum to allow for faster withdrawals within the next few days.

🔧 To learn more about Arbitrum’s architecture, check out their developer docs.

Onboarding To Arbitrum

Now that we understand Arbitrum under the hood, let’s walk through how to migrate funds onto the network.

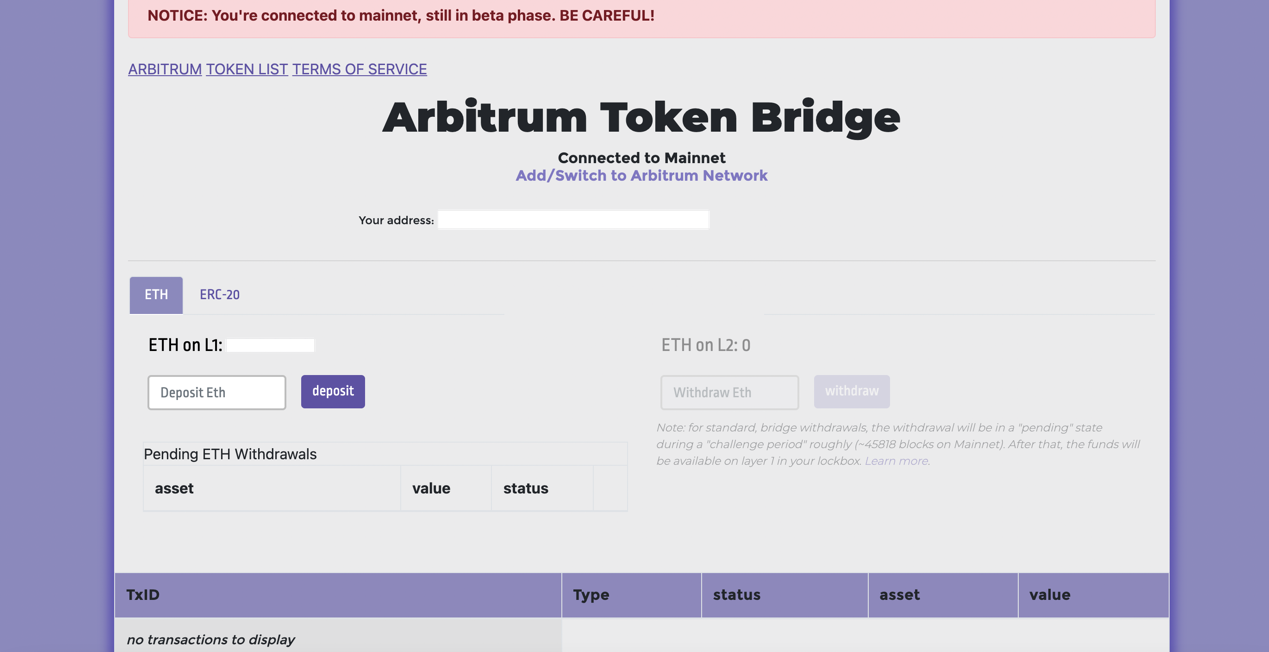

The process for onboarding to Arbitrum is no different than that of any other chain. Users simply have to add support for the network to their wallet, and then transfer funds through the Arbitrum Token Bridge.

Let’s go through this process step by step.

- First, navigate to the Arbitrum Token Bridge.

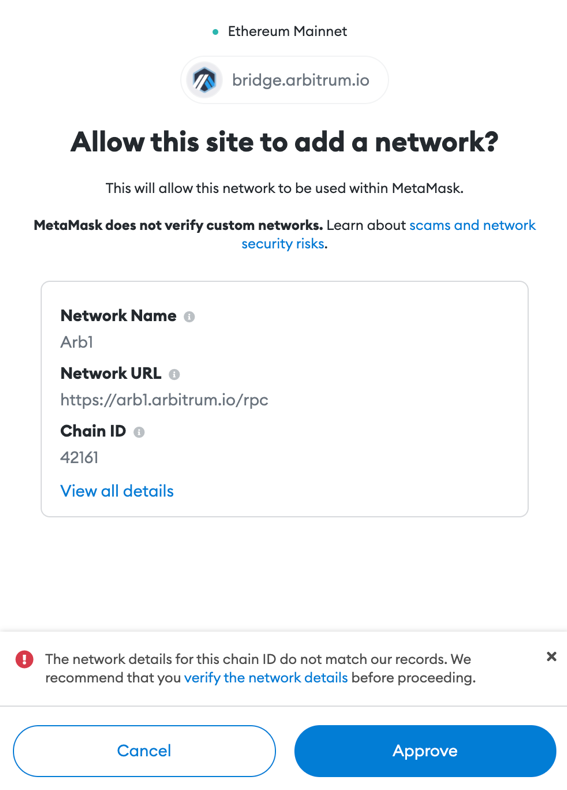

- Next, you’ll have to add the network to your MetaMask. Click “Add/Switch To Arbitrum Network” and you’ll be prompted with information regarding the chain. Hit “Approve” to connect to the network without needing to manually enter in any information. (If you’d like to enter in the network details yourself for any reason, you can use this guide).

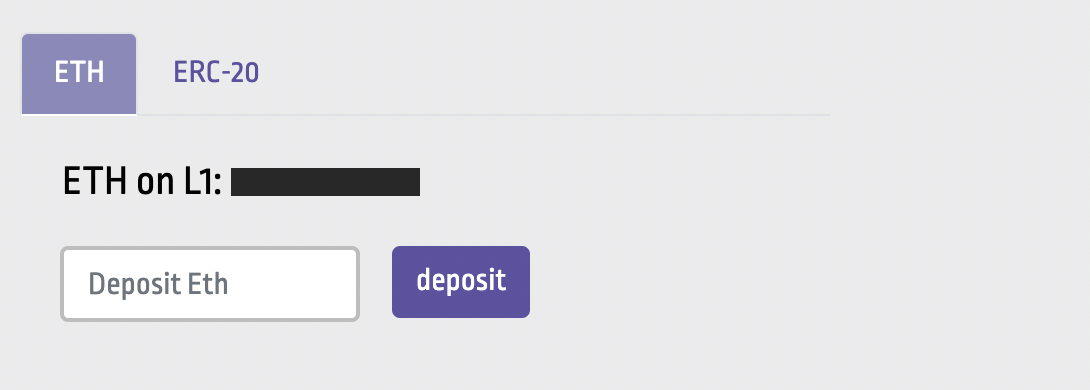

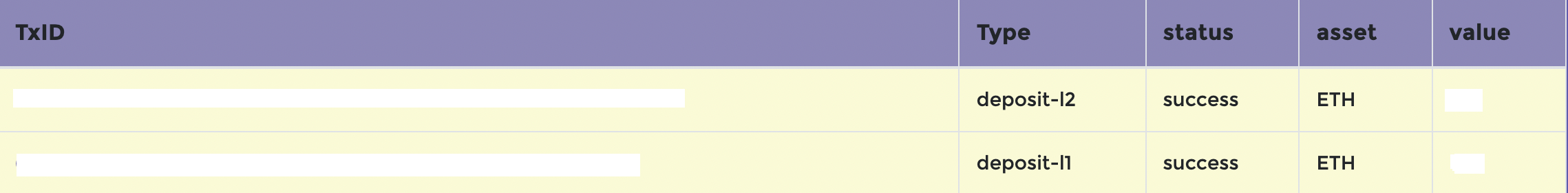

- Now it’s time to transfer the funds. Enter in the amount of ETH or other tokens you’d like to bridge over, and then click “deposit.” You’ll then be prompted with standard approval and confirmation transactions, for which you’ll have to pay gas. At current gas prices, the cost to bridge works out to around $30-35 (0.009 ETH).

- You can monitor the status of the bridging transaction at the bottom of the interface. After about 10 minutes, your funds should be available for use on Arbitrum!

Opportunities on Arbitrum

Now that we understand how to onboard to Arbitrum, and the trust assumptions that come with using the network, let’s look at some of the major protocols that have already been deployed and the opportunities they hold.

👉 To explore the different applications live on Arbitrum, along with ones that have yet to deploy, check out the Arbitrum One Portal.

Balancer

- 🧑🌾 Yield Farming: Yes

- 💰 Estimated APYs: 50-75% APY in BAL

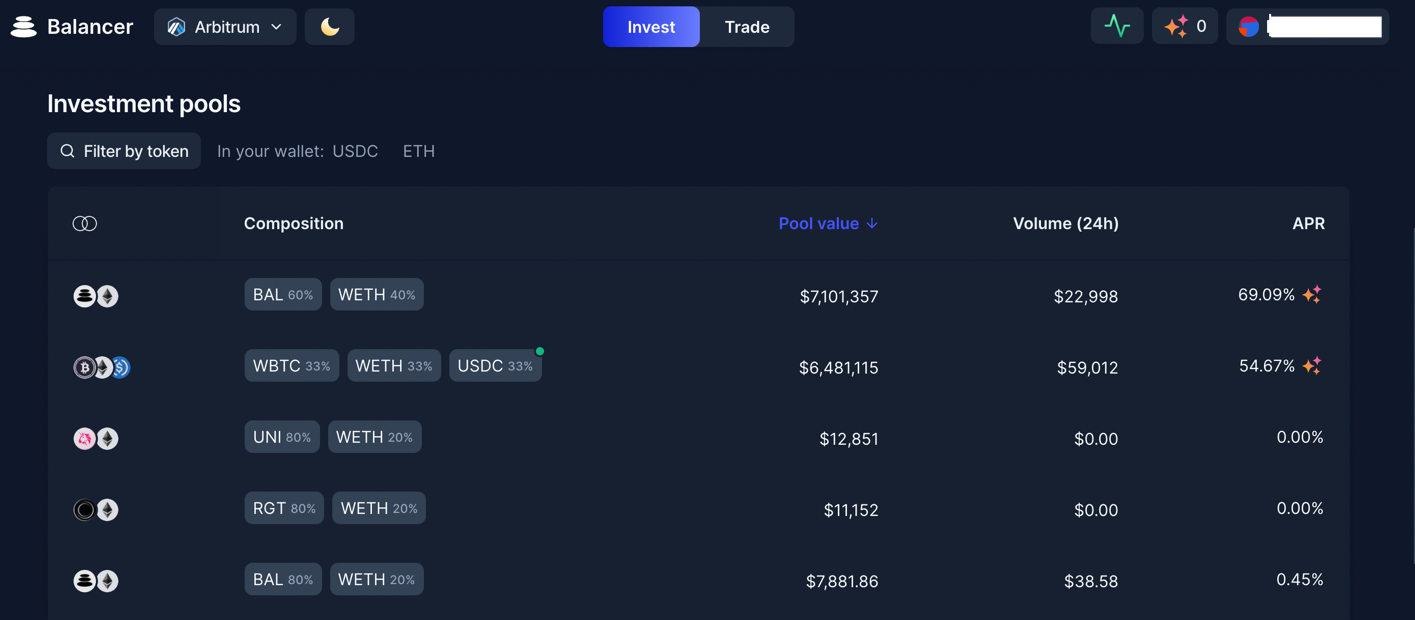

A prominent decentralized exchange and asset manager, Balancer was the first major protocol to go live on Arbitrum after launch. The protocol currently offers fifteen different pools, which make use of customizable token weights, where users can swap between assets, and provide liquidity to earn trading fees.

The two pools on the exchange meaningful liquidity are wBTC/wETH/USDC, with each asset having an equal 1/3 weight, and BAL/wETH, split 60/40 between the two tokens respectively.

Each pool currently holds north of $6.2 million and is being incentivized with BAL rewards, in addition to a 0.25% fee on every trade within the pool. Currently, wBTC/wETH/USDC yields 55% APR, while BAL/wETH boasts a return of 73% APR.

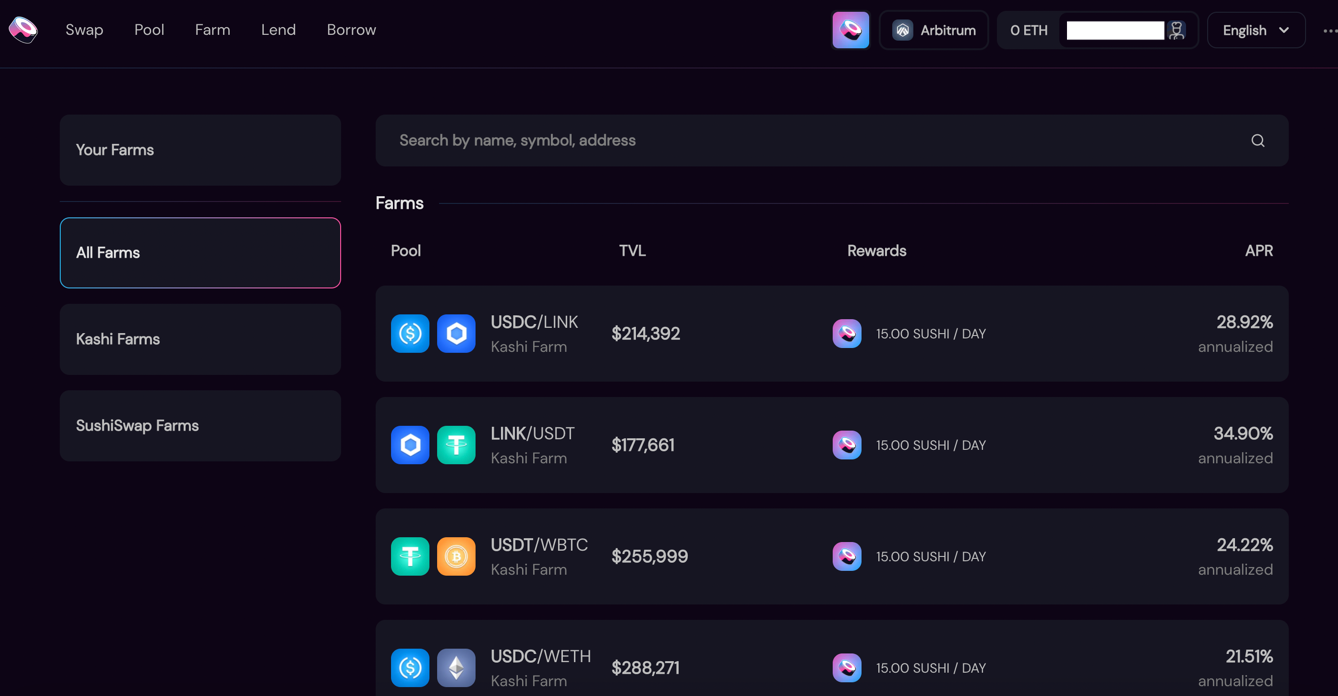

SushiSwap

- 🧑🌾 Yield Farming: Yes

- 💰 Estimated APYs: 13-48% APY in SUSHI

SushiSwap is another prominent protocol deployed on Arbitrum. The second largest decentralized exchange on Ethereum by volume and value locked, Sushiswap currently allows its Arbitrum users to trade, passively provide liquidity, lend and borrow through Kashi — all while earning yield in SUSHI.

The latter activity has allowed SushiSwap to emerge as an early hotspot for users seeking yield. The protocol currently is incentivizing five pairs, wETH/USDC, wETH/USDT, wETH/wBTC, wETH/LINK and wETH/SUSHI with SUSHI rewards, which farmers can earn along with the standard 0.25% trading fee on swaps. These pools are currently yielding between 13-33% APR, with the ETH/stablecoin pairs being the most lucrative.

SushiSwap is also incentivizing Kashi, a protocol for creating isolated borrowing and lending pairs. Users who borrow or lend in the USDC/wETH, USDT/wBTC, LINK/USDT, and USDC/LINK markets will receive SUSHI rewards, in addition to interest (if lending). These farms are returning between 26-48% with USDC/LINK at the highest end of that range.

It’s important to note that liquidity on SushiSwap is sparser than Balancer: The most liquid trading and Kashi pairs, wBTC/wETH and USDC/wETH, hold just $1.2 million and $208,000 in assets respectively.

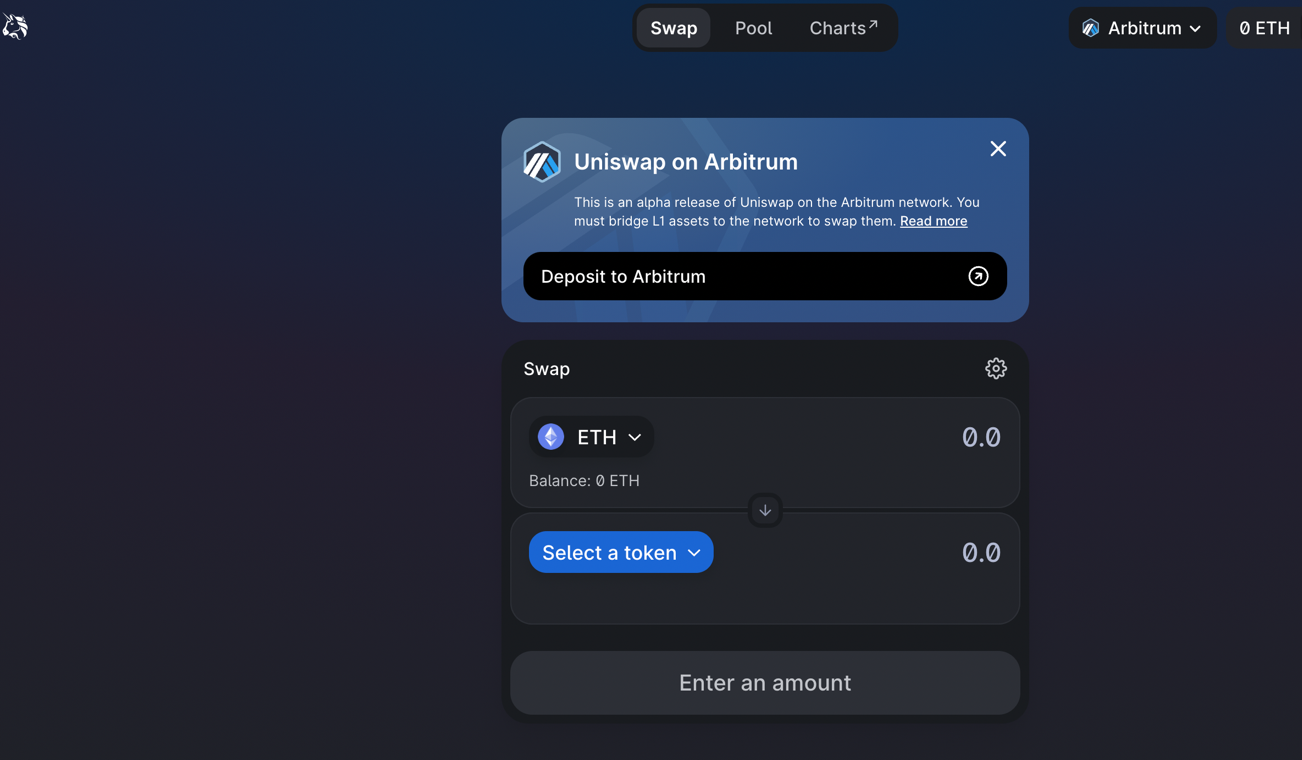

Uniswap

- 🧑🌾 Yield Farming: No

- 💰 Estimated APYs: Depends on trading volume

A first-mover to Optimism, another promising Layer 2, Uniswap has also deployed its V3 protocol to Arbitrum, allowing users to trade and provide liquidity just as they would on mainnet.

While it’s currently not offering any yield farming opportunities, the decentralized exchange currently holds more than $14 million in value while also facilitating millions in daily volume.

The highest volume pools since launch have been the wETH/GMX (the native token for GMX, a decentralized perpetuals exchange that is live on BSC and Arbitrum) pool at the 1% fee tier, and two wETH/USDC pools that are charging 0.05% and 0.30% fees respectively. Although LP opportunities are relatively limited, the reduced gas costs increase the accessibility for curious users to experiment with the active liquidity provision, and manual rebalancing, that is required for V3.

Conclusion

Ethereum scaling is in full gear with the launch of Arbitrum. While the network is not yet fully decentralized or running at full strength, users can still take advantage of near-instant confirmations and significantly reduced gas fees to explore the layer-two frontier.

Despite many protocols having yet to launch, there are still several prominent projects and yield farming opportunities for users to maximize the value of their assets and level up their DeFi game.

The state of gas fees may seem bleak. But thankfully, there’s a light at the end of the tunnel.

Action steps

- Onboard to Arbitrum using the Token Bridge

- Execute on any of the above opportunities!

Ben Giove

Ben Giove