Don't sleep on the merge

.png-a616dc52961c1edd72b0c1fdf5f47e7a.png-d44bdfd9b52d9f76131f38376a1fe385.png) Kraken - See What Crypto Can Be with Kraken

Kraken - See What Crypto Can Be with Kraken

Dear Bankless Nation,

There are so many items worth covering in the past week:

- Yuga Labs, the creators of the Bored Ape Yacht Club, bought the intellectual property of CryptoPunks and Meebits from Larva Labs, causing a stir in the Punk community and starting conversations for what it means for the NFT industry. (Stay tuned for coverage from OverPriced JPEGs and Metaversal later this week!)

- As the war in Ukraine continues, disruption in commodity markets continues to see movement.

- Biden’s executive order on crypto seems to be creating overwhelming supportive responses from everyone.

- And the crypto markets seem to be coming to an inflection point. (Stay tuned for tomorrow’s State of the Nation with Ledger from Up Only.)

But instead of all those topics, today we’re talking about the thing we’re convinced every is forgetting about.

That’s right…

😎 We’re talking about the merge 😎

3 Months to the Merge

SuperPhiz is an active member of the EthStaker and Rocketpool communities and pays attention to the details surrounding the merge more than anyone I know (other than the devs themselves).

On the r/EthStaker subreddit, SuperPhiz detailed 5 indicators that the merge will happen in June.

- There’s a planned ‘difficulty bomb’ coming mid-June.

- Danny Ryan signaling that a delay in the bomb isn’t needed.

- The Merge Mainnet Readiness Checklist is nearing completion.

- Devs are being picky about delays.

- The Kiln testnet is testing the merge.

Barring any significant unforeseen issue, it’s looking increasingly likely that we’re going to see the Merge in June.

June.

That’s 3 months away.

This is the most significant blockchain network upgrade ever, and probably ever will be. Long-time Bankless readers and listeners certainly know the merge’s significance and imminent arrival. But I’m not sure the rest of the industry does, let alone the greater world outside of crypto.

If Ethereum achieves its goals of becoming the global settlement layer for the metaverse, it would elevate the merge to one of the most historically significant events of the modern age.

But for most people, it won’t even register.

Many readers here are old enough to remember logging into the internet when it was dial-up. This is like that.

Our kids are going to think it’s crazy that we were transacting on Ethereum while it was still Proof of Work.

It’s become a hobby of mine to daydream the question: “How much yearly income will I get if $ETH is priced at $x and staking yield is x%?” Fortunately, you can use this to do that calculation, and we walk you through how here.

Most people think ETH is going to $10k or maybe even $20k…

10k is bearish.

20k is FUD.

Here’s your reminder to dream bigger dreams.

Post-Merge $ETH

There’s currently 10.5m ETH staked in the Beacon Chain, earning a respectable 4.8% ETH-denominated yield.

Once this 10.5m ETH merges with the PoW Ethereum chain, that yield goes from 4.8% to ~10-15%. That’s a 2-3x increase in returns:

- A 2-3x increase in the incentive to hold ETH.

- A 2-3x increase in the incentive to stake ETH.

Simultaneously, new ETH issuance is reduced by 90%.

Currently, retail PoW miners are earning 12,000 ETH per day, and are forced to sell a significant percentage of that to cover expenses for their electricity consumption.

Post-merge, PoS validators will earn 1,280 ETH per day and have effectively no reason to sell ETH to cover operational costs.

We’re going from 12k to 1,280 ETH in daily issuance and thousands of ETH in daily sell pressure to 0.

How much more ETH will be staked as a result of the increase in yield? Where will that ETH come from, since a lot of regular selling pressure is going to dry up?

What’s the price going to do as a result?

These answers are coming in ~3 months.

The Triple Halvening Ends the Bear Market

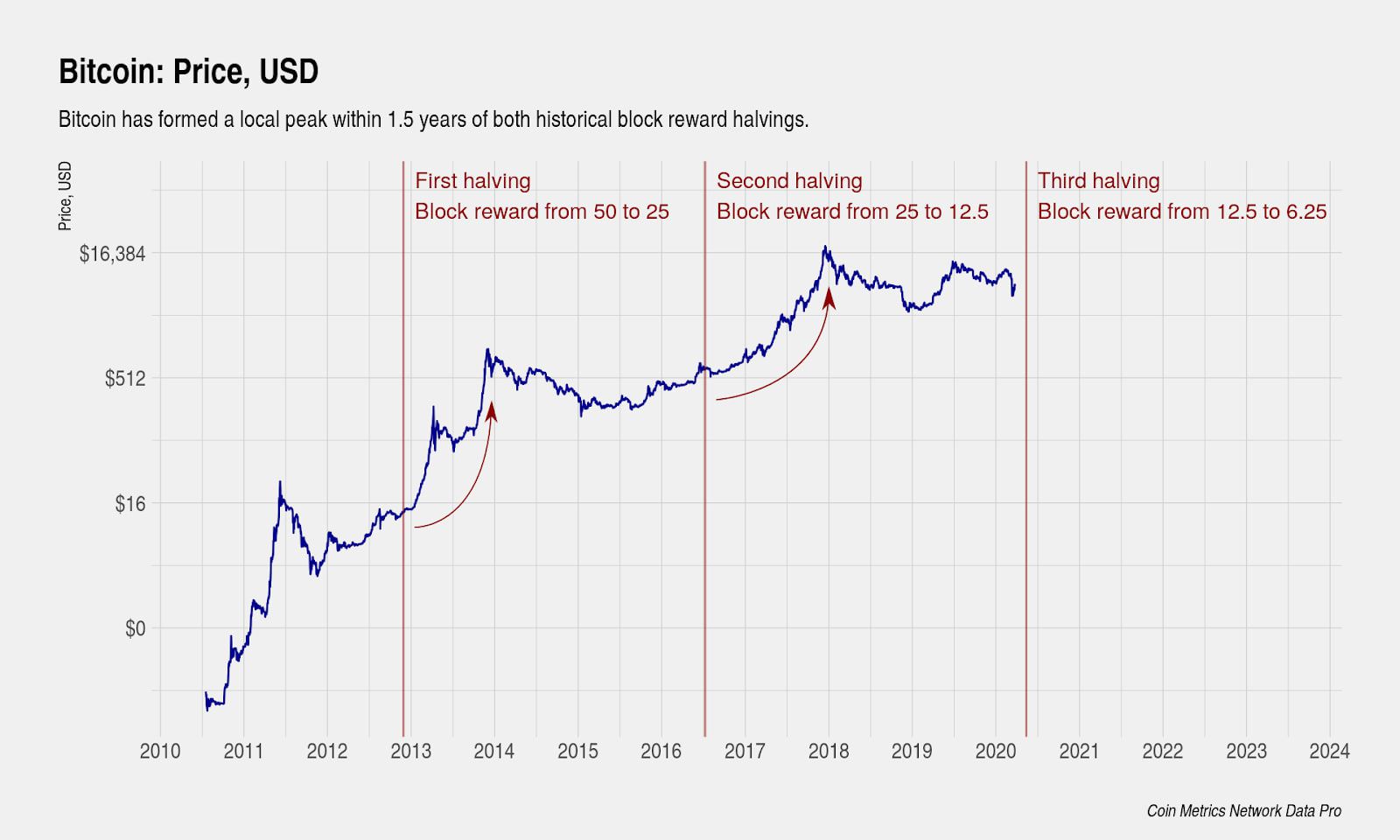

A common belief from Bitcoiners is that the Bitcoin halving is what drives the crypto market cycles. Every 4 years, we have a bull market, and the bull market begins at the halving. The BTC issuance reduction reduces new supply inflows to the secondary markets, slowly manifesting a bull market as the remaining liquid supply of BTC on the secondary market drys up.

If the Bitcoin halvings are truly the cause of the crypto market cycles, then the significance of the Ethereum merge is going to be massive.

- The Bitcoin halving reduces new BTC supply by 50%.

- The Ethereum merge reduces new ETH supply by 90%.

The merge has been nicknamed ‘the triple halving’ because it would take Bitcoin three halvings to produce an equivalent supply reduction.

It would take Bitcoin twelve years to do what Ethereum is going to do in 3 months.

If you believe the notion that Bitcoin halvings cause bull markets, imagine what a triple-halving would do.

The last Bitcoin halving was May 2020, where each Bitcoin block went from 12.5 BTC-per-block to 6.25 BTC-per-block. At $8,000 / BTC, that removed $3.6m in daily sell pressure from BTC, making it easier for price to go up.

Ethereum currently issues ~12,000 ETH per day, or roughly $30m per day in security costs. The merge removes 10,720 ETH from that new daily issuance but also removes the need to sell the remaining issuance of 1,280 ETH. Since stakers don’t need to consume electricity, they don’t have to sell their ETH rewards.

If the removal of $3.6m daily BTC sell pressure is enough to trigger a bull market, what will the removal of $27m-$30m of daily ETH sell pressure do?

I express bearishness about the crypto markets for the first time on last week’s Weekly Rollup, much to the surprise of listeners.

To me, commodity markets, geopolitical risks, inflation, nuclear war, and the loss of the up-only momentum of the 2021 crypto-markets are just too many bearishly-aligned stars.

I fully expect the crypto markets to move in ways that completely ignore the fundamentals of the merge. A bear market will suppress all price trajectories, no matter how bullish an individual asset may be.

That means the merge isn’t priced in.

They don’t understand its significance, and they don’t see it coming.

You heard it here. When ETH sets new ATHs post-merge, I’ll link back to this post and say:

Bankless told you.

Start stacking.

- David

David Hoffman

David Hoffman

.png-a616dc52961c1edd72b0c1fdf5f47e7a.png-8359976fdb0656215e306b0de9208da8.png)