A Tale of Two Money Systems

Cartesi - Build app-specific rollups with Web2 tooling!

Cartesi - Build app-specific rollups with Web2 tooling!

Dear Crypto Natives,

Happy Thursday. On Thursday’s we zoom out. We think. We calibrate.

Last Thursday I introduced the crypto money portfolio: money bets, bank bets, and stablecoins. I recommended the money bets as your biggest holding—the big thing you need to get right.

So today we’re spending more time on crypto money. We narrowed the crypto money list to two money contenders: ETH & BTC. Both of these have a distinct path to moneyness we should understand.

Tomorrow I’ll send you the weekly summary.

Getting into the rhythm yet?

- RSA

P.S. I added some Bonus content for you at the end—don’t miss it!

THURSDAY THOUGHT

A Tale of Two Money Systems

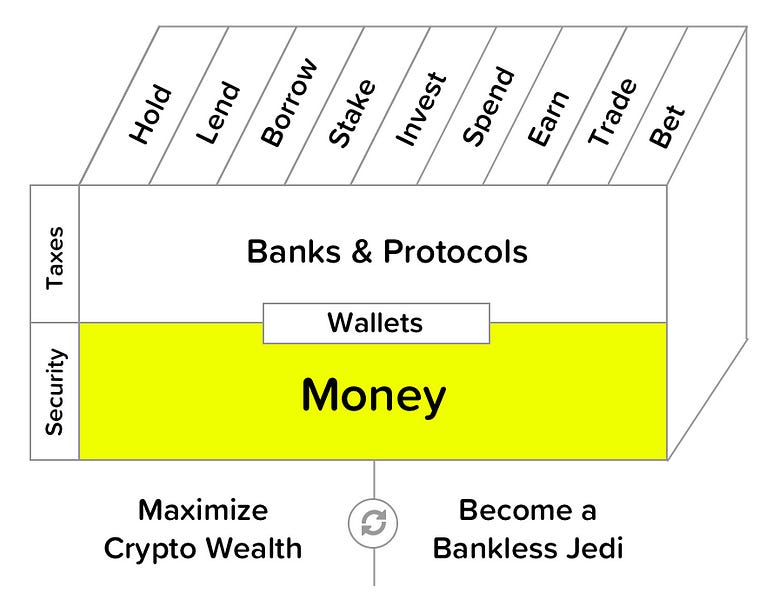

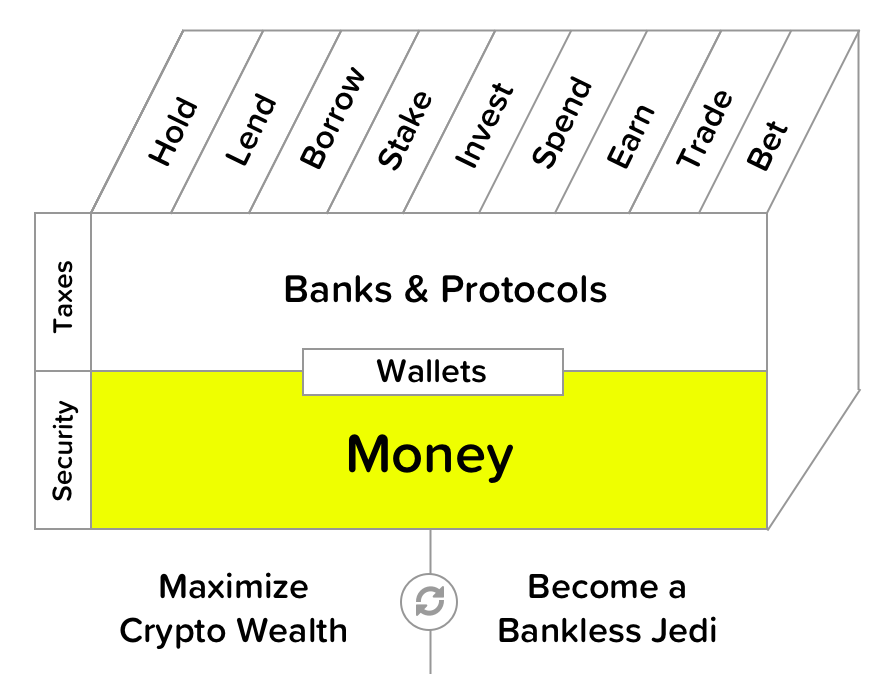

The Bankless Skill Cube is more than a map for leveling up your open finance skills. It’s a framework for thinking about the crypto money system—a lens for viewing ETH and BTC and the financial networks they secure.

If you’re betting on these assets it’s important to understand their paths to moneyness.

The asset is not the network

It’s important to understand the distinction between bitcoin and Bitcoin. Bitcoin is an asset. And Bitcoin is a network. They’re separate things with the same name. And “BTC” is often used to refer to both which only adds to the confusion.

- BTC the asset: the money of Bitcoin—the thing you buy on an exchange

- Bitcoin network: a network that settles BTC transactions

This is not so different from the legacy financial system:

- USD the asset: the money of the US economy

- Fedwire network: an interbank network that settles USD transactions

Ethereum also has an asset and a network:

- ETH (or Ether): the money of Ethereum—the thing you buy on an exchange

- Ethereum network: a network that settles ETH & money protocol transactions

While Bitcoin and Fedwire only allow the settlement of value denominated in their own currencies, Ethereum allows value settlement denominated in both ETH and non-ETH value. It’s a poly-asset network. Ethereum can settle any form of digital value—imagine if Fedwire settled transactions for Euros, stocks, gold, real-estate, and rare pokemon cards in addition to USD—Ethereum is like this.

Let’s talk networks

Unlike Fedwire, the Bitcoin and Ethereum networks cannot be separated from their underlying assets. That’s because the security of these networks depend on economic guarantees secured by their assets: the higher the value of ETH and BTC the more costly it becomes to revert transactions and co-opt these networks.

As an aside, these economic guarantees are the special thing that allows digital scarcity networks to run and propagate without central operators. This was the huge breakthrough of Bitcoin. And we’ve had major protocol breakthroughs like this at other points in human history—Adam Smith’s capitalism replaced central planners. The protocol of the U.S. Constitution replaced a monarchy. The crypto protocols now replacing banks? Protocols are the fabric of civilization—they help humans coordinate. And now we have them for digital scarcity.

While Bitcoin and Ethereum are backed by similar economic concepts, their networks have different capabilities. I mentioned already that Bitcoin is mono-asset while Ethereum is poly-asset, but they’re also different when it comes to the money verbs.

On Bitcoin you can:

- Hold

- Transact

As it stands, other money verbs require the assistance of crypto banks. You can’t do them directly on Bitcoin network. Even transacting on Bitcoin may eventually be a luxury for only a small set of banks and wealthy individuals assuming block rewards continue to decrease and transaction fees rise which is the current design of the network.

On Ethereum you can:

- Hold

- Transact

- Lend

- Borrow

- Earn

- Trade

- Long

- Short

- Bet

And any additional verb the money protocols enable. This is because Ethereum includes a state-machine where money can be programmed—and the programmers are turning the banks into protocols too. Software eating the world.

The divergent paths

Bitcoin maximalists make much of the design tradeoffs of Ethereum vs Bitcoin, quick to point out the perils of base-layer programmability. Some of perils are overstated, some may have a point, only time will tell. But suffice it to say, we have two experiments running in parallel: a fully programmable money and not-so-programmable money.

And these design decisions shape the trajectory of ETH and BTC.

You can see it playing out now.

On its current path BTC is being financialized primarily through crypto banks and institutions. Exchanges are listing BTC pairs first, ETH second. There are regulated futures for BTC today, but ETH futures are still in progress. Trading platforms like BitMEX denominate in BTC, not ETH. Part of BTC’s advantage here comes from its longevity relative to ETH.

ETH on the other hand is being financialized primarily through money protocols. The ICOs of 2017 serve an example—these fundraising protocols propelled ETH to massive liquidity and network value. But the ICOs were just the first permissionless money protocol to take off. Today trading protocols like Uniswap use ETH as their base pair for all exchange. And money protocols are now creating demand for ETH as a store-of-value to back trustless currencies, synthetics, and loans.

And yes crypto banks also play a major role in financializing ETH, particularly those aligned with the mission of open finance. It’s my belief that crypto banks overall are agonistic with respect to BTC vs ETH—they’re simply incentivized to provide services for the assets most demanded by their customers. And they’ll chase that demand no matter how it’s generated.

Not to say these are all competitive. There’s plenty of synergy between BTC and ETH and between the crypto banks and money protocols. The crypto money system grows together—the only real competitor is legacy finance.

Why does this matter?

This matters because BTC and ETH have different visions of the future. The world of BTC is one of central bank diminishment but not private bank diminishment. BTC as the base money and a new breed of crypto banks providing banking services on top. In this world Bitcoin’s scarcity meme propagates until even the central banks require BTC in their vaults to bolster confidence in their failing state-run currencies.

This is a partially bankless world.

The vision of Ethereum grants a more ambitious possibility. We can disrupt the central banks yes, but we can also replace private banks with protocols. We can turn all bank functions into code, both central and private. Saving, lending, borrowing, trading—the entire money system—all bankless. And as long as the central bank monetary policies remain competitive, they too can encode their money on this public settlement network. That’s the point. Anyone can. The Ethereum network is open and neutral like the internet.

A world where all banks become code is a wilder proposition—but with more upside.

It’s no secret that I’m hoping we achieve the second vision. Not least because I believe the first vision is fragile. It can easily collapse into the system we have today, just as the gold standard collapsed. Banks consolidate. They capture. In the U.S. this private bank consolidation ultimately formed the Federal Reserve, a money system which later disbanded the gold standard entirely and has proved the ultimate ally to the bankers—a captured system. If we turn money into a protocol without turning the entire money system into a protocol, are we destined to repeat this fate?

More bankless means more self-sovereign and less prone to capture.

So ETH or BTC?

My answer is both.

They each have strengths. And different visions of the future. How you weight your crypto money investment depends on how you see this future playing out.

Will we merely achieve digital gold?

Will money protocols take off?

How bankless is our future?

The best way to answer these questions is to use these systems. Using them helps you see the future. It helps you make better bets. It helps you front-run the world.

And that’s our focus in the Bankless program.

We are the pioneers in a tale of two money systems.

Actions

- How do you see the future of ETH and BTC playing out?

Continue leveling up. $12 per month. 20% off if you subscribe before November 1.

Filling out the skill cube

By considering ETH and BTC’s path to moneyness you’re leveling up on the money layer of the skill cube. This is the foundational layer for the rest of the program. Important stuff.

BONUS

Check out my chat with Ryan Selkis yesterday.

We covered Bankless, crypto money, banks, why all the ETH killers will fail...you know...the usual stuff.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.

Ryan Sean Adams

Ryan Sean Adams