Dear Bankless Nation,

Binance Smart Chain and Ethereum gas fees have been dominating headlines.

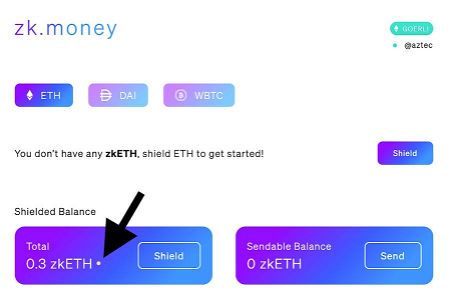

There’s no denying it—Ethereum gas fees are restrictively high. A single Uniswap trade costs $30. Depositing, withdrawing, and borrowing from Aave, Compound, or Maker costs over $100. We’re at the point where it’s nearly impossible to ‘dabble’ on Ethereum mainnet. It costs too much.

This is an extremely unfriendly environment for onboarding people who have never touched crypto, especially when they are used to $0 trading fees on platforms like Robinhood.

Fees are awesome and fantastic and bullish for Ethereum…in aggregate. But when the per-user transaction fees are as high as they are, people begin looking elsewhere to achieve their goals. Not good—Ethereum is here to maximize inclusivity.

The Goldilocks zone for Ethereum fees is high aggregate fees (we’re here now!) while maintaining low fees per user (not yet). This is the thesis behind scaling. In Eth2, sharding will increase the capacity for Ethereum as a protocol to collect fees, yet reduce the average fee size on a per-user basis.

But right now Ethereum is stuck in an awkward transition phase—there is insane demand for block space but still-immature or to-be-delivered scaling solutions. (They’re coming fast though.)

The demand to use Ethereum and DeFi exceeds what Ethereum is capable of supplying to the market at a low price. And since Ethereum is currently incapable of meeting demand, some have looked elsewhere to conduct their crypto-economic activities.

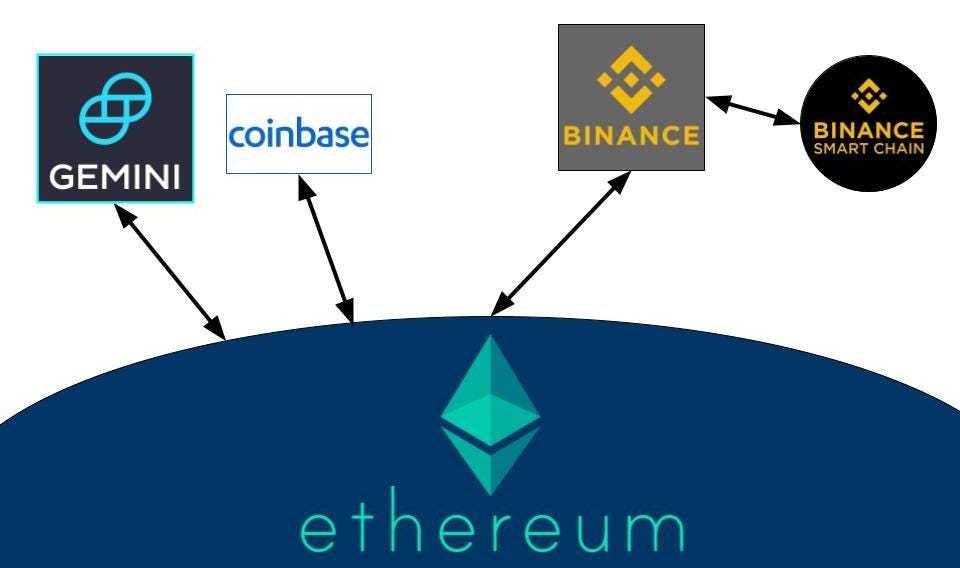

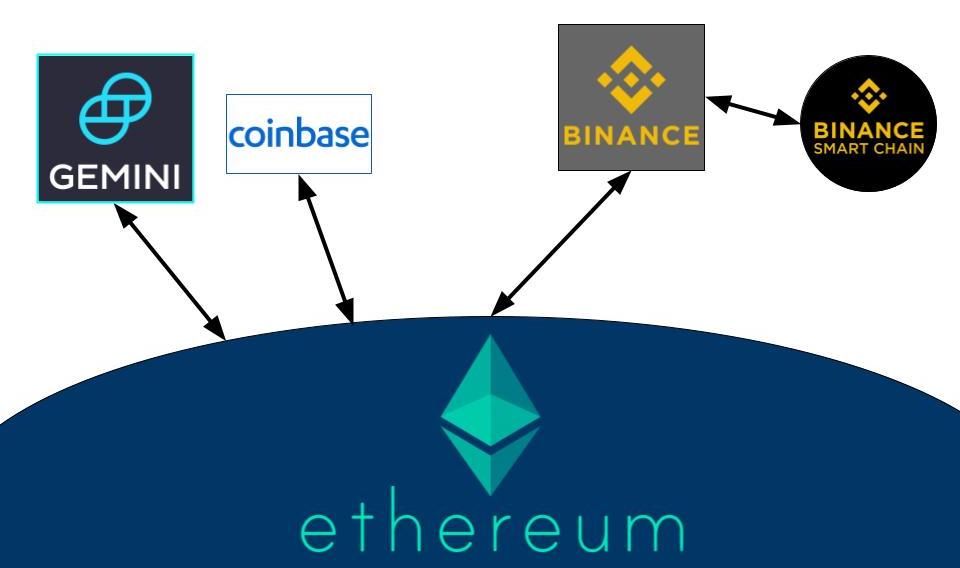

One of these places is Binance Smart Chain. BSC has a unique value proposition over centralized exchanges like Binance itself, as it’s a ‘blockchain’ that has surface area exposed to the outside world, rather than being a closed database like a typical centralized exchange.

This offers a similar developer sandbox and potential for composability that emulates some of the valuable things that make Ethereum cool.

But let’s make one thing clear: Ethereum and Binance Smart Chain are not the same. Here’s three ways they’re different:

1. Binance Smart Chain is a sidechain to Binance

Binance Smart Chain is technically an L1 blockchain.

BSC is a fork of Geth—one of Ethereum’s clients—with one main difference: it uses Tendermint BFT consensus (i.e. Cosmos tech) with 21 trusted validating nodes instead of the Ethereum 1.0’s proof-of-work.

21 entities come to consensus on the state of Binance Smart Chain, and these 21 entities are all extrapolations from Binance and its leadership.

These 21 entities are how Binance Smart Chain achieves its scale and throughput capabilities; they can censor transactions or reverse them. TLDR; it’s centralized.

While there are many other centralized chains, the competitive advantage of Binance Smart Chain is that it can both mimic Ethereum’s DeFi applications while tapping into the liquidity and volume of the Binance exchange. BSC is more open than Binance, which opens up access for developers to build products and apps on the chain.

When Ethereum is highly congested and expensive, this actually makes sense, as BSC’s centralized chain can provide relief to those trying to escape fees while allowing users to get a taste of what composability and smart contracts can do.

2. BSC captures value for a centralized company

The Binance Smart Chain is a Binance product. When Binance Smart Chain generates revenue, it does so for Binance the company and for BNB shareholders.

This is fundamentally different than Ethereum, a self-perpetuating protocol. It captures value and returns it back into the ecosystem, either through ETH payments to Miners (or validators in the future), ETH holders under EIP1559, or smart contract deployers.

One of the main goals of the Ethereum 2.0 is to make a sustainably decentralized protocol that returns the value it captures back into the ecosystem. Centralized for-profit institutions are out – decentralized, community-operated protocols are in.

3. BSC competes with Ethereum Killers

Interestingly, BSC is actually executing on some of the same promises that the so-called Ethereum-killers also promise: high scale, low fees, actual users.

While some Ethereum killers at least tried to implement aspects of decentralization into their protocol (a noble effort!), Binance is barely maintaining the facade of decentralization…but it’s working!

It’s working because there’s a large portion of the crypto community that doesn’t care about decentralization and is only around to make a quick buck. This is especially true during bull markets, as the lessons of ‘why decentralization’ are not 5-minute lessons, and usually take months or years to learn.

Who has that kind of time, when tokens are pumping left and right? Money first, values and decentralization later.

At the end of the day, Ethereum has the ‘maximally decentralized smart contract platform’ cornered. But it’s starting to look like Binance Smart Chain has the opposing ‘scaled, no fees, compromised on decentralization’ side cornered.

So what’s left for the Ethereum killers to capture?

Having A Soul

From Vitalik Buterin’s recent blog piece Endnotes on 2020: Crypto and Beyond

…if people think a project is good, they will do it for free, if they do not, they will not do it at all. This is also likely why blockchain projects that raise a lot of money but are unscrupulous, or even just corporate-controlled profit-oriented "VC chains", tend to fail: even a billion dollars of capital cannot compete with a project having a soul.

According to Vitalik, there are projects in society that have noble goals and aspirations. These projects are perceived to be ‘good’ by people, because of their capacity to reduce suffering and increase the quality of life for people everywhere.

Projects with noble goals tend to receive positive tailwinds because people will work for something they believe in.

People will accept reduced compensation and work longer and harder on projects that resonate with them—they’re simply happy to have an impact on the world.

When we take a long-term approach to the space, we see clear differences in what Ethereum can bring to the world, versus what Binance Smart Chain offers.

Admittedly, Binance Smart Chain has really strong product-market fit right now. It’s a place where people can trade assets using DeFi-like platforms, and they can get their upside exposure without exorbitant fees.

People don’t play long-term games in bull markets; people are trying to get paid.

It’s hard to convince people on the value of decentralization and the importance behind such efforts. These lessons can’t be taught in a day.

What’s being built with Bitcoin and Ethereum are multi-generational cathedrals. There’s hope to build lasting institutions, and building these Cathedrals takes many generations. I hope that when I pass from this Earth, my children can take on the responsibility of continuing the effort.

People sometimes ask me what Bitcoin means to me, and this is my best attempt at an answer. Bitcoiners who earnestly believe in a better monetary world, and aren’t afraid to bring that reality to bear, are the equivalent of masons and laborers, working on a monetary cathedral which they may never see come to fruition. But this is ok. As long as we believe in a big, audacious vision, believe that there is still beauty in the world, and that there remain great things worth striving for, we will succeed and inspire.

Nic Carter: Bitcoin at 12

There’s nothing inherently wrong with Binance Smart Chain; it serves a real purpose and provides real value to people.

But it’s not the same as Bitcoin or Ethereum. These projects have soul.

People who market BSC as such likely know that it’s complete BS. Both Bitcoin and Ethereum optimize for maximal decentralization. Binance Chain doesn’t.

That’s a key difference in values that shapes the trajectory over the long term. According to the Protocol Sink Thesis, the market will adopt credibly neutral systems. Unfortunately, having 21 validators is not credibly neutral—it’s a mafia (we learned this one from EOS in 2018).

What is inherently wrong with Binance Smart Chain is that many people try to market it maliciously as an Ethereum competitor.

Why?

Because as we’ve seen for the last 4+ years, it’s extremely lucrative to position your blockchain as an ‘Ethereum competitor’.

Whether or not they succeed is another story.

-David

David Hoffman

David Hoffman