BTC's monetary policy is overrated

Cartesi - Build app-specific rollups with Web2 tooling!

Cartesi - Build app-specific rollups with Web2 tooling!

Level up your open finance game three times a week. I’m releasing this Free for Everyone until November 1. Get the Bankless program by subscribing below.

Dear Crypto Natives,

BTC's monetary policy is overrated.

I should qualify—BTC’s monetary policy is overrated by some. And yes, it’s still underrated by many, but maybe not for the reasons people think.

In this thought piece and the next I’m going to contrast the monetary policies of BTC and ETH. I’m going to argue that Bitcoin’s monetary policy is overrated and Ethereum’s is underrated. That both have different tradeoffs.

Why? Because no one else is brave enough. 😄

Just kidding. Kind of. Talking about monetary policy in the Bitcoin community is treading on holy ground—(oddly enough, that’s one of Bitcoin’s strengths).

The bigger reason? These two monetary policies back the entire crypto money system. And since they’re biggest parts of your crypto money portfolio, you should know about them—warts and all.

Oh and remember, you don’t always have to agree with these thought pieces. If you disagree and can articulate your disagreement you’re probably leveling up even faster.

So maybe I’m secretly hoping you disagree with this. 😉

- RSA

THURSDAY THOUGHT

What is monetary policy in crypto?

Crypto appropriated the term monetary policy from central bankers. To bankers, monetary policy is how a country sets interest rates and money supply to grow GDP, manage employment, and maintain predictable exchange rates—all without overly high rates of inflation.

Crypto monies don’t have a mandate involving GDP or employment—their issuance schedule is blind to these. This makes their supply as immune to political pressures as gold is. Gold and crypto: non-sovereign assets. But unlike gold, crypto actually does have a monetary policy mandate: to maximally secure the network.

Gold is secured by chemical bonds forged from the energy output of a supernova. Not crypto—crypto is a product of human design—security comes from the economic value placed on the crypto asset itself and the accompanying monetary policy of its network.

Fiat money and crypto money have different mandates:

- Policy mandate of fiat: GDP, employment, exchange—without hyperinflation

- Policy mandate of crypto: to secure the network

I’m going to keep using the term monetary policy for BTC and ETH, but issuance policy is probably more accurate given the difference in mandate. I might even prefer the term security policy since that is true goal.

What secures BTC and ETH?

Let’s back up for a second and discuss how BTC and ETH are secured.

The security of these networks is based on economic incentives. Without strong economics they’re susceptible to attack.

A 51-percent attacker for instance, can reverse transactions—steal money—in either network. An attack of this type just requires control of 51-percent of the capital securing the network. In the case of proof-of-work, the capital is hardware and energy. In the case of proof-of-stake, the capital is ETH tokens. Good security for these networks means making the cost of attack higher than the value they secure.

The difference between a high value and a low value chain can be seen in settlement time. Coinbase is willing to settle transfers of BTC in 6 confirmations—an hour. But a lower value chain like BSV chain requires 1,008 confirmations—7 days to settle! Coinbase requires more from BSV to protect itself from theft by 51-attackers.

But wait a second—why is all this capital being put to work to secure the network in the first place? Again we’re back to incentives: miners are investing capital to secure Bitcoin and Ethereum because they’re paid to do it. They’re in it to make money.

Their security revenue comes from two sources:

- Block rewards—they earn all new BTC and ETH coins that are minted

- Transaction fees—they earn fees from users paying for transactions

The sum of these is miner revenue. And miner revenue is equal to security budget.

Would an analogy help?

Imagine a nation-state that both mints new money each year and collects taxes on economic transactions to pay for its national defense. That’s what BTC and ETH are doing. The new money is block rewards, the taxes are transaction fees, the sum of which is the security budget that pays for the military—the military is the miners.

Most security comes from block rewards

Now the bulk of the security budget, I’m talking about 95% to 99% comes from block rewards not transaction fees. This is true for both networks.

What portion of mining revenue comes from block rewards vs transaction fees?

Good thing you’ve already leveled up and know how to read onchain data to find the answer to this. You can see the difference between block reward revenue and transaction fee revenue in BTC and ETH under the “Mining Revenue” metric.

You’ll notice that block reward revenue increases as the value of BTC and ETH increases. That’s because block rewards are denominated in BTC and ETH while miner capital costs is usually measured in USD. So if I earn a 2 ETH block reward as a miner my revenue is double when the price of ETH is $400 vs. when the price of ETH is $200.

And what makes ETH double in price? Demand for ETH as an asset.

Transaction fee revenue is different. Doubling the price of BTC or ETH as an asset doesn’t double transaction fee revenue. Transaction fees only increase when the demand to use Bitcoin and Ethereum transactions increases—blockspace demand and asset demand are separate things. This goes back to a core insight we’ve talked about before—the asset is not the network—they’re two different markets.

Ok, so security budget is mostly block reward revenue that’s driven by the demand for BTC and ETH as assets. So how does this tie back to BTC monetary policy?

Issuance and Security

You probably know Bitcoin’s issuance schedule. Really simple. Block rewards started high and are cut in half every four years.

- 2012: 25 BTC per block

- 2016: 12.5 BTC per block 👈we are here

- 2020: 6.5 BTC per block

- 2024: 3.1 BTC per block

- 2028: 1.7 BTC per block

- 2032: .78 BTC per block

And so on as it approaches 0.

This monetary policy was baked into the Bitcoin design from the beginning. It’s enforced by code and upheld through strong social social consensus. Really hard to change. Really clear narrative.

Remember the single mandate of a crypto monetary policy? To maximally secure the network. The scarcity narrative—only 21m Bitcoin—has worked wonderfully to maximally secure the Bitcoin network so far. Why? Because in its early early years Bitcoin’s network security is highly subsidized by block reward revenue. Block reward revenue increases with demand for BTC. And demand for BTC increases with a scarcity narrative. And the scarcity narrative is perpetuated by a monetary policy that decreases block rewards. A virtuous cycle.

This is Bitcoin’s great strength.

But there’s also a flaw.

With each halving this great strength is used less in the security of the network. Each halving cuts the security budget subsidy making Bitcoin’s security less reliant on the price of BTC and more reliant on demand for Bitcoin blockspace.

Bitcoin eventually becomes almost entirely reliant on blockspace demand—by 2032 BTC-denominated block rewards will be only 6% of today’s rewards. Yes, we can assume BTC will have appreciated between now and then—for example, if price rises to $140k per BTC then 2019 level security budget may be maintained. But is 2019-level security enough for a multi-trillion dollar network?

And what happens when the rest of the block reward subsidy is taken away?

Hasu and others recently wrote an excellent paper enumerating future solutions to the problem of decreasing block rewards. One of which is to alter Bitcoin’s monetary policy to add perpetual inflation—more than 21m BTCs—no fixed cap on supply. An action like this would almost certainly cause a fork. Further, it’s likely to harm the scarcity and immutability narrative which some argue is Bitcoin’s reason for existence.

Others assume transaction fee revenue in Bitcoin will pick up the slack. I’m far less convinced. It’s not clear that blockspace demand is Bitcoin’s core strength. Even today, Ethereum is neck-in-neck with Bitcoin on transaction fee revenue. This is because Ethereum serves as a settlement network for a multitude of digital assets and money protocols—due to this broader use, I wouldn’t be surprised if Ethereum exceeds Bitcoin in transaction fee revenue in the years to come.

Overrating BTC’s monetary policy

The people overrating BTC’s monetary policy are those that treat it as the incarnation of perfection. It’s not perfect. The fixed cap monetary policy of Bitcoin makes tradeoffs:

- Fixed cap strengths—scarcity narrative, perceived predictability, & perceived immutability—this drives value to BTC and higher block reward revenue

- Fixed cap weaknesses—block reward reduction may lead to a lower security than alternatives and may require an alteration to monetary policy

Under this lens, you could argue Bitcoin’s monetary policy is front-loading its short to medium-term network security at the cost of its long-term network security. This could be the right play—capture network effects through scarcity narrative and bootstrap your way to liquidity domination. But Ethereum is taking a different approach. One with a different set of tradeoffs—certainly with weakness, but also with under appreciated strengths.

We’ll explore Ethereum’s monetary policy tradeoffs in the next article of this two-part series. Next Thursday look out for—Why Ethereum’s monetary policy is underrated.

Action steps

- Consider: what are the strengths and weaknesses of Bitcoin’s monetary policy?

- (Advanced) Check out 2nd half of Hasu’s paper on declining block reward subsidy

Continue leveling up. $12 per month. 20% off if you subscribe before November 1.

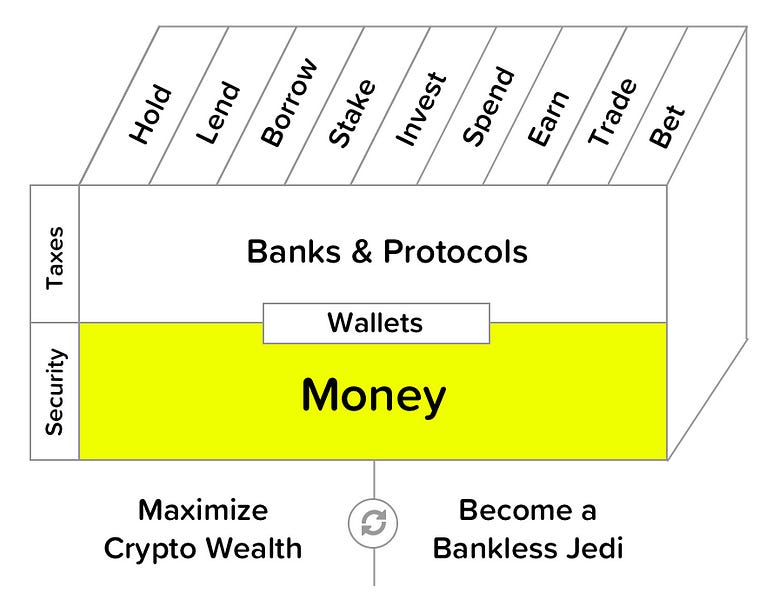

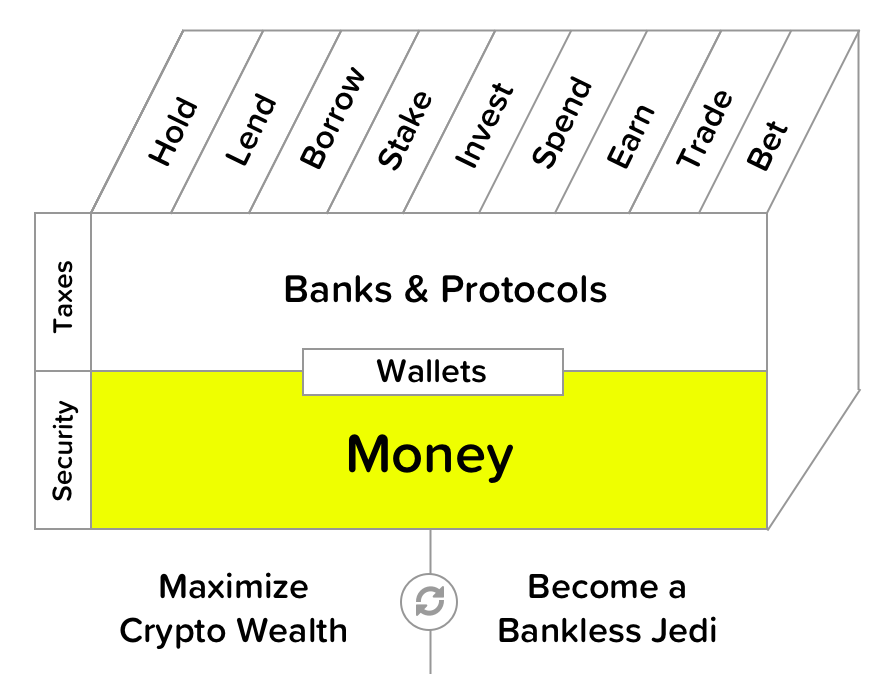

Filling out the skill cube

By understanding BTC and ETH’s monetary policy you’re leveling up on the money layer of the skill cube. The money layer is the foundation for everything else.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.

Ryan Sean Adams

Ryan Sean Adams