Hottest tokens in the Cosmos Ecosystem

Cartesi - Build app-specific rollups with Web2 tooling!

Cartesi - Build app-specific rollups with Web2 tooling!

Dear Bankless Nation,

Earlier this week, William wrote a primer on the Cosmos Ecosystem, discussing its architecture, wallets, and applications.

In it, we learn that Cosmos, like other blockchains, has its own healthy ecosystem of applications - DeFi, privacy, DEXs, smart contracts, etc.

Many of these projects have their own tokens. These tokens provide exposure to Cosmos, but which tokens provide the most upside for investors?

Today, Ben takes an in-depth look at some of the hottest projects on Cosmos, reviewing the protocol, tokenomic design, and his takeaway for each token.

- RSA

2021 was defined in large part by the rise of Layer-1s. Following Ethereum’s ascendancy during the summer of 2020, blockchains such as Solana, Terra, Avalanche, and Fantom saw exponential growth in both network activity and the prices of their native tokens.

The meteoric rise of these blockchains demonstrated two things:

- There is a massive opportunity for adventurous users who explore and adopt new, and emerging networks.

- There are major technical limitations inherent in monolithic, single-sharded chains.

Enter Cosmos.

Cosmos enables the creation of highly customizable blockchains, whether they be generalized, or application-specific. Cosmos aims to connect these networks through what’s known as Inter-Blockchain Communication (IBC) which allows for the trust-minimized, near-instantaneous transfer of value and data across blockchains. This modular design has the potential to unlock a new design space of interoperable, cross-chain applications while providing a potential path to sustained scaling.

Although much of Cosmos’s potentially transformational tech is in its infancy, the ecosystem has begun to see meaningful traction and brings to the table numerous new innovations on both the protocol and application layers.

With innovation comes opportunity - As many are likely familiar with Cosmos chains such as Terra and ThorChain, let’s dive into five other tokens within the ecosystem that investors should be keeping an eye on.

1. Cosmos Hub (ATOM)

- Token Type: L0/L1

- Market Cap: $8.2 billion

- FDV: n/a (Perpetual inflation)

- Apeability: 5/5

Protocol Overview

Although it is Cosmos’s flagship token, ATOM deserves a closer look due to its evolving role within the ecosystem. As the first-ever Cosmos chain, Cosmos Hub plays an important role as infrastructure, serving as an endpoint for IBC transfers and will see further utility over the coming months by providing interchain security.

A core challenge facing application-specific blockchains is the need to bootstrap their own validator set. Unlike rollups, Cosmos chains do not inherit security from a parent chain. Rather, each chain is responsible for securing itself, needing to independently source validators and ensure their native token retains value. While allowing for a greater degree of sovereignty and customizability, it could lead to a drastic reduction in security for a given chain relative to shared security Layer-1 such as Ethereum. While many use cases differ in their security needs, some, such as DeFi, require a highly robust and decentralized validator to withstand potential attacks from nation-states.

The Cosmos Hub aims to serve a beacon-chain type role through the launch of Interchain Security. This will enable Cosmos chains to outsource their security needs to the Cosmos Hub, benefiting from its more than $5.2 billion of ATOM stake. Interchain security could help to bring more high-value use cases to the ecosystem, and is expected to be rolled out beginning in Q3 2022.

Tokenomics

Although it can be argued that the Cosmos Hub serves as a “Layer-0” rather than a Layer-1, the ATOM token in practice serves a similar role to that of a traditional L1 token. ATOM is utilized to secure the Hub, with stakers eligible to receive inflationary rewards as well as transaction fees from IBC transfers.

One feather in the cap of ATOM relative to other L1 tokens is its role as an “airdrop magnet.” Many networks and projects within the Cosmos ecosystem, such as Osmosis, Juno, and Shade Protocol, have or plan to airdrop a portion of their token supply to ATOM stakers.

What’s less clear is whether or not ATOM will command the monetary premium held by other L1 tokens to varying degrees. For instance, ATOM is the second most liquid token, behind OSMO, on the aforementioned Osmosis DEX, suggesting that it could play second fiddle to the native tokens on various chains.

Takeaway

While it already carries a more than $8 billion market cap, and its favorability as an asset among Cosmos DeFi users is unclear, ATOM likely represents the safest, broadest way for an investor to get exposure to the Cosmos ecosystem. The token is poised to benefit from the increased utility and demand as a result of the rollout of interchain security, and at least in the near future, is likely to generate an additional stream of cash flow for its holders through airdrops, further increasing its attractiveness.

2. Osmosis (OSMO)

- Token Type: L1/DeFi - DEX

- Market Cap: $2.8 billion

- FDV: $8.5 billion

- Apeability: 5/5

Protocol Overview

Osmosis is a decentralized exchange and application-specific blockchain, with more than $1.66 billion in TVL, and in recent weeks facilitating between $70-170 million in volumes. Similar to Terra’s UST stablecoin, users and applications are able to leverage the capabilities of having the network built atop an AMM.

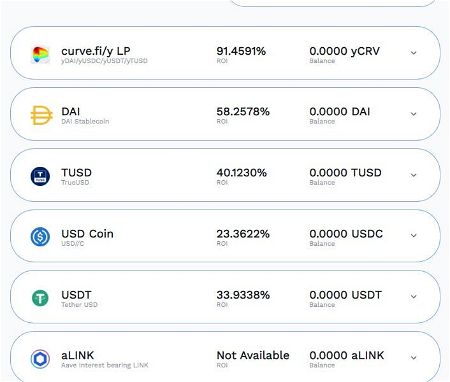

Osmosis is most similar to Balancer, in that it allows for the creation of highly customizable, multi-asset pools, but also incorporates elements from other AMMs while bringing unique features of its own to the table. For instance, each liquidity pool is “self-governing,” with liquidity providers having governance rights over its parameters. Like Curve, LPs must lock their tokens to participate in governance, with voting power, and boosted liquidity mining rewards, proportional to the length of the lock period.

Tokenomics

The OSMO token plays several key roles within the Osmosis ecosystem, having characteristics of both Layer-1 and DeFi tokens.

Like ETH, AVAX, SOL and other L1 tokens, OSMO is used to secure the network, with stakers receiving inflationary rewards and transaction fees from gas payments in exchange for doing so. In addition, like the latter two tokens, OSMO is also used to vote on network-wide governance proposals.

OSMO shares similarities to DeFi tokens in that it is also used for AMM-level governance. For instance, the token is used to determine the base swap fee across all Osmosis pools, and like Curve, is used to vote on rewards to different OSMO gauges.

OSMO is also utilized in what's known as “Superfluid Staking,” which will allow OSMO to be staked while simultaneously being utilized as liquidity within the AMM.

To read more about Superfluid staking, click here.

Takeaway

Osmosis is both a highly unique blockchain and AMM. OSMO benefits from one of the most unique token designs in all of crypto, with utility and demand-driven from its use as an L1 token, AMM governance token, and as superfluid stake.

3. Juno (JUNO)

- Token Type: L1

- Market Cap: $1.4 billion

- FDV: $5.6 billion

- Apeability: 2/5

Protocol Overview

Juno is a generalized smart contract platform. Unlike many other chains in the Cosmos ecosystem, Juno allows for the permissionless deployment of smart contracts built using the CosmWasm, a virtual machine that uses Rust as its programming language. JunoSwap, the network's most popular application, holds more than $42 million in TVL, while in the future the chain will leverage IBC to enable true cross-chain applications.

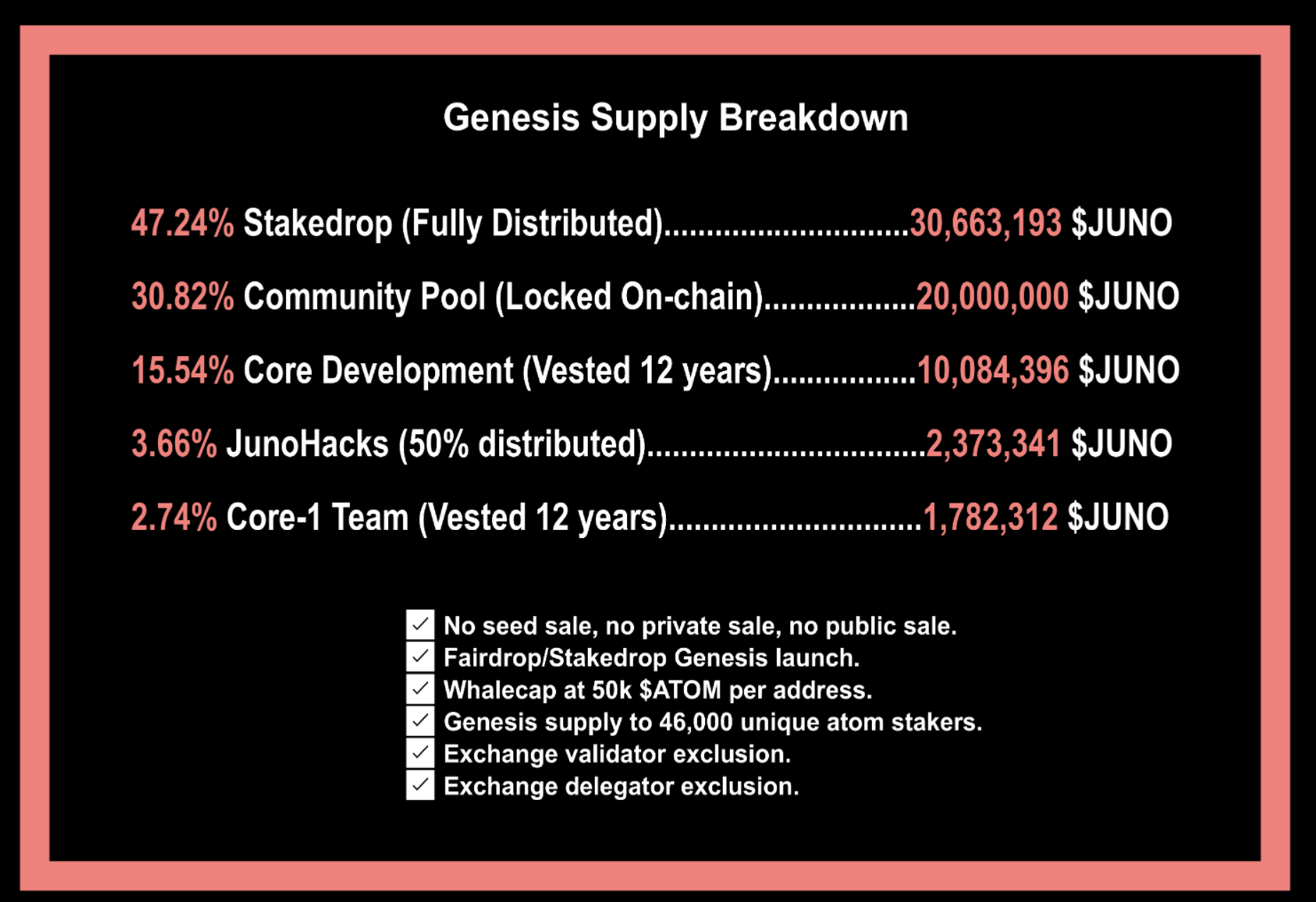

Juno has recently found itself at the center of a highly contentious and controversial governance proposal. As a part of its token distribution, Juno allocated 47% of its supply to ATOM stakers. Although there was a “whale-cap” in place, to prevent entities such as exchanges from receiving JUNO, one whale managed to sybil the airdrop, accumulating 2.5 million JUNO, worth roughly $75 million at current prices. This accounts for 7.5% of the tokens initial circulating supply and 1.3% of the expected supply at the end of the team's twelve year vesting period.

After intense deliberation, in a highly controversial proposal known as “Prop 16,” the community decided through an on-chain governance vote to slash the whales balance to 50,000 JUNO, the maximum allotment per address during the initial airdrop.

Tokenomics

As with ATOM, OSMO, and other PoS networks, JUNO is used for security, with stakers able to earn inflation rewards and transaction fees. As with the former two tokens, Juno is utilized for gas on the network, and is showing signs of being the chain's reserve asset, as it serves as the most popular base pair asset on JunoSwap.

Takeaway

The results of Prop 16 pose a substantial risk to Juno’s credible neutrality, potentially hindering developer interest and capital inflows into the ecosystem. However, should the community hold together, and should the network hard fork, as one of the first permissionless, general-purpose CosmWasm L1s, JUNO could prove to be intriguing for contrarian investors.

4. Secret Network (SCRT)

- Token Type: L1

- Market Cap: $805 million

- FDV: n/a (Perpetual inflation)

- Apeability: 3/5

Protocol Overview

Secret Network is a generalized smart contract platform, which (living up to its namesake) allows for the creation of privacy-oriented applications, known as Secret Apps. Secret Apps can be built using “Secret Contracts'' that are capable of encrypting user data. With this emphasis on privacy, Secret has the potential to play a valuable role within the Cosmos ecosystem as a “privacy chain.” By encrypted transaction data across an entire Layer-1, the network combines the benefits of both privacy coins such as Zcash and Monero, as well as applications such as Tornado Cash.

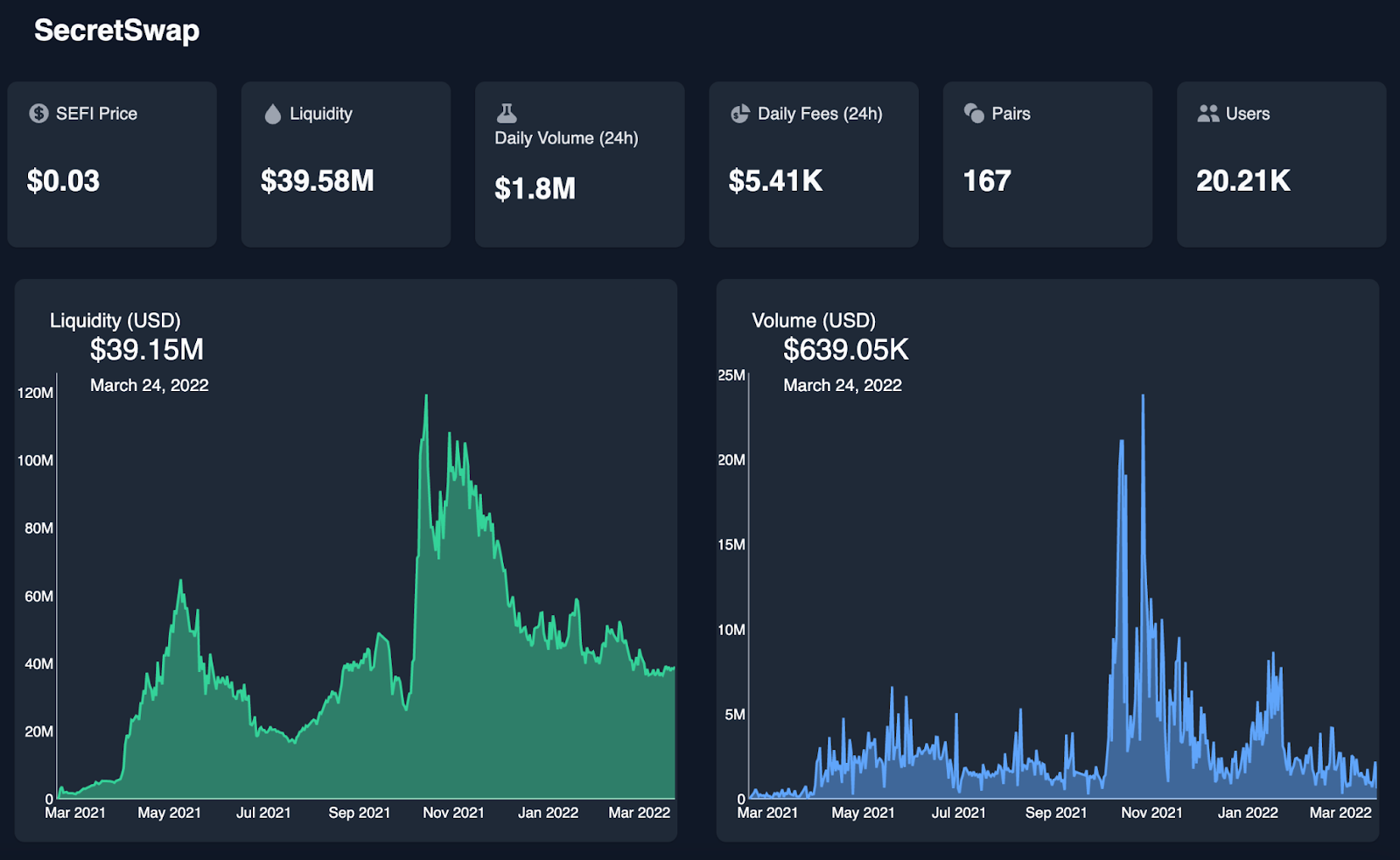

As there is a limited amount of applications deployed to the network, Secret has seen only the earliest signs of traction. For instance, SecretSwap, the network's largest AMM, facilitates just $1-3 million in volume per day, holding only $39.1 million in TVL. Furthermore, although Secret has also emphasized interoperability with other networks, just $46.2 million has been bridged from Ethereum, Binance Smart Chain, Monero, and through IBC.

Tokenomics

Similar to Juno, SCRT is an L1 token, used to secure the network, pay for gas, and for governance at the protocol level. However, as touched on above, SCRT can wear multiple hats by also serving as a form of private money with similar widespread utility to an L1 token like ETH.

Takeaway

In being a private, public blockchain, Secret Network and SCRT have the potential to serve an incredibly valuable and important niche within the Cosmos ecosystem, and crypto at large. However, given that to date, the network has seen limited traction, SCRT seems most suitable for investors with longer time horizons.

5. Astroport (ASTRO)

- Token Type: DeFi - DEX

- Market Cap: $274 million

- FDV: $2.1 billion

- Apeability: 4/5

Protocol Overview

Astroport is the largest decentralized exchange on Terra, with more than $1.3 billion in TVL and consistently generating north of $100 million in trading volumes. Bootstrapped through a unique, three-phase “lockdrop” that incorporated elements of both an airdrop and vampire attack, the DEX serves as a mix of both Uniswap and Curve in that it facilitates swaps between volatile trading pairs, as well as like-assets.

The protocol utilizes what they call “generators,” which function similarly to Curve and Frax gauges in that they are trading pairs that receive an allocation of emissions via governance vote. Generators are also capable of automatically depositing LP tokens into third-party protocols that are currently offering incentives in order to boost capital efficiency by offering users dual farming rewards.

Tokenomics

ASTRO utilizes a two token model. The first, xASTRO is a liquid asset, as holders who stake their ASTRO will receive the token and be entitled to governance rights as well as a share of trading fees generated by the platform.

The second, vxASTRO, is a non-transferrable token most similar to veCRV. ASTRO holders can lock their tokens to receive vxASTRO, which entitles them to a greater share of governance power and trading fees relative to xASTRO, as well as boosted rewards when providing liquidity on the platform. This token design could

Takeaway

As the governance token for the largest DEX on the Cosmos ecosystem's largest blockchain, ASTRO seems poised to be a prime beneficiary from the growth of Terra. Furthermore, with its ability to direct liquidity across the pairs on the exchange, the token is likely to be in high demand among Terra-native protocols, perhaps kicking off the “ASTRO Wars.”

Conclusion

Although they vary in present-day apeability, there are numerous intriguing chains, protocols, and tokens that are worth keeping an eye on in the Cosmos ecosystem. While many are in the early stages of their adoption cycle among crypto natives, they bring exciting innovations in terms of network, application, and token design.

Could they take investors to the Cosmos? 📈

Action steps

- 📖 Read our primer on the Cosmos Ecosystem

- 🎓 Learn how to ape responsibly

- 🔎 Check out Ben’s analysis of TRIBE

Ben Giove

Ben Giove