How to automate your staking rewards

Dear Bankless Nation,

Sometimes staking your DeFi tokens can be a pain.

Claiming rewards every week can be costly and maybe even unprofitable for some—especially in the current gas fee environment.

There are even some protocols that require you to regularly vote on governance proposals in order to be eligible for the rewards (more tx fees!!).

But what if we could just hold a wrapped token that automatically accrued rewards?

That’s xToken.

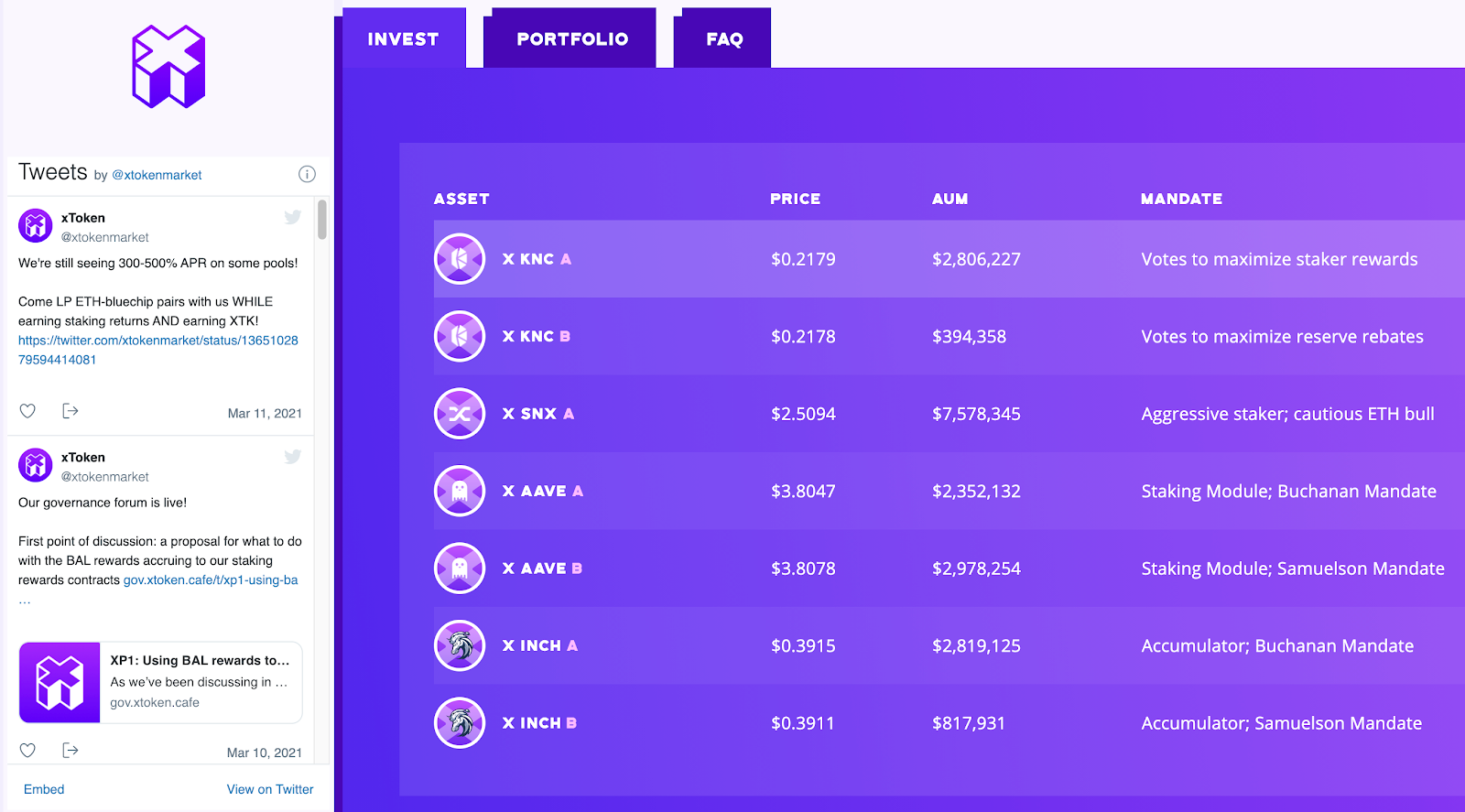

With xToken, token holders can mint an xAsset by depositing popular DeFi tokens with staking opportunities—like AAVE, INCH, KNC, SNX, and others—and in return, receive an ERC20 token that’s automatically earning the underlying rewards.

No claiming, no voting, no transaction fees. Just pure compounding returns.

Powerful.

Let’s explore xTokens today and see how we can automate our staking rewards.

- RSA

Tactic Tuesday

Guest Writer: Michael J. Cohen, Founder & Team Lead at xToken

How to automate your staking rewards

xToken is a protocol for automating staking rewards with the help of wrapped assets. By holding an xAsset, token holders can automatically earn the protocol’s native staking rewards without having the need to claim or govern.

Better yet, all rewards are automatically reinvested and compounded, providing holders with a capital efficient way to earn staking rewards.

This tactic will dive into how xToken works, the possibilities with this design, the risks associated, and how you can mint your own xTokens in a few minutes.

- Goal: Automate your staking rewards

- Skill: Intermediate

- Effort: 10 mins

- ROI: Staking rewards, gas fee savings, and potential tax efficiencies!

Introduction to xToken

If you’re a Bankless reader, you’re probably familiar with DeFi blue chips like SNX, AAVE, KNC or 1INCH.

Chances are you’ve staked one or more of these tokens directly through the protocol’s native staking contracts and UI. Why not right? As time passes, you earn a share of protocol revenue or inflation and the value of your position grows. This is simple enough and, relative to some of the more novel financial primitives in this space, most DeFi investors understand the mechanics of staking.

While staking may be easy to understand, it comes with its fair share of pitfalls. In many cases, staking is expensive, technical, time-intensive, tax-inefficient, capital-inefficient, not to mention incredibly restrictive.

With all of that in mind, is it possible to design a set-and-forget solution that solves for these challenges—eliminating the burden on investors—while also providing holders with an opportunity to express a delegated governance position?

That’s exactly what xToken is aiming to achieve.

✍️ Editor’s note: Each xToken is empowered with a specific governance mandate that will automatically vote on proposals based on the associated mandate—denominated with either an “a” or “b” on the asset’s ticker (i.e. xKNCa will vote differently than xKNCb).

You can learn more on this on xToken’s governance blog

What is an xAsset?

An xAsset (or an “xToken”) is a set-and-forget staking wrapper that grows in value as a protocol’s native staking rewards accrue to the token. Each xAsset is slightly different depending on the staking mechanics of the base token being wrapped, but all are designed to gain value in base token terms.

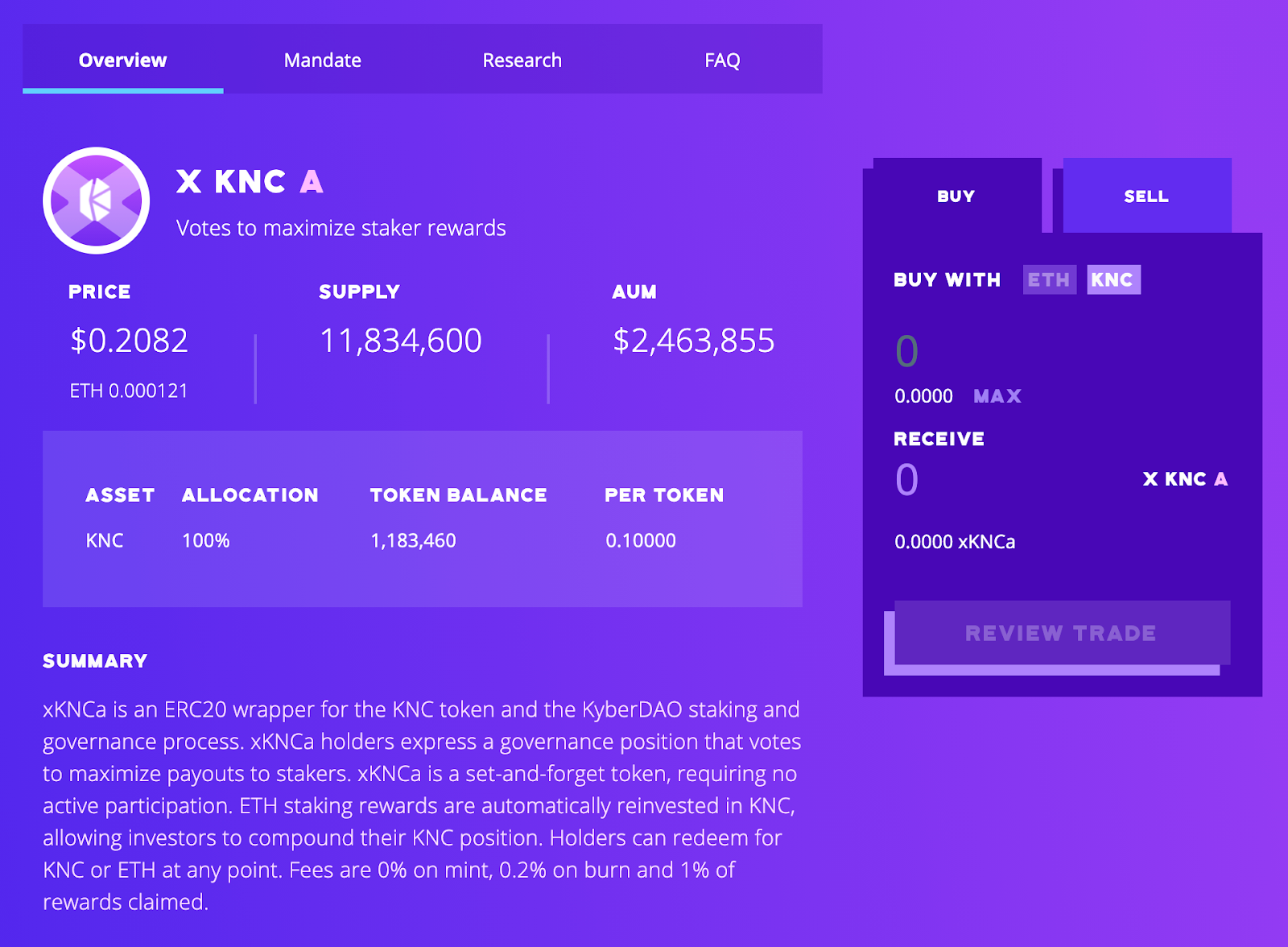

Let’s use xKNC as an illustrative example.

A KNC holder visits xToken Market to mint xKNC. The minting process requires the investor to deposit KNC, and after an approval transaction and confirmation of the mint transaction, they receive xKNC in return.

This is all an investor needs to do to earn compounding Kyber staking returns.

As time goes on, the conversion ratio between xKNC to KNC increases as value accrues to the xKNC pool.

For those unfamiliar with KyberDAO, stakers are required to participate actively in governance in order to earn protocol fees—that means submitting one to three on-chain “vote” transactions over the course of each two week epoch.

Additionally, stakers need to submit a “claim” transaction each epoch in order to retrieve their earnings (paid in ETH). All in, KNC stakers can easily spend $50 or more every two weeks managing their staking position.

xToken abstracts this process by voting and claiming on behalf of the pool of holders. On claim, ETH earnings are reinvested in KNC and staked, increasing holders’ pro rata KNC value while paving the way for compounding returns.

The Utility Escalator

While we’ve demonstrated how straightforward the utility and usage of xAssets can be for an investor, there are multiple levels to the xToken value proposition.

Many users will be content settling for the above example—let’s call it “Level 1”.

As described in the section above, investors benefit from significant gas savings and the peace of mind of a set-and-forget investment instrument.

Full returns, no worries. That said, all holders of xTokens ascend to “Level 2” on the utility escalator, whether they realize it or not.

Level 2

Proceeding with the xKNC example, when KyberDAO ETH fees are claimed and reinvested in KNC, xKNC holders benefit from compounding returns. More KNC invested means more KNC staked, which means more ETH fees, which means more KNC invested. This is standard compounding interest which we all know and love.

But by holding xKNC, investors access a second layer of compounding returns. In many locales, the act of claiming fees is a taxable event, registered at the “regular income” tax rate.

That means that each ETH claim comes with 10%-50% of value leakage. While you should absolutely not take tax advice from xToken or Bankless, it’s quite possible that staking KNC unprotected will wipe out a significant portion of your gains.

✋ This is not tax advice! Please talk to your accountant on the implications of holding xTokens and the taxable events associated with staking in your jurisdiction.

xKNC solves this by providing an abstracted interface—a “wrapper”—for investing and staking KNC. You the investor are not required to claim. All you do is buy xKNC when you want in and sell xKNC when you want out.

On redemption, you pay taxes on your profits, having benefited from full compounding with no value leakage along the way.

Level 3

The final level on the utility escalator concerns the role of xAssets in the larger DeFi ecosystem. We designed our funds with maximal composability in mind, empowering holders with xSNX or xAAVE to do whatever they can do with normal SNX or AAVE.

The first example of Level 3 utility is devastatingly simple: users can transfer their fee-generating, value-accruing xTokens from wallet to wallet just like any ERC20.

As it stands now, SNX, AAVE, KNC and 1INCH direct stakers cannot do this. Their tokens are locked in each protocol’s contracts with little hope of seeing the light of day.

While some protocols mint stakers an IOU token (ex: “StakedAave” or “Staked1Inch”), these have a static value and do not generate revenue directly. And of course, users still have to claim and reinvest their rewards on their own.

Now, with a composable, transferable, yield-generating token in tow, users can do a lot more than simply transfer their xAssets. As one prime example, investors can generate secondary income by LPing their xTokens on a DEX.

🧑🌾 Yield Farmers! xToken is a few weeks into a ten week rewards program where xToken LPs earn XTK (xToken’s native token). Learn more about the program here.

While we love supporting our friends at Uniswap, Balancer and 1Inch (and soon Bancor), why do we need xAsset liquidity on DEXs when users can just mint or burn directly on the xToken contracts?

There are multiple reasons but xAAVE provides one simple, resonant example.

All AAVE stakers are subject to a 10 day cooldown period, where they’re required to signal their intention to unstake 10 days before they actually do it. This is a necessary component of the Aave system, where stakers act as a backstop—or an insurance reserve—for the protocol at large.

Without a cool down, stakers would be able to flee at the first signs of trouble. This cooldown period works for Aave, but poses UX problems for AAVE investors.

In contrast, xAAVE is a liquid staking derivative that offers investors immediate liquidity. No need for the cool down. Instead you can just sell your xAAVE for ETH or AAVE on Balancer—instantly.

In the long run, we foresee DEXs as the primary gateway for xToken trading. The AAVE cooldown requirement is a good example of a protocol-specific value prop, but in many cases, Uniswap is just more familiar to the average investor.

Why learn the xToken UI when you can invest in our funds via your favorite DEX?

There’s more to say about the importance of secondary liquidity for xToken, but we’ll have to save that for a future post. For now, let’s move on to the holy grail of the utility escalator: xTokens as collateral.

xToken Collateral

Simply put, investors and traders want leverage on their tokens. For investors bullish on DeFi, tokens like AAVE or KNC make great candidates for collateral. As price increases, more borrowing power becomes available. Between Compound, Aave, Maker, Cream and others, there are now hundreds of millions of dollars of DeFi tokens being used as collateral.

These tokens do the trick as collateral. However, in most cases, they are earning nothing or next to nothing in interest. With the market strongly biased to the upside, there’s little demand to borrow these tokens to sell short. Sometimes the ‘Farm du Jour’ will offer a short term spike in borrow demand and interest fees, but lending rates on DeFi tokens are frequently below 1%.

What if investors could earn the native staking returns of their tokens while using them as collateral?

That’s what’s on the board next for xToken. In Q2, DeFi leverage-seekers will have this option available to them. We believe that there doesn’t have to be an opportunity cost of using your tokens as collateral. Enjoy your staking returns and your leverage too!

How to Mint an xAsset

Step 1: Head to our xToken Invest page.

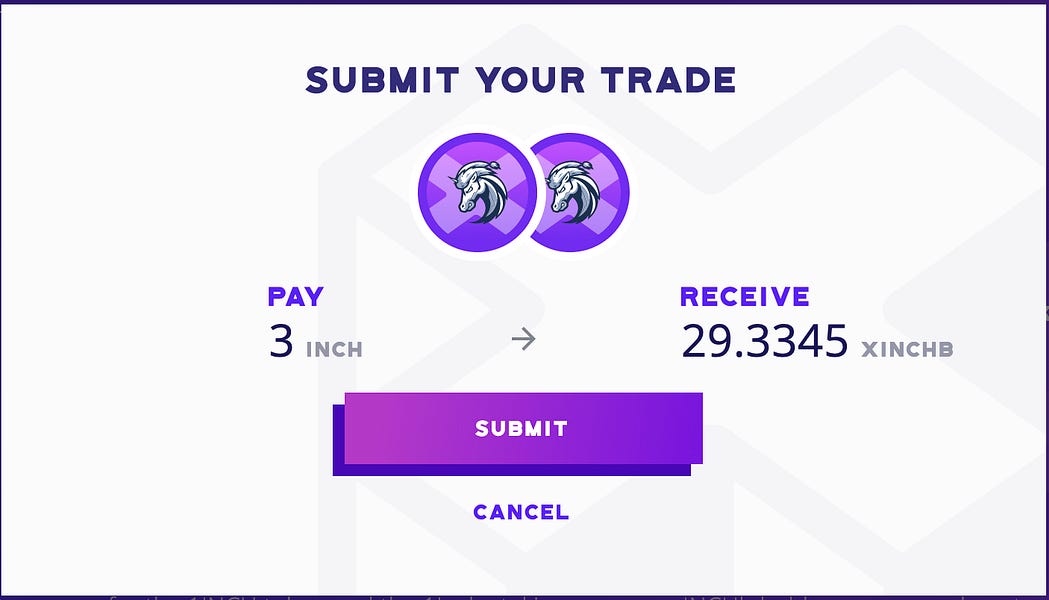

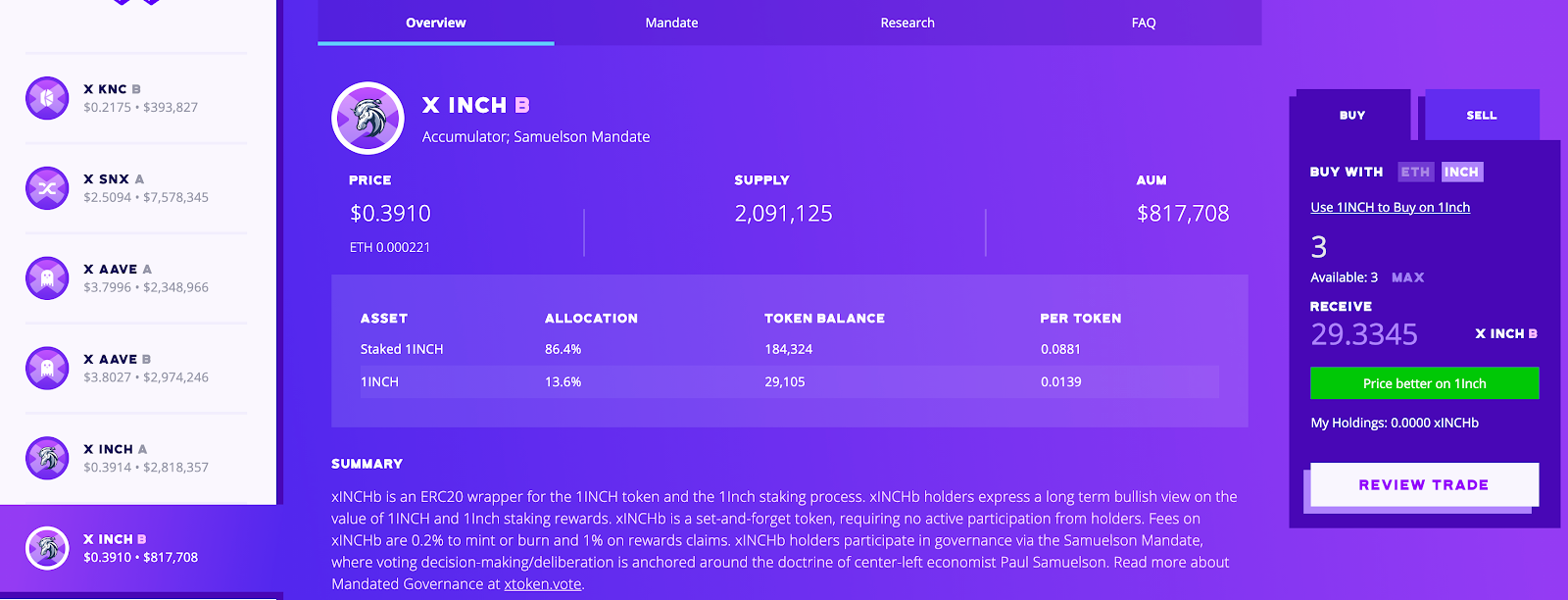

Step 2: Click on the xAsset you’d like to invest in. We’ll invest in xINCHb for this example. You can select ETH or 1INCH as the input token for your mint.

🤓 Pro Tip: Always compare prices between direct mints on the xToken contract and available prices on a DEX. In this case, 1INCH Exchange offers a better entry price for xINCHb than a direct mint. For demonstration purposes however, we’ll continue with a direct mint.

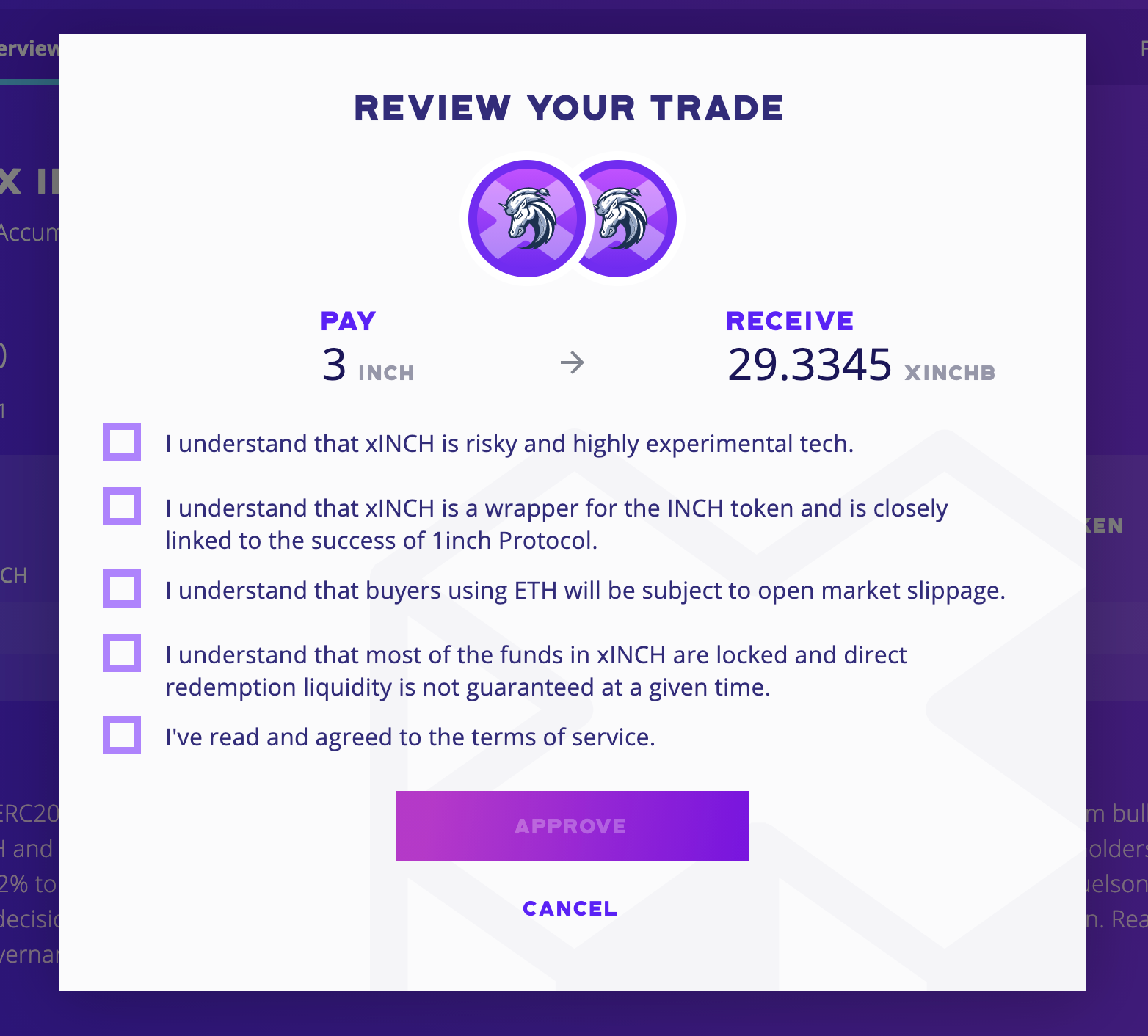

Step 3: Press ‘Review Trade’, review the risk factors, and submit the approval transaction.

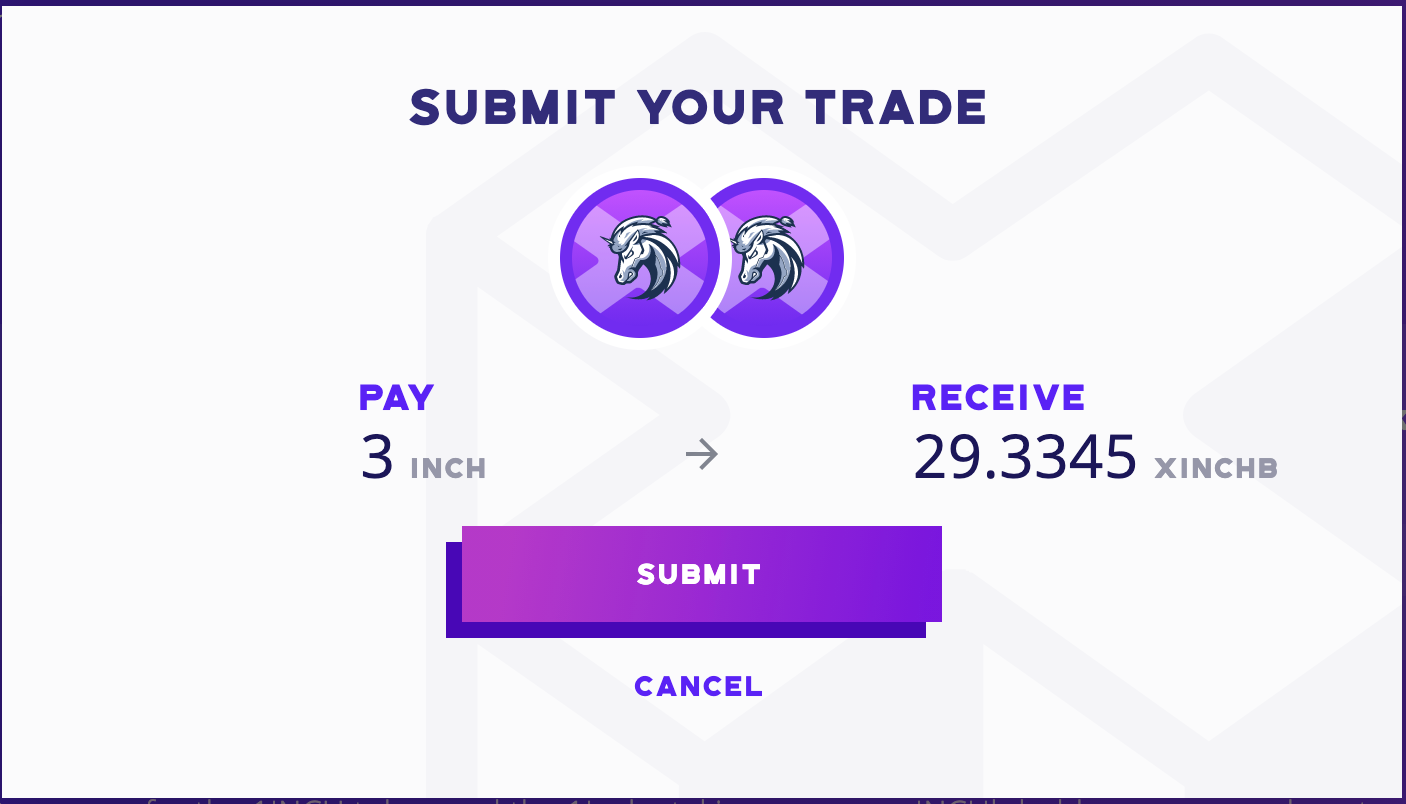

Step 4: Finally, submit the mint transaction!

Once this transaction confirms, you’ll be an xINCHb investor! You’re now automatically earning 1inch staking rewards in a fungible ERC20 token.

Risks of Using xToken ⚠️

While our contracts are fully audited and have been running safely on mainnet for months, there is naturally extra risk to using xToken, relative to staking your tokens directly through the protocol. There’s always risk on the frontier!

First, we’re building smart contracts on top of each protocol’s smart contracts, so you will be exposed to multiple layers of smart contract risk. Beyond the native protocol, we also integrate DeFi protocols like Uniswap and Set Protocol into our contracts, adding an extra layer of complexity.

Second, each xToken fund manages exit liquidity a bit differently. In order to maximize returns, we often only maintain about 5% of capital available as exit liquidity at a given time. While we can always unlock more—and while we’re seeing growing secondary liquidity on DEXs—you may not always be able to find full, immediate exit liquidity for your position.

Final Thoughts

A couple years from now, when you’re a sophisticated DeFi investor with a tens of assets in your portfolio along with various LP strategies, and even a healthy dose of leverage, it’s unlikely that you’ll be jumping from dApp to dApp managing your staking positions.

It’s not convenient for the average investor, nor is it cost efficient, and you lose out on the potential for composability!

By allowing xToken to do the low-level work for you, you can be empowered to maximize your capital and freed to spend time on the important decisions.

For more info on xTokens, join our Discord or follow us on Twitter!

Action steps

- Explore xTokens and how it can automate your staking rewards

- Read up on xToken’s governance blog to understand each token’s gov mandate

Author Bio

Michael J. Cohen is the founder and team lead at xToken, a protocol for automated staking rewards.

Bankless

Bankless