Open Season on OpenSea

Dear Bankless Nation,

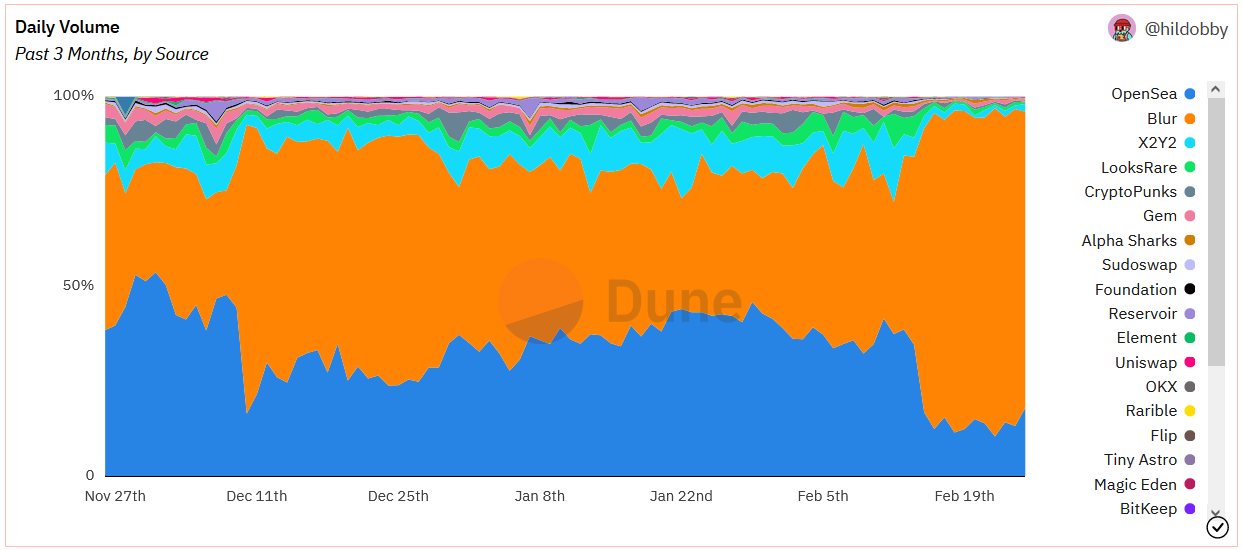

OpenSea’s market dominance has been near-absolute for years, which makes the stunning ascent of Blur all the more impressive. The upstart NFT marketplace still has plenty of challenges ahead of it, but its hunt for OpenSea volumes and users has been going very well so far.

Today, we dig into the war between the two platforms and highlight where OpenSea still holds the high ground.

- Bankless team

After countless toothless upstart challengers, OpenSea finally has a full blown competitor on its hands threatening its market dominance.

Following a successful airdrop, Blur is not falling by the wayside like other trendy NFT marketplace platforms have. In fact, this past week has seen Blur consistently flipping OpenSea in trading volumes.

Much of these volumes still appear focused on juicing the Blur rewards mechanisms, but if regulatory handcuffs leave the venture-backed OpenSea unable to launch a token, Blur may have a wide window to flex this muscle over its larger competitor.

Blur arrived in the NFT market relatively late in October 2022 as an aggregator. How did it rise to the top so quickly? — Blur’s rapid ascent to the top can be credited to a price strategy targeting a niche market audience as well as its well-crafted liquidity mining program.

The company’s traction has pushed OpenSea to adjust its underlying monetization mechanics and has kickstarted a war over one of the NFT market’s most cited benefits — creator royalties.

A battle over creator royalties

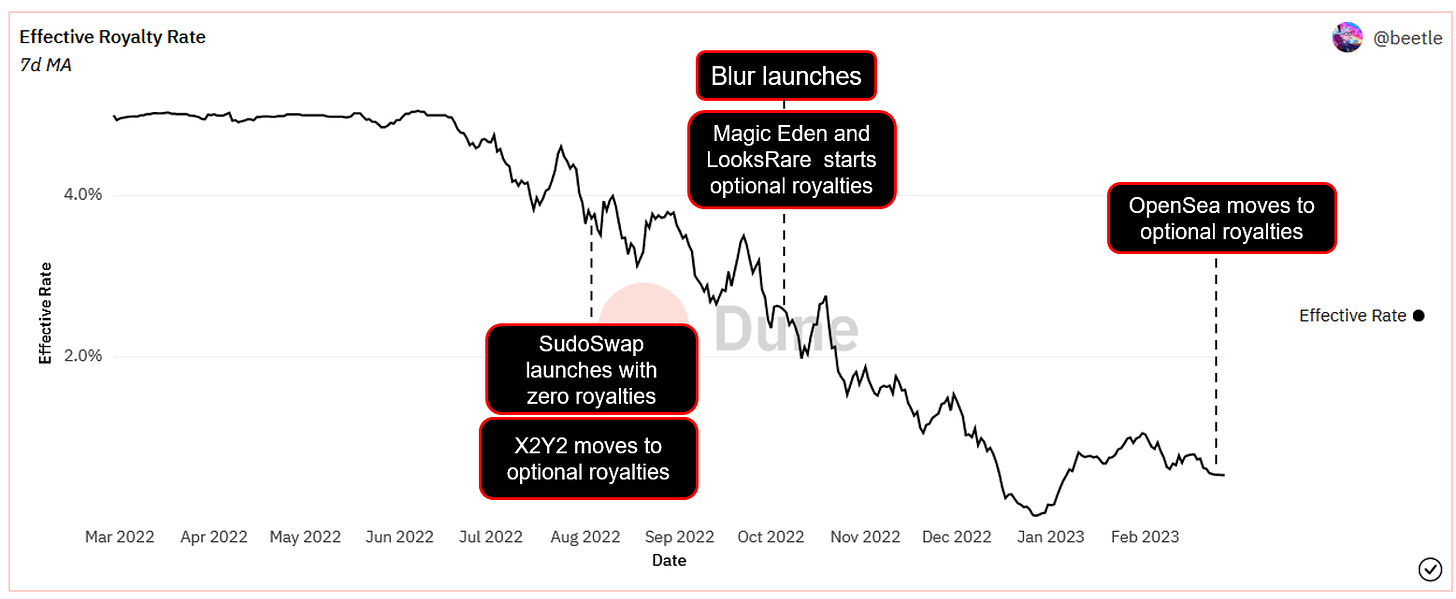

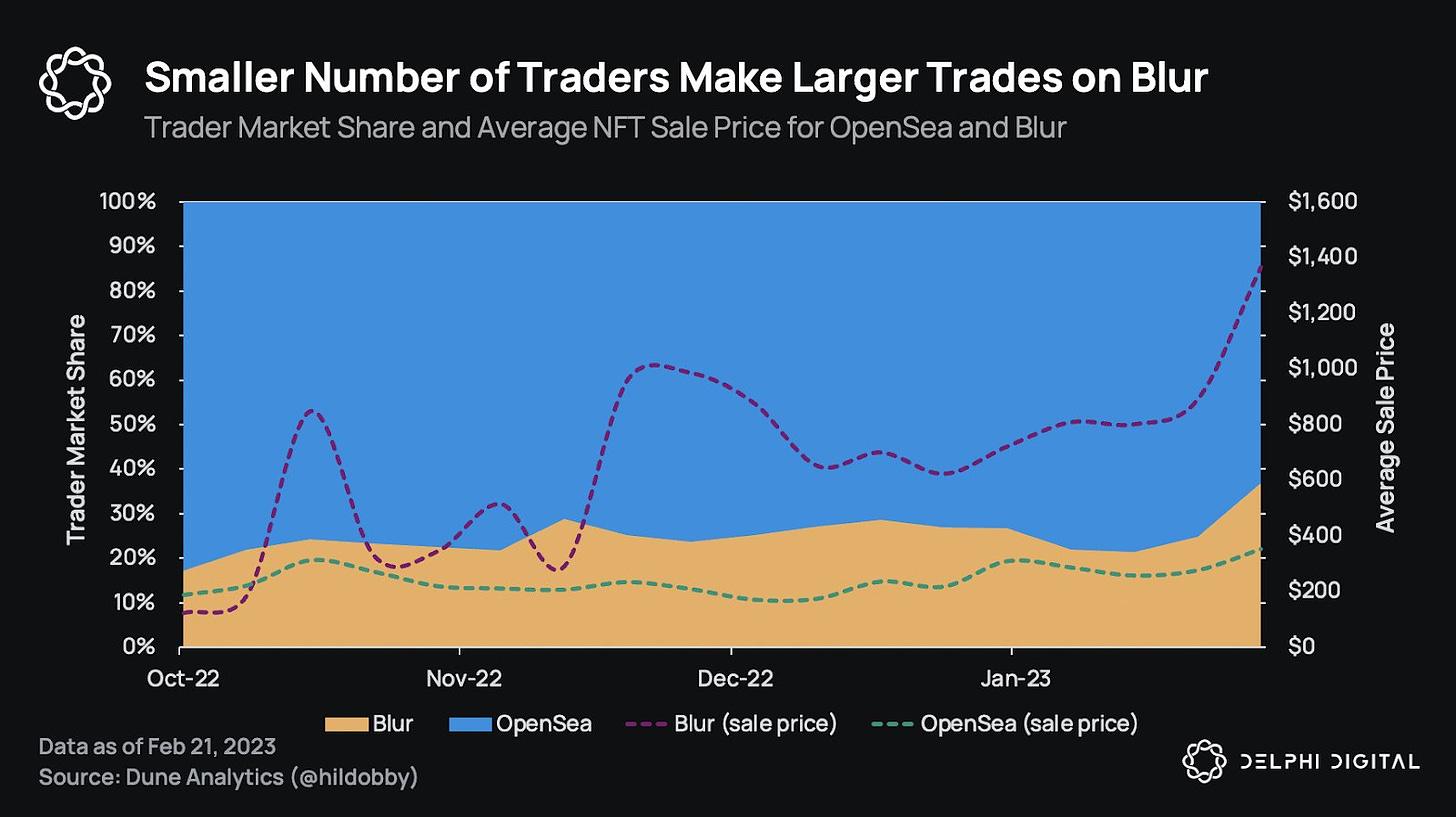

Blur seemed to realize that one way to gain market share in an OpenSea-dominated field was to first corner the most price-sensitive user segment in the NFT market. It began by targeting a niche swath of speculative NFT traders by offering a frictionless optional-royalty, zero trading fee marketplace.

Blur was by no means the first to pursue such a price strategy; both Sudoswap and Magic Eden had before with varying success. But Blur greatly accelerated the zero royalty race to the bottom.

Royalties have become an increasingly prickly subject. Should NFT creators be entitled to a cut every time their collections are traded? Most NFT royalties are nothing more than a social agreement; the marginal cost for NFT creators to upkeep their digital art is, of course, zero, but many creators in the market see perpetual royalties as a way to offset initial costs in a way that aligns incentives with collectors.

The market standard of NFT royalties emerged from the 1 of 1 NFT art boom when degen trading was more uncommon and collectors had fewer qualms with paying a royalty percentage to creators enforced by third party marketplaces like OpenSea.

Plenty changed amid the speculative mania of the 2021 NFT bull market. When the meta of 10,000 NFT collections sprang up, altruistic royalties were now costly to upkeep. Yet, the concept of royalties persisted, and continued to be enforced at the centralized marketplace level. Royalties were a massive revenue generator for the largest NFT projects, but one that speculative NFT flippers increasingly lamented.

After the bull died down, illiquid market conditions set the stage for emerging NFT marketplaces like Sudoswap and Magic Eden to test market waters with zero royalty policies. Blur’s ascent in recent months single-handedly accelerated the abandonment of the market standard of NFT royalties being honored.

This inroad against OpenSea was a test for its values. OpenSea’s initial positioning attempted to side with creators and flex its market dominance to push traders to only list to OpenSea buyers.

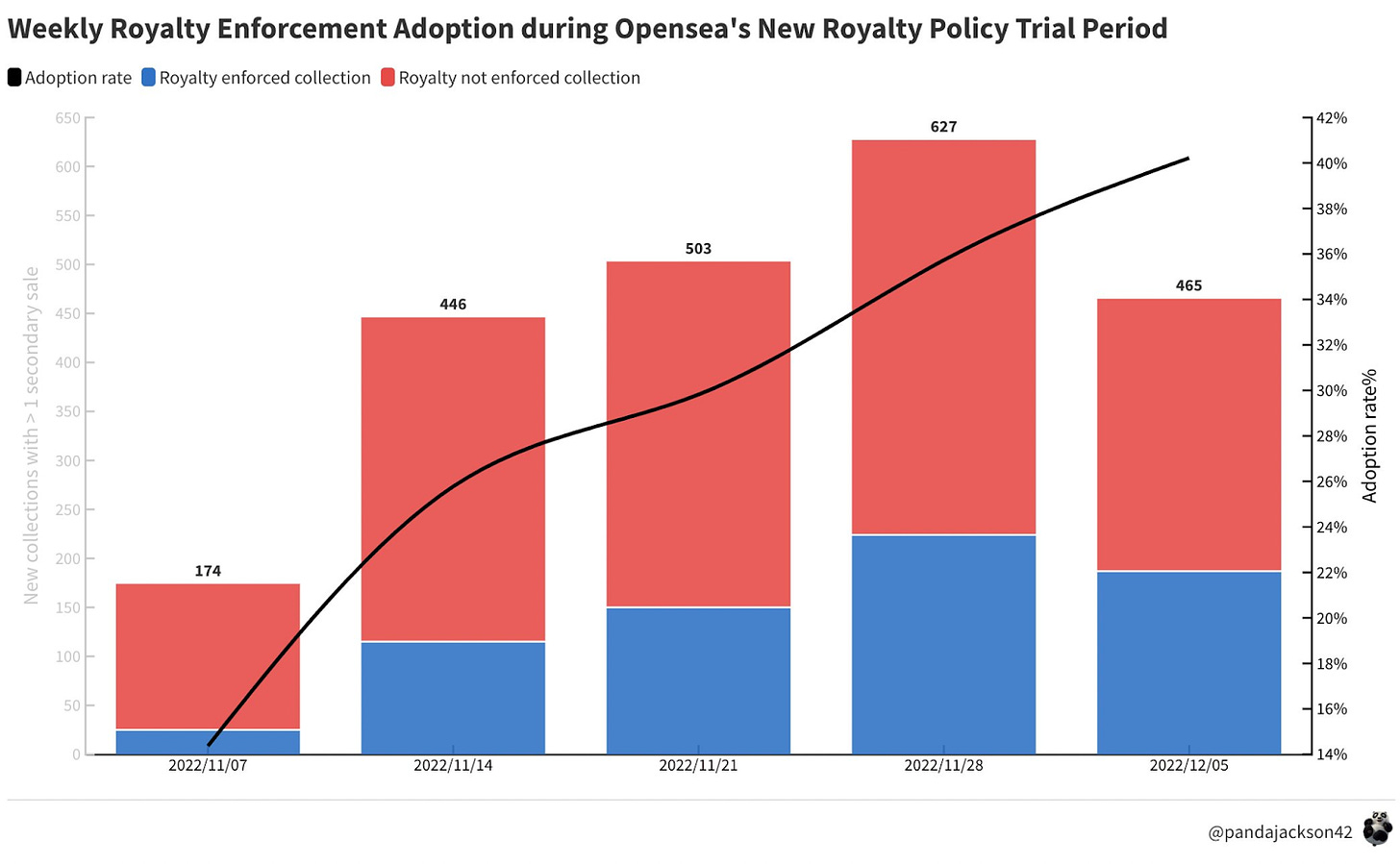

The platform introduced a “pro-creator” policy on November 8th that forced creators into the dilemma of choosing between earning royalties on OpenSea or Blur. OpenSea declared that it would restrict creator royalties on their marketplace, unless creators voluntarily blocked zero-royalty marketplaces (including Looksrare, X2Y2 and Sudoswap) from trading their collections in their smart contract code.

This strategy worked to an extent. Hundreds of NFT projects embraced OpenSea’s royalty policy, eager to return to a status quo where they could sit back and collect a blank check through perpetual royalties. Smaller NFT marketplaces that were previously optional-royalty like Manifold, Sound and Zora updated their own policies to let creators choose to do so if they wished. Unlike Blur, smaller competitors could not afford to go up against OpenSea.

For a time, Blur even reversed its attractive price strategy by trying to court NFT creators that would’ve blocked them by promising to enforce royalties.

Blur will enforce royalties on permissioned NFTs. We will continue to incentivize royalties on all NFTs while taking 0% marketplace fees ourselves.

— Blur (@blur_io) November 14, 2022

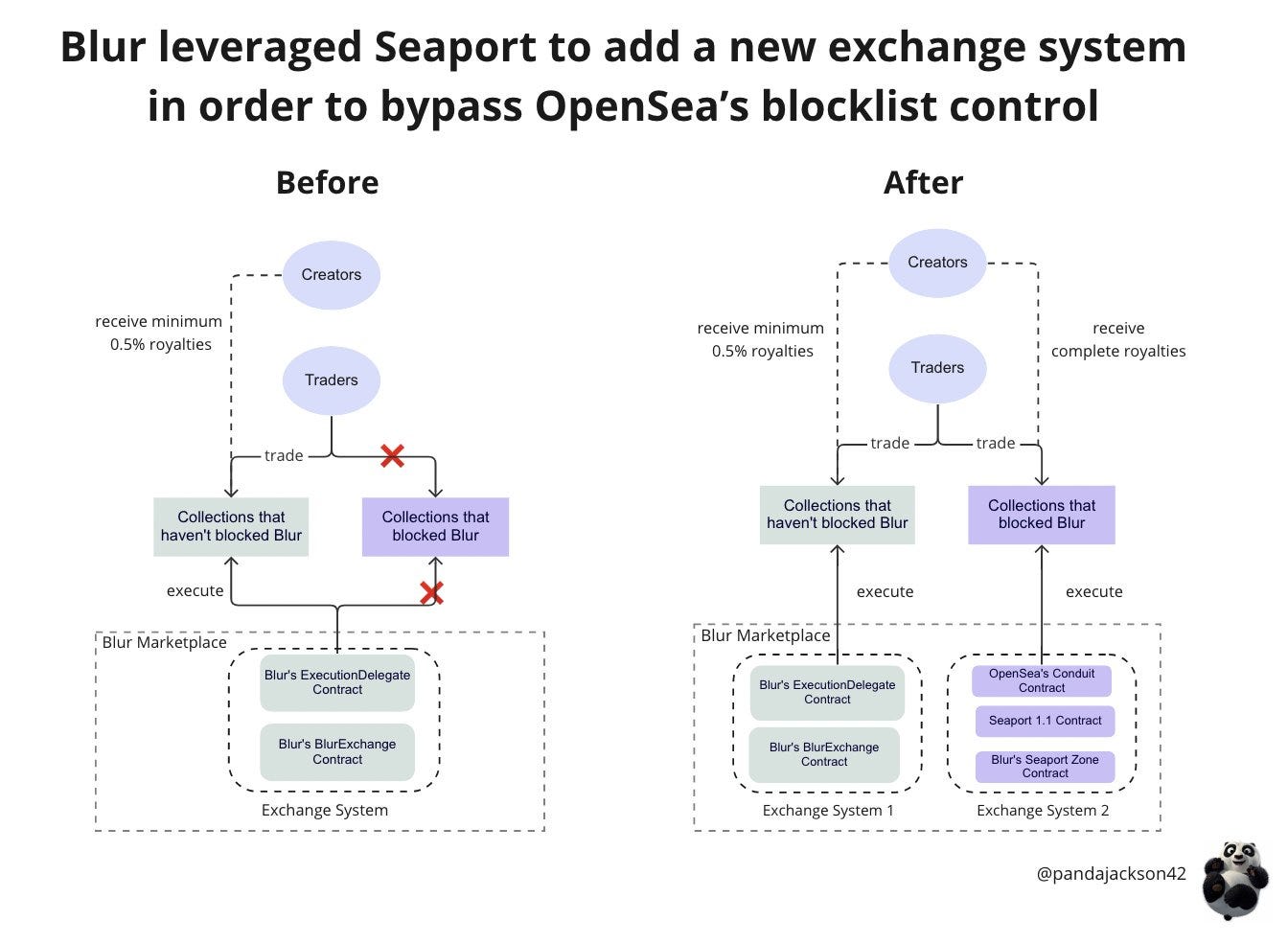

Few anticipated what came next. To everyone’s surprise, Blur found a way to circumvent the block. Blur ingeniously leveraged OpenSea’s Seaport protocol and built its marketplace on top of it. Seaport is OpenSea’s permissionless decentralized protocol that lets anyone build marketplaces on it.

Blur, in effect, put the ball back into OpenSea’s court and said: “If you want to block us you’ll have to block your own Seaport protocol.”

And with that, things went back to normal in the NFT market. From the user perspective, “restricted” collections were tradable on Blur once again. From the creator’s perspective, they no longer had to choose – they could earn full royalties on both OpenSea and Blur.

Within 48 hours, OpenSea made an unprecedented announcement to backtrack on its “pro-creator” royalty-enforcement policy and temporarily lower marketplace trading fees to zero.

We’re making some big changes today:

— OpenSea (@opensea) February 17, 2023

1) OpenSea fee → 0% for a limited time

2) Moving to optional creator earnings (0.5% min) for all collections without on-chain enforcement (old & new)

3) Marketplaces with the same policies will not be blocked by the operator filter

Liquidity mining done right

The second prong in Blur’s market strategy is a familiar page out of the DeFi playbook: liquidity mining for free helicopter money.

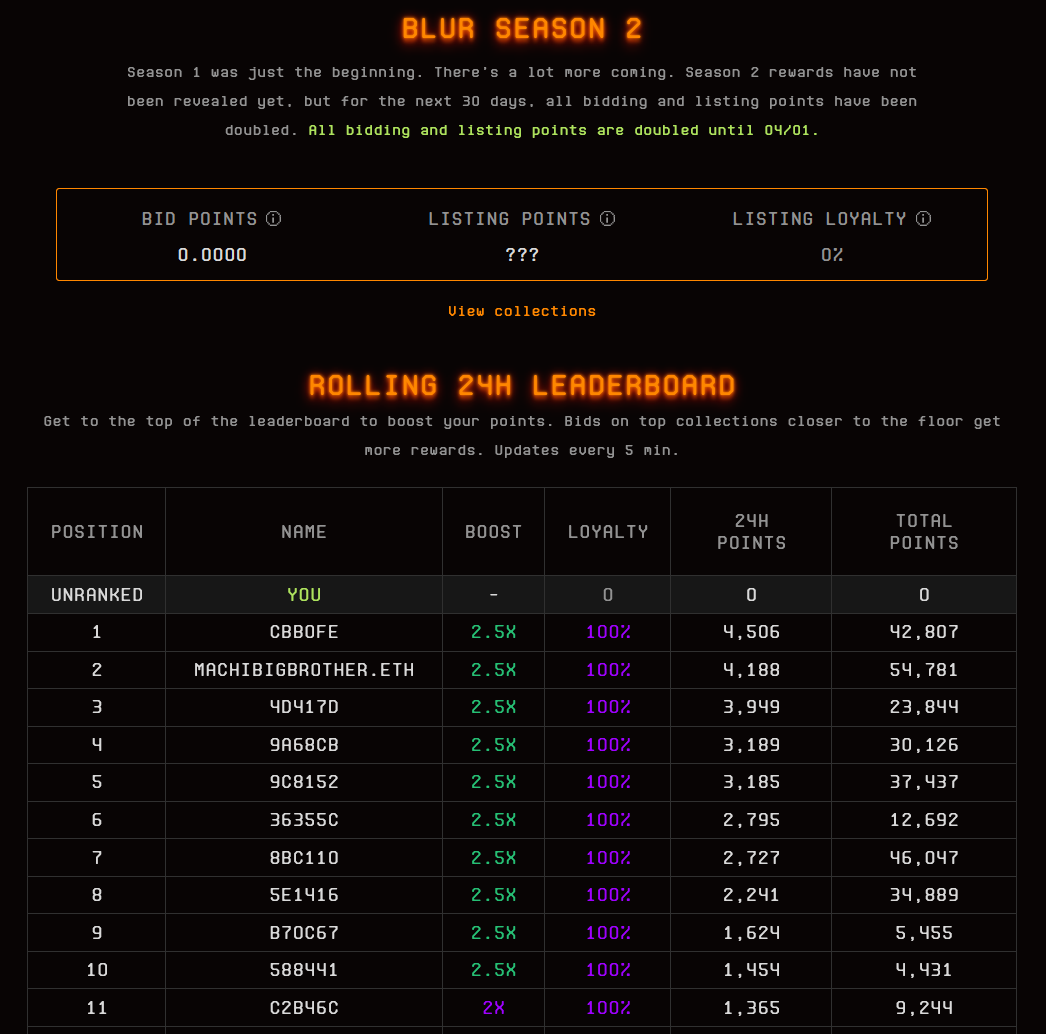

Where Blur’s liquidity mining strategy differed however, was in the way it incentive-aligned mercenary airdrop gaming with actual value creation i.e., supplying bidding liquidity.

Blur’s airdrop was designed around a “loyalty point” system that awarded points based on the number of bids users placed on its marketplace. The bigger bids you placed, the closer those bids were to the collection’s floor price, the more loyalty points you got, and the larger your eventual airdrop.

This incentivized whale mercenaries to assume actual risk, pouring millions in bids, creating liquidity for the Blur marketplace. Positive externalities splashed across Blur’s marketplace, presenting Blur as a premier destination for NFT trading.

In contrast, previous OpenSea competitors like X2Y2 and Looksrare tied airdrop qualification to mere product usage. This incentivized airdrop hunters to participate in superficial, risk-free wash trading. Trading volumes pumped on these platforms but it did not make those marketplaces an overall better trading platform.

Is Blur’s position sustainable?

In short, Blur’s rise to the top was a calculated, two-pronged attack on OpenSea based on a price strategy undercutting on royalties/trading fees, plus a well-designed liquidity mining program.

OpenSea finally capitulated by dropping trading fees last week, but the NFT marketplace wars are only just beginning.

Blur’s design of liquidity incentives, while successful thus far, is far from risk-free. The sweet spot for Blur airdrop hunters is being able to supply a bid and earn Blur loyalty points… without it being actually taken up by a seller.

In the event that NFT markets tank, this could create a series of cascading bids being accepted and markets tanking even further when airdrop hunters realize that the risks of supplying capital > the gains from Blur loyalty points.

In what's likely the largest NFT dump ever, in the past 48 hours Machi has sold 1,010 NFTs, including:

— Andrew T (@Blockanalia) February 24, 2023

- 90 BAYC for 5707 ETH

- 191 MAYC for 3091 ETH

- 112 Azuki for 1644 ETH

- 308 Otherdeed for 582 ETH

But he's not registering much profit for these collections. Why? pic.twitter.com/4NyMF3gzuy

Second, Blur’s surging activity is contingent on the constant dangling of a very expensive carrot. While Blur has deliberately split out its airdrops into a creative “seasonal” marketing campaign that conveys endlessness, it merely obscures the massive costs in millions that Blur is paying for incentivizing liquidity.

Let's assume Blur Season 2 lasts for 6 months and distributes 300M tokens.

— Teng Yan ⛩ (@0xPrismatic) February 25, 2023

That's 1.66M tokens/day = $1.3M at today's prices

So it costs $1.3M/day to maintain ~$130M in liquidity

Could be more or less. Blur has not revealed the length of Season 2 yet.

The BLUR token is also nothing more than a meme token at this point, or if you’re being charitable a “token with governance utility”. Anyone who desires BLUR is likely just speculating on the future of the project or on the desires of the next bagholder in line.

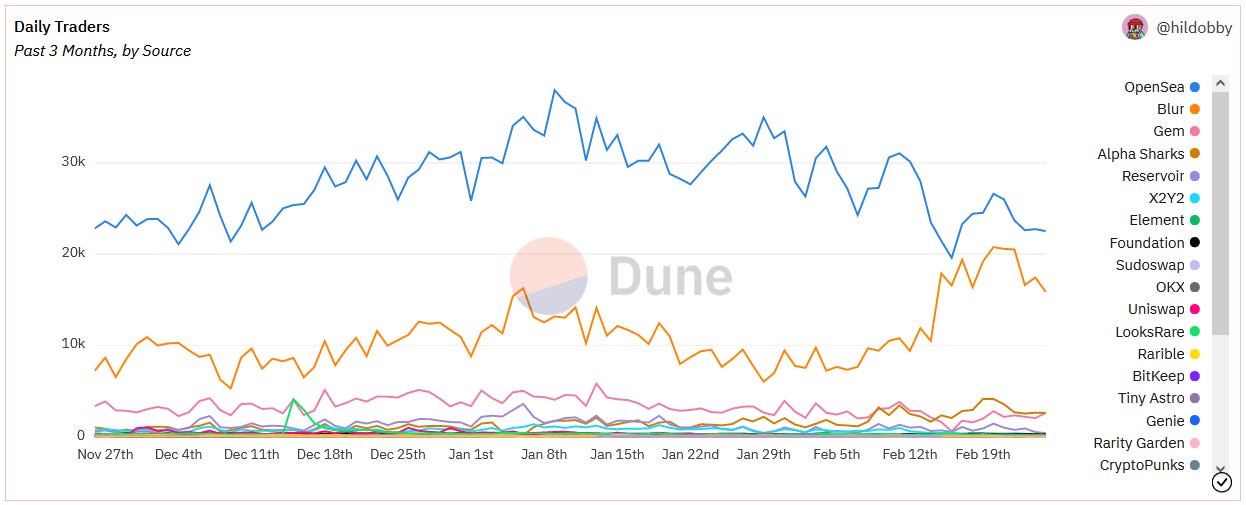

Finally, while Blur has surpassed OpenSea on trading volumes, the latter still reigns in organic usage as seen by the below Dune chart on unique user metrics.

Blur’s activity is largely dominated by a small number of wealthy airdrop hunters, while the broader “normie” market remains on OpenSea.

The rising platform may still lag in a few spots, but the momentum against an entrenched incumbent is certainly worrisome for OpenSea’s venture investors who awarded it a $13 billion+ valuation last year.

Can Blur sustain their market position and momentum? That’s the question.

Donovan Choy

Donovan Choy