Cartesi - Build app-specific rollups with Web2 tooling!

Cartesi - Build app-specific rollups with Web2 tooling!

Earn, Save, and Invest your crypto from your checking account with OnJuno. 4% savings rate!

Dear Bankless Nation,

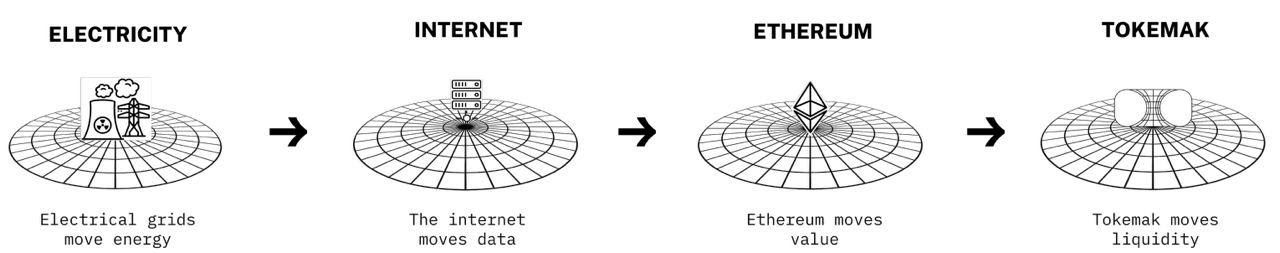

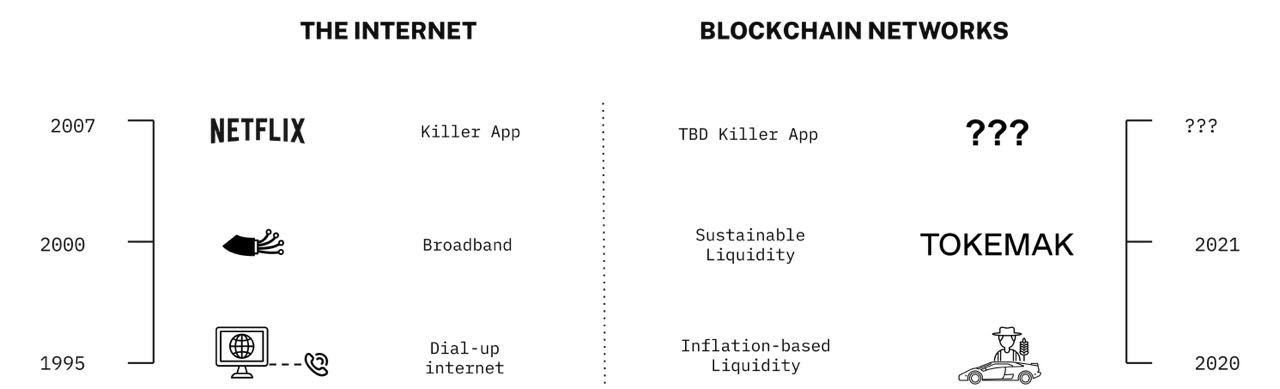

The internet of communication relied on data bandwidth.

The first innovation was dial-up, which allowed for communication applications like email and websites. Transformational…but still just a shadow of what was possible.

Then we had our broadband moment. Data bandwidth increased by nearly 200x over the subsequent decades and brought a new wave of new applications into the internet. Netflix, YouTube, Social Media, and cloud-based everything—broadband did this.

In Web3—the internet of value—liquidity is the new bandwidth. Data bandwidth allowed communication to flow freely, but liquidity bandwidth enables value to flow freely.

The problem is that we’re still in the dial-up phase. Liquidity is fragmented and inefficient, there are barriers to entry, we use basic primitives like liquidity mining, and we’re only just discovering the potential.

Web3 needs its broadband moment.

Hyper efficient capital formation? Globally accessible on-demand loans? Seamless, real-time payments in the Metaverse?

Liquidity makes all this possible.

Liquidity is bandwidth.

Let’s explore this concept today using Tokemak as an example.

- RSA

The internet is changing at a tremendous pace.

The immense network of data exchange known as “the internet” is evolving into an increasingly intricate ecosystem where direct value can be exchanged, in the form of tokens. Web3 will revolutionize economies, transforming the way in which businesses function, individuals work and organize themselves, and products are delivered and consumed. This decentralized economy requires both electrical grid access and network access (as does the internet).

Furthermore, it requires blockchain access and most importantly, liquidity.

The goal of this article is to discuss how liquidity is the bandwidth of not just the future “internet”, but the entire future decentralized economy. We follow this with a brief discussion regarding Tokemak’s role in greatly increasing liquidity bandwidth.

Broadband liquidity is almost here.

In order to better grasp the concept of liquidity as bandwidth, one should first comprehend the meaning of both terms. We will start with the definition of bandwidth, which is easier to define, followed by liquidity.

Bandwidth

Network bandwidth is the rate at which data can move across a network. Therefore, more bandwidth represents more data flow. In a world where users are interacting with each other across the internet, it’s apparent that higher bandwidth means a better internet-based economy (just think about all the hype around 5G).

Bandwidth is measured in bits of information per second (bits/sec). At the genesis of the modern internet, consumers used dial-up modems that transferred data at 56 kbits/sec. This enabled early internet products like web pages and email.

When Ethernet arrived, the game changed quickly. Ethernet boosted bandwidths with a whopping 10 Mbits/sec. This meant that Ethernet could send roughly 180 times more data across the internet when compared to a dial-up modem. Broadband bandwidth and data transfer had arrived!

Things have only gotten faster since, with speeds commonly now in the 1-10 Gbits/sec range (18,000 – 180,000 times more data than dial-up). These speeds were required to unlock a slew of internet-based products that weren’t fathomable with the low bandwidth of dial-up. Streaming services such as Netflix, cloud-based gaming, as well as always-on servers in the cloud are only possible due to the increased bandwidths of the current internet.

Of additional importance, however, is that reliable network bandwidth requires more than just strength and speed, but also sustainability. Users send and parse data asynchronously across the internet, which means reliable bandwidth needs to be accessible on demand. More on this later.

Liquidity

Liquidity is a trickier character to define. In DeFi/Web3, liquidity is used to define tokens (value) that is provided or parked almost anywhere. While there is nothing wrong with this general use of the term per se, here we will try to be a little more specific.

We define liquidity in a more targeted manner, as usable liquidity that can be used to exchange one token for another. In a sense, liquidity is the magic juice used to trade and transform tokens. For example, if I have ABC token and I want to trade or “transform” it into XYZ token, I need to interact with liquidity.

In trading speak, I need to interact with ABC/XYZ liquidity, by selling ABC/XYZ. Selling ABC/XYZ means I am selling my ABC tokens in exchange for XYZ tokens.

Next let’s discuss good liquidity vs. bad liquidity, starting with bad.

Bad liquidity is any liquidity where you lose a significant amount of value when you interact with it. This means that “thin liquidity” is bad liquidity. Thin liquidity occurs when there aren’t enough tokens available to trade into. For example, say you want to sell ABC into XYZ as discussed above, and let’s say that every 1 ABC is currently worth 1 XYZ. If there aren’t many XYZ available as liquidity, it means that the ones that are available will go at a premium. You want to sell 10 ABC to receive the 10 XYZ that you should get (at a price of 1 XYZ).

Instead, you walk away from the trade with only 8 XYZ due to thin liquidity. You lost significant value along the way (2 XYZ in this case), by interacting with thin liquidity and purchasing XYZ at a higher price than they were actually worth.

On the other hand, good liquidity is any liquidity where you retain most of your value when you interact with it. As you probably guessed, “deep liquidity” is good liquidity.

Let’s return to the example above. Recall that you wanted to sell 10 ABC into XYZ and the price of 1 ABC is currently worth 1 XYZ. Now let’s say that there is deep liquidity, in other words, lots of XYZ available to purchase. In this case, you could walk away from the trade with 9.9999 XYZ. You still got a tiny bit less than 10 XYZ, which is the cost of taking liquidity. But you preserved almost your entire amount of value that you started with.

✍️ Author’s Note: Some exchanges can give better or worse pricing for the same level of token liquidity, but that’s beyond the scope of this article!

“Deep liquidity” means preserved value when trading between tokens. “Thin liquidity” means loss of value when trading between tokens.

In other words, you can trade at the price of a market when there is deep liquidity. With thin liquidity, the price moves significantly as you interact with it.

Who needs liquidity?

Having elaborated on both bandwidth and liquidity, we need to next understand why this is important and who truly needs liquidity. In a word: everyone. Furthermore, this is not broad enough. It really is everyone and everything.

The above discussion may make it seem like only traders should care about liquidity. In Web3, this couldn’t be further from the truth. All users interact with liquidity, as all users need to move in and out of the tokens required to interact with a token-based economy. Similarly, all protocols need to interact with liquidity as they buy/sell and lend/borrow tokens between themselves and the other protocols that they interact and interface with.

Here are a few examples.

Example 1 🌾

First, let’s use the example of a user seeking out yield. A user wants the APR available from staking ABC token. They likely started with ETH or USDC (or another stable), so they need to interact with ABC/ETH liquidity to acquire the initial ABC tokens to stake in the first place.

Meanwhile, they start accruing yield in tokens. Once they claim these tokens, they might want to sell in order to pay bills, purchase items, or make other investments. Again, they will interact with liquidity to do this.

Example 2 🎮

A gamer user decides that they want to purchase real estate and an avatar in a new “play-to-earn” game. The game only takes the in-game currency ING. The user first needs to trade with ING liquidity to acquire ING. Next, the user uses the ING to purchase the real estate NFT and the avatar NFT, again interacting with liquidity (this time ING vs NFT liquidity).

Example 3 🧠

Plenty of protocols function by transforming some of their TVL into something else upon a specific trigger. For example, say that Protocol A interacts with Protocol B to hedge when a price reaches a certain point.

When the trigger occurs, Protocol A needs to take a certain amount of their token AAA and swap it into Protocol B’s token BBB, so that it can interact with Protocol B. This means that both Protocol A and Protocol B need to interact with liquidity in this process. A specific case of this is the liquidation of a MakerDAO vault when the value of the collateral falls below the minimum collateralization ratio. When this happens, enough collateral is sold to cover the debt in addition to the existing liquidation penalties.

Example 4💰

A DEX protocol (decentralized exchange) relies on liquidity deposited from liquidity providers (LPs) for its entire business model to function. More liquidity deposited into the protocol means they can provide better pricing (less value loss for users). This, in turn, attracts users to trade there instead of other venues, which increases trading volume through that DEX. Increased trading volume of course means increased fee revenues generated at the DEX.

Having examined a few examples of how liquidity is used in Web3, we will move on to the topic of liquidity bandwidth.

Liquidity = Bandwidth

In this new “internet of value”, liquidity is needed to do fundamentally anything. Therefore, in this world, liquidity serves the role of bandwidth.

Recall that with the internet of data, additional bandwidth is needed to do more things and move more data. Low data bandwidth meant participants could not move more data. You simply could not create Netflix until you had sufficient data bandwidth to reliably stream movies across the network.

In the internet of value, greater amounts of liquidity are necessary to do more things and move additional value. Thin liquidity means participants will not move greater value, because the value loss to them is too high. Imagine an economy where value cannot flow freely because every time it moves, exchanges, or transfers; it loses value. This is the current state of DeFi and Web3.

Value transfer has replaced data transfer, and liquidity is the new bandwidth of the Web3 network. The issue is that the liquidity bandwidth is currently thin and unreliable. Take a look at how many tokens are currently sidelined, rather than being used as liquidity. The answer is a majority.

Using ALCX as an example, less than 20% of its circulating supply is available as liquidity on Sushiswap (the incentivized exchange). There is also additional non-circulating supply, therefore a vast majority of ALCX tokens are not actively used as liquidity. Note that this is not specific to ALCX, rather this is an example of a phenomenon that is generally applicable across all tokens.

The underlying reason for thin liquidity is that the DeFi space has introduced far too much friction for users to be LPs. For a normal token holder to provide liquidity, there are three key reasons they don’t provide liquidity:

- UX challenge

- Impermanent loss

- Capital inefficiency

The UX challenge arises because it takes a fairly advanced user to discover and provide liquidity into Uniswap, Sushiswap, or Balancer (as an example). Casual users will be deterred from the entire experience.

For those that are capable of facing the UX challenge, they still need to understand impermanent loss and be willing to take that risk. Additionally, they need to have the “other side” of the pair, making it very capital inefficient for them to provide liquidity. For example, if they want to provide ABC liquidity, they need to have and provide both ABC tokens and ETH tokens, in order to provide ABC/ETH liquidity.

The outcome is that liquidity in DeFi is currently in a dial-up state. There is just not enough liquidity to enable and encourage transfers with low value loss.

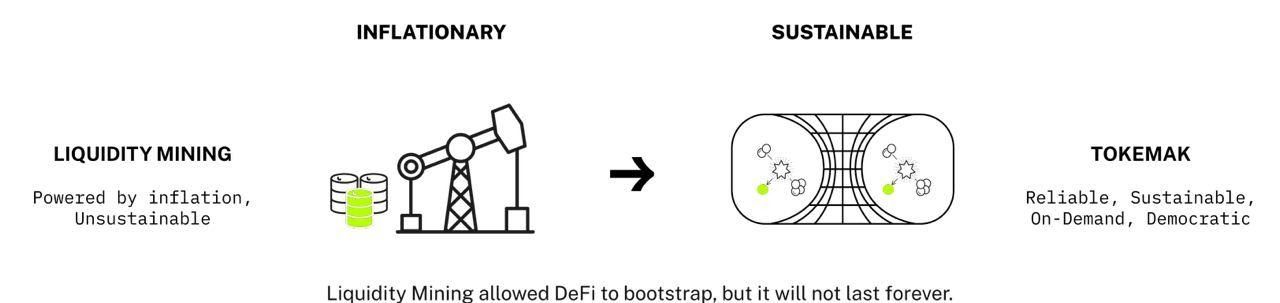

Additionally, the liquidity that exists is highly unreliable. Token projects generally incentivize their liquidity via inflationary rewards. This inflation-based liquidity is unsustainable and can turn off at a moment’s notice. Stop the rewards? Lose the liquidity. Keep the rewards going? Inflate away the value of your token.

Neither are good outcomes.

Tokemak is one solution aiming to fix these problems by unlocking deep, reliable, and sustainable liquidity bandwidth.

How Tokemak Solves the Liquidity Issue

Tokemak is a utility that attempts to usher in the broadband moment of liquidity bandwidth. This bandwidth will unlock Web3/DeFi/GameFi applications that one can only dream about.

The liquidity engine of Tokemak will power it all.

So, what is Tokemak?

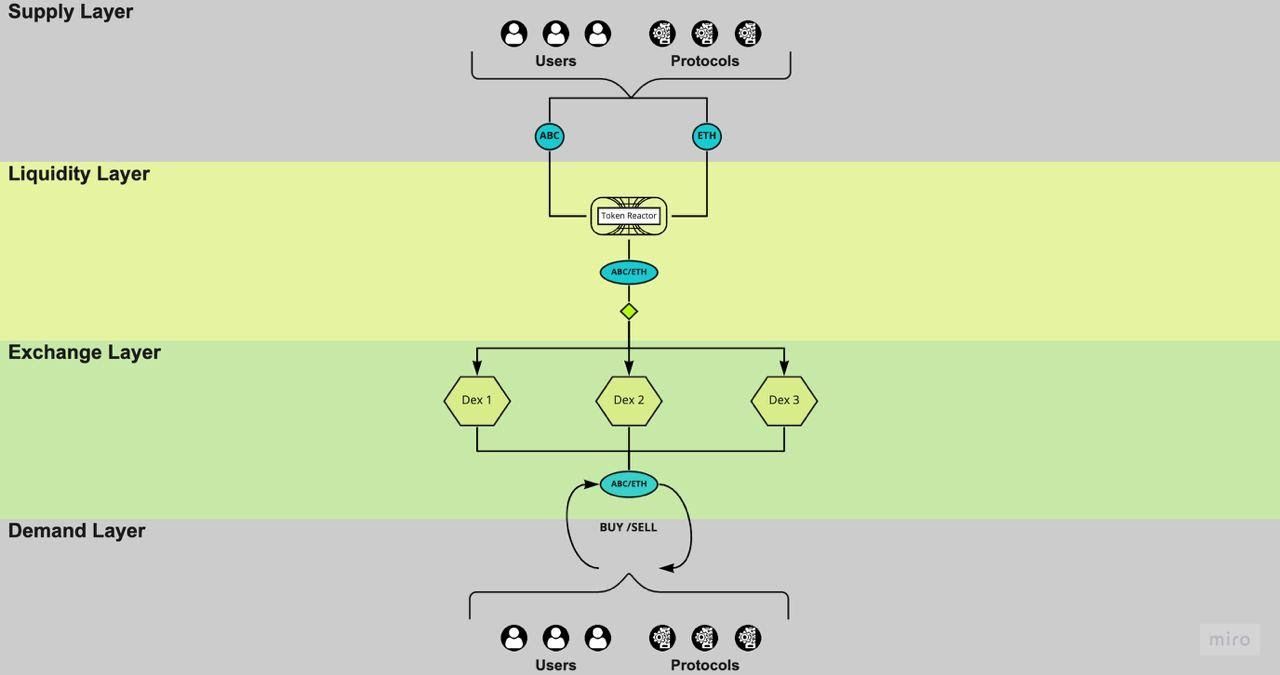

Tokemak is the unified liquidity layer of Web3, spanning across all DEXs, chains, and layers. It removes the friction for users to become Liquidity Providers, increasing liquidity bandwidth across the board. The diagram below shows how Tokemak functions.

Starting from the top of the diagram, any user or protocol can now provide liquidity simply by depositing their ABC tokens directly into Tokemak. They don’t have to go through the UX challenge of LPing at the exchange level, and they don’t bear the risk of impermanent loss.

They can deposit just the assets they have, without the requirement to pair it with another asset (ETH, USDC, etc). In this way, Tokemak translates one-sided liquidity supply into two-sided liquidity in the market, pulling from one-sided pools for both assets.

Users known as Liquidity Directors direct where the liquidity is routed across all of DeFi. This routes the economic bandwidth provided by Tokemak, securing liquidity for tokens and ensuring the success of DEXs, chains, L2s, and stablecoins by providing liquidity across the spectrum. Users and protocols are then able to go to the exchanges and interact with the deep liquidity that Tokemak provides (by buying and selling into it).

If you take a look again at the diagram of Tokemak, you’ll notice something very interesting. The supply layer and the demand layer are the same: both are comprised of Users and Protocols as participants.

This is because with Tokemak, everyone (meaning all token holders everywhere) can now become passive liquidity providers. This unified liquidity layer becomes the most powerful for all users, with the lowest value loss for all, when all the base assets of the entire network sit in DEXs as liquidity that can flow freely based on the needs of the participants.

The Future

So, what happens when the maximum amount of liquidity bandwidth is made available? This is the final state of liquidity bandwidth, where Tokemak will fulfill its destiny as the liquidity engine powering the entire network.

The decentralized economy will truly be unleashed.

As we move towards a future with broadband liquidity, it becomes challenging to imagine what, exactly, that future looks like. While we know that deep liquidity will enable reliable pricing and less volatility, the implications are much more intriguing.

Trying to imagine what will be built upon the coming deep liquidity bandwidth is as difficult as someone in 1995 with dial-up internet trying to imagine Netflix streaming videos to a mobile phone. The future innovation that deep liquidity bandwidth will unlock will be even more significant.

That said, I’ll try to postulate a few examples of innovation that I believe will be coming, built on the shoulders of broadband liquidity.

First, think about how challenging it is for an individual in a developing country to obtain a loan to make a major purchase, such as a house.

In most cases, the financial infrastructure (i.e. banks) either do not exist or the individual does not have access to the system. In the new world of democratized finance with deep liquidity bandwidth, the individual’s cash flows could be verified on-chain, and lenders all over the world could offer a loan or mortgage to this individual, on demand. Smart contracts could check the capital flows and verify the individual’s on-chain activity instantly, and flow capital to the person’s wallet the very moment they ask for the loan.

Second, imagine an entrepreneur that has a great idea for a new on-chain business, but no capital to get things started. In the future, the user will put an overview up on the internet, and use a token template to launch to initial “idea investors”. Individuals and protocols will see the materials, decide if the idea has merit, and fund the new venture at this seed stage (or pre-pre-seed stage). This collapses the entire capital raise process into something that can occur right after the idea and model are formed; every entrepreneur’s dream.

Last, imagine the world we are heading towards with GameFi and the metaverse. All individuals will own their own identity, data, and cash-flows associated with that data and identity. No longer do the Web2 giants own the user. Built on deep liquidity, tokens to pay and incentivize users can flow to the individual in real-time on the blockchain. As users interact, purchase, contribute, and simply spend time in the virtual “always on” universe, all forms of entertainment and gaming can stream value and payments to participants as easy as racking up a high score in today’s video games.

To summarize, the coming deep liquidity bandwidth will enable ANY flow of value to stream freely, without friction, middlemen, or rent seekers.

The future will be much more incredible and hard to imagine than those examples outlined above. The entire economy will soon be running on liquidity bandwidth, you heard it here first.

Action steps

- Consider what happens when crypto has its “broadband” moment

- Read “The Liquidity Singularity”

Author Bio

Liquidity Wizard is the Founder of Tokemak, a DeFi protocol optimizing liquidity.

Bankless

Bankless