8 Projects I'm Bullish On This Bear Market

.png-a616dc52961c1edd72b0c1fdf5f47e7a.png-d44bdfd9b52d9f76131f38376a1fe385.png) Kraken - See What Crypto Can Be with Kraken

Kraken - See What Crypto Can Be with Kraken

Interest rates are up. Inflation is up. Crypto is down. How bad will it get?

We answer this question with legendary macro investor Jim Bianco 🧠

Bankless Premium members have early access right now! Tune in.

Dear Bankless Nation,

I know we’re all preoccupied with this abominable price action, but let’s not forget our mantra: crypto is in a build market.

And this isn’t any ol’ mall standard Build-a-Bear. We’re entering what will be the greatest phase of crypto development ever…

It all starts with these trends:

- A bear market that enables CEOs to think clearly from first principles.

- Cash-rich private markets that allow builders to spend less time fighting to survive, and more time building meaningful tech.

- An abundance of new surface area to build out. Whole new sectors of web3 went from 0 to 1 in 2021 — that was the hard part. Now we need clear-headed, well-financed companies to build big from those blueprints.

- A huge supply of engaged and interested users. The 2018 bear market was a ghost town. The 2022 bear feels like a relative metropolis. Crypto is retaining this time round. Its culture has matured too.

Today, I’ll highlight 8 companies building out this frontier of the crypto-verse.

They’re building some really cool sh*t and you should know more.

DISCLAIMER: I have exposure to all projects mentioned — either through angel investing or advising. This is also why I can speak deeply about the details and strategies of each project.

I built this article to be a highly concentrated download of alpha from across the crypto space.

And now it’s yours.

There are different ways to get value out of this article.

- Big-time investors and allocators: Get a pulse for the direction of emergent startups. Startups pioneer, then the industry catches up on smart money’s dime.

- Airdrop hunters 👀: You could assume each project here will have a token (remember: be a genuine user, not a farmer)

- Job seekers: I’ve included employment openings for each project for you. Tell ‘em David recommended you :)

- Crypto explorers: These projects cover ETH staking technology, specialized L2s, DeFi apps, and even projects that don’t exist on-chain. Crypto is growing in all directions at once. Keep up!

I’ve linked additional resources for each project, labeled beginner, intermediate, or expert, for diving deeper!

Each one is a rabbit hole, so you’ve got your work cut out for you, Bankless Nation!

Go dive in! 🤿 🕳

- David

🙏 Sponsor: Polygon Studios—Fostering culture across Gaming, NFTs, and the Metaverse✨

🎙️ NEW PODCAST EPISODE

Listen to podcast episode | Apple | Spotify | YouTube | RSS Feed

WRITER WEDNESDAY

Bankless Writer: David Hoffman, Bankless Co-Founder

Table of Contents

Choose your own adventure: Quick tl;dr with a link to the website to check it out. Catch the full in-depth analysis below!

Ready to dive deeper? Get your wetsuit on! 🤿

1. Obol Network

Distributed Validator Technology (DVT)

🌐 Website: Obol.tech

Obol comes first because it’s about my favorite thing ever: ETH Staking.

Obol is pioneering ‘Distributed Validator Technology,’ or ‘DVT’.

DVT is like having a multisig between a distributed set of validating nodes, enabling a new kind of validator that runs across multiple machines and clients simultaneously, while still behaving like a single validator to the network.

Instead of having backup computers on standby (in case the main signing computer goes down), DVT allows for many computers to be online and all collectively participate in private-key signing.

DVT lets you combine multiple computers into a single staking network, without the risk of accidental slashing dual-signing.

It works like this: All validators in the group come to consensus on what they should sign, and once a supermajority of the nodes produces these signatures, they are combined into a signature for the ‘distributed validator’ they operate together.

So long as most of the computers in the group are online, the shared-validator is online for 100% of the time.

This technology democratizes the ability to create competitive ETH-staking infrastructure, helping reduce network monopolies. Most people can keep their validator up with 98% uptime, but 99.99+% uptime requires highly sophisticated knowledge, as well as additional capital expenditure.

With DVT, getting to >99.99% uptime is trivial for any group of people.

This is important as the LSD (liquid staking derivative) wars progress. stETH from Lido has a significant dominance at the moment, and this dominance could turn into a self-reinforcing feedback loop as Lido professionalizes and optimizes its validator network to outcompete alternatives with economies of scale providing operating cost savings, and increased yield relative to smaller LSDs.

Obol aims to even the playing field for staking networks, by making it easy to achieve extremely competitive validator uptimes while minimizing slashing risks.

Some Obol use-cases:

A DAO wouldn't trust a single member to stake its treasury ETH, but might trust a group of members to run validators together with shared accountability.

You and your buddies might not have 32 ether alone, but together you could pool all your ETH to spin up a shared node.

A custodian might not trust a single staking operator with their client’s ETH, but they might trust a network of operators, who collaborate together via Obol tech.

How Obol Could Win Big:

- Obol becomes integrated inside every staking protocol and consumer staking software.

- Every staking-as-a-service company and protocol (Coinbase Cloud, Lido, RocketPool) distributes their validation risk with Obol and DVT.

- The quantity and quality of Liquid Staking Derivatives (stETH, rETH, etc) grows significantly and becomes highly competitive.

- ETH Staking hobbyists are able to be competitive with professionalized and competitive services like Coinbase.

Dive Deeper

- Intermediate: Tackling the Staking Problem 📄

- Intermediate: Obol presentation @ DevConnect 📺

2. LI.FI

L2 Bridge & DEX aggregator aggregator

🌐 Website: LI.FI

“9 Bridges, 15 Chains, and all the DEXs”

The number of both assets and chains in DeFi will increase by an order of magnitudes over the long growth of DeFi.

LI.FI is building a mesh-network of liquidity between every asset on every EVM-compatible chain.

We’ve got DEXs like Uniswap and Sushiswap. We’ve also got DEX aggregators like 1Inch or Matcha. We’ve also got many EVM chains, like Optimism, Arbitrum, Avalanche, and Ethereum. We’ve also got many bridges between all these EVM chains, like Connext, Hop, and AnySwap.

So as a user, you’ve got ETH on Ethereum, but you want BNB on Binance Chain. Or you’ve got DAI on Avalanche and you want USDT on Polygon. Because there are 9 different bridging protocols, and more DEXs than you can count, there’s more permutations for getting from Chain A with Asset X to Chain B with Asset Y than what you want to manage.

LI.FI automates all of that complexity. It finds the best route, with the most liquidity and cheapest fees to get you and your money where you want to go, for the least cost.

It’s a DEX aggregator, built on top of a bridge aggregator, that makes complex transactions very simple.

Try out LI.FI here.

How The LI.FI Gameplan Wins DeFi:

- LI.FI becomes the liquidity mesh network between assets and chains in the infinite-asset, multi-chain world.

- Applications integrate LI.FI’s widget to easily plug into capital flows throughout the crypto-verse.

- The complications of holding assets across multiple chains are eliminated wholesale

- Li.FI becomes the solution to navigating all the apps across all the chains without leaking capital to high fees or slippage along the way.

Dive Deeper:

- Beginner: Intro to Li.Fi

- Advanced: Bridging: Trust is a Spectrum

Get Hired:

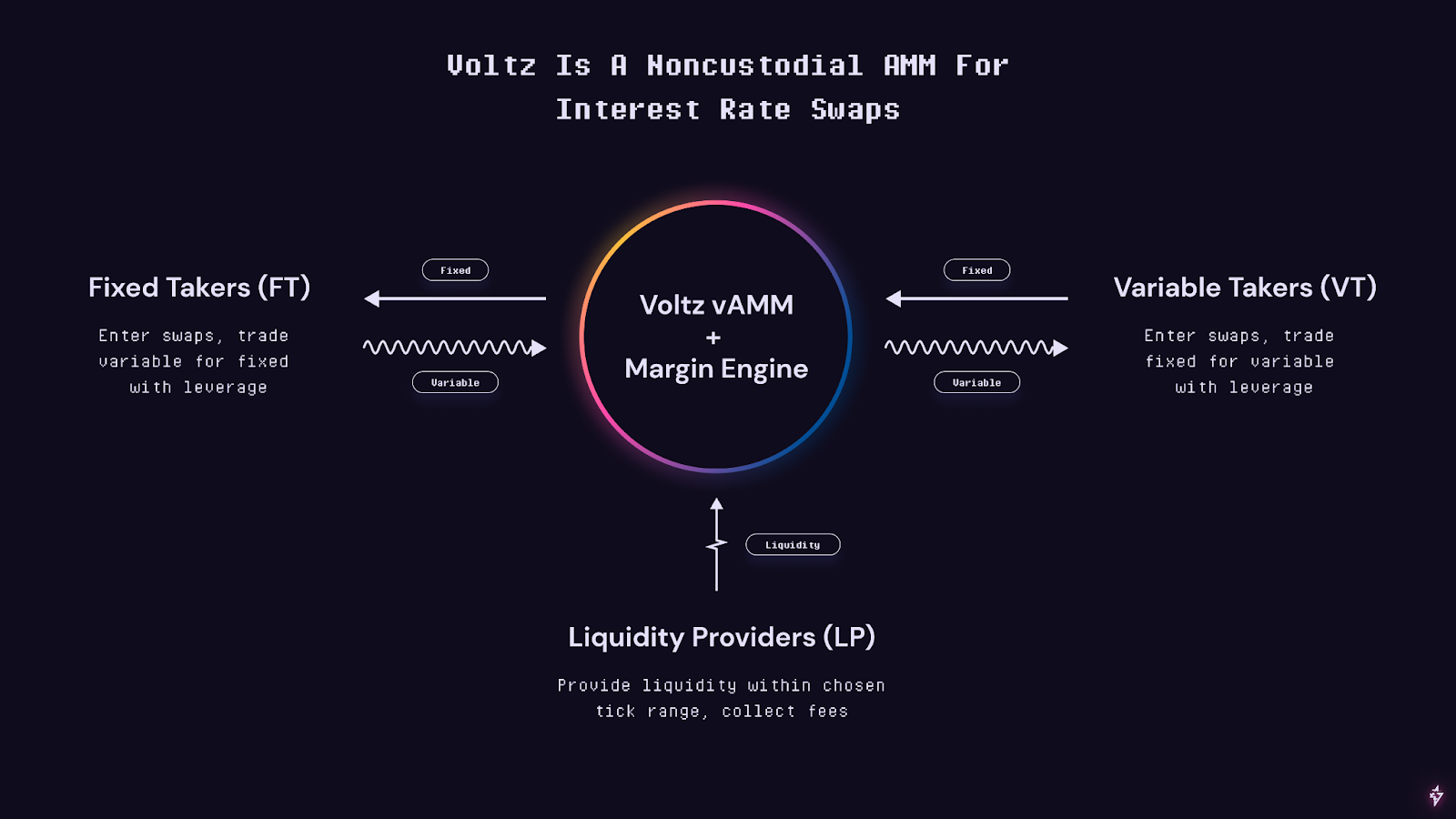

3. Voltz

Internet Rate Swap AMM

🌐 Website: Voltz.xyz

Voltz is an Interest Rate Swap AMM. Voltz takes Uniswap V3’s liquidity engine and builds an Interest Rate Swap market.

Voltz Protocol allows you to trade interest rates, with leverage. With Voltz, you can exchange ‘variable rates for fixed rates’ or ‘fixed rates for variable rates’.

Here’s how the two sides of the market work:

Fixed Interest Rate Buyers (and variable IR sellers)

- Alice owns $10,000 worth of cDAI, which currently has a variable rate of return of 10% APY

- Alice doesn’t want to risk seeing that rate drop, so would rather fix the rate for 90 days

- Alice comes to Voltz Protocol and enters the 90-day cDAI pool, where the fixed rate is currently 10% APY

- Alice deposits her $10,000 worth of cDAI and locks in the 10% APY for the next 90 days

Variable Interest Rate Buyers (and fixed IR sellers)

- The current variable APY of cDAI is 10%, the fixed rate of the Voltz Protocol 90 day cDAI pool is also 10% APY

- Bob believes the rate of cDAI will increase to 20% and wants to lever his exposure to this potential upside

- Bob enters a swap by depositing $10,000 DAI in margin and choosing leverage of 15x

- This gives Bob a notional exposure of $150,000 to the underlying rate of cDAI minus the fixed rate of Voltz Protocol AMM at the point he enters the swap (i.e. 10% in this example)

Yield is probably crypto’s biggest use-case after money, and Voltz provides an infrastructure to build more powerful and expressive financial products around yield-bearing assets.

There is so much development left in the financialization of (post-merge) ETH as the native internet bond market. Voltz is positioned to be providing sophisticated financial tooling around ETH, or any yield-bearing asset in DeFi.

Liquidity Providing

Voltz is a fork of Uniswap V3, making Liquidity Providing a core part of the Voltz system. Instead of LPs providing liquidity inside a price range, Voltz LPs provide interest rate liquidity inside a range of interest rates.

Same same, but different.

No Impermanent Loss

Voltz marketplaces are trading interest rates, not assets. Voltz LPs only have to submit one asset into the pool; as a result, LPs don’t have the risk of impermanent loss since they’re only depositing one asset. The IL risk is instead now “Funding Rate Risk”, which is a risk of a different type; details are in the Voltz litepaper.

Here’s How Voltz Wins Crypto Derivatives:

- Voltz opens up DeFi to the massive market of Interest Rate Swaps, and eats into the $1,000T of interest rate swap volume that takes place in TradFi each year.

- New markets are created, allowing traders to synthetically trade rate exposure across any asset with a variable rate of return

- Global interest rates markets stop being driven by central bank policies, and instead are market driven based on supply/demand dynamics in DeFi

- Long Game: Voltz Protocol becomes a generalizable derivative protocol that expands beyond interest rate swaps and crypto to girding global derivatives markets

Dive Deeper

- Beginner: Voltz Overview

- Advanced: Read the Litepaper

Get Hired:

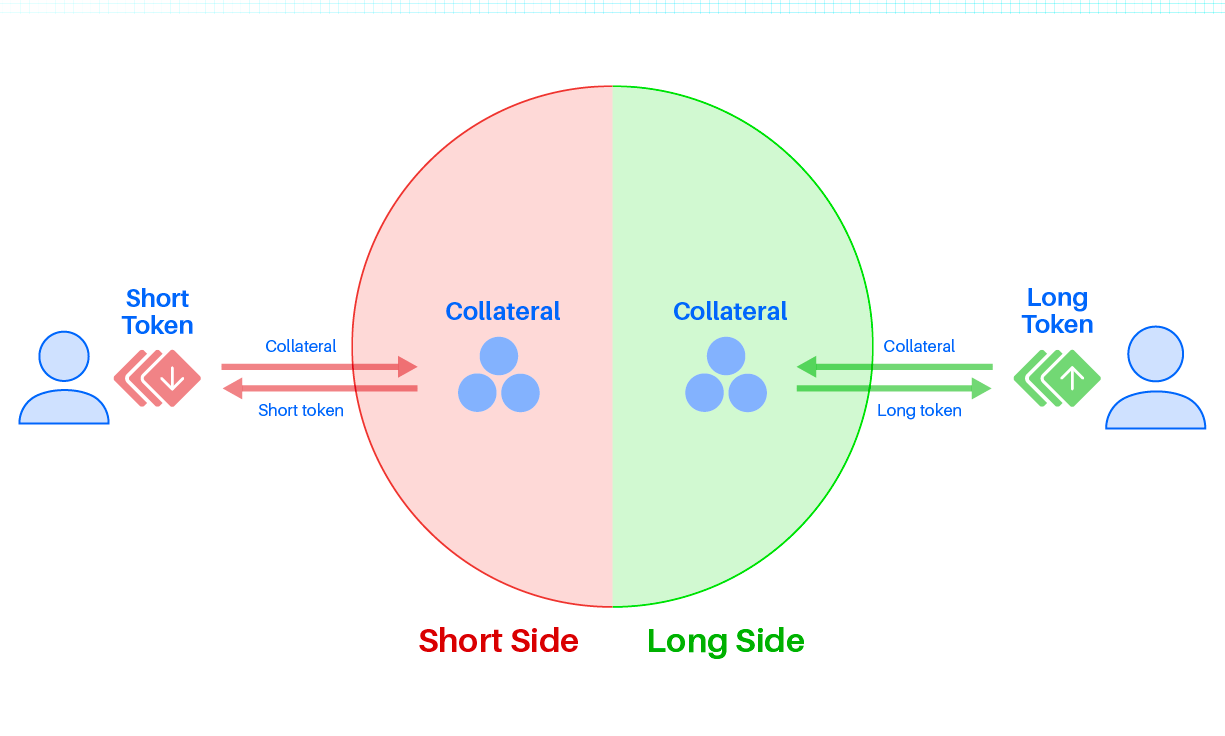

4. Tracer

Derivatives Meta-Protocol

🌐 Website: Tracer.Finance

Tracer is a meta-protocol for derivatives.

There are so many possible derivatives products, and Tracer is making Factory Contracts (templates) for all of them.

Derivatives are already a massively popular product in crypto, but the current derivative protocols have not yet unlocked the full power of DeFi.

For example, dYdX is a popular perpetuals marketplace, but it’s siloed and permissioned. It’s basically a non-custodial centralized exchange, not fully DeFi. This is true for most crypto derivative protocols.

Tracer takes derivative products and imbues them with the full might of DeFi.

I think of Tracer as ‘the Uniswap of derivatives’. Uniswap can make a market around any token, and Tracer can produce a derivative around any asset.

Each TracerDAO product comes with a Factory Contract. Using Tracer’s factory contracts, any price or data feed can be turned into an option, swap, or future product.

Plug in the oracle → generate a derivative.

Permissionless market generation empowers DeFi with a new tool in the toolbelt, rather than having to ask a centralized perpetual provider to list a new marketplace. If the market wants it, it can make it happen on Tracer.

Product #1: Perpetual Pools

Crypto loves Perpetual Swaps. A perpetual swap is a derivative product that lets you bet on price movements with very little capital. Essentially, margin trading.

But with Tracer, Perpetual Swaps evolve into Perpetual Pools, which instantiates a Perpetual position into a token, unleashing that token to the full potential of composable DeFi (something that dYdX or other perpetual markets cannot do).

Tracer’s Perp Pools V2 recently launched, bringing pool token optimizations to be better collateral in DeFi, such as reduced volatility decay (good for long-term holding!)

Tracer Factory Contracts

Perpetual Pools are just the tip of the iceberg for derivative products. Future Tracer products include Options, Interest Rate Swaps, Futures, and Structured Products.

Each Tracer derivative product is going to come with its own Factory Contract. Factory Contracts are where individual marketplaces are ‘minting’. If you’ve ever minted a Uniswap marketplace, then you’ve interacted with Uniswap’s ‘factory contracts’

TCR governs the Factory Contracts. While each individual Tracer market is meant to be governance-immune and trustless, the template for producing Tracer markets is where the DAO steps in.

In the same way that Yearn governs over strategies for yield farming, Tracer governs over its derivative templates.

If you believe the thesis that DeFi will completely replace all previous forms of finance, it’s hard not to be bullish on DeFi-native derivatives infrastructure which offers the same products as TradFi, but with all the perks of DeFi.

The TradDerivatives market is estimated at over $1 quadrillion. Imagine what happens when you add in financial composability to TradDerivatives.

How Tracer Wins Tokenized Derivatives:

- TracerDAO’s tokenized derivatives products offer vastly improved capital efficiency, by being composable in DeFi. The capital efficiency leads to TVL capture by Tracer, as traders can simply do more with $1 of capital inside Tracer.

- Tracer’s Factory Contracts enables the long-tail of assets to access sophisticated derivatives products, enabling it to capture marketshare and mindshare of the broader crypto community (just like how Uniswap did).

- The volatility of the metaverse becomes controllable, enabling DeFi treasuries, DAOs, and individuals to think in long-term time horizons

- Real-world commodities (water, oil, real-estate) can access global derivative markets to create new financial products unlike anything possible in TradFi (Short Manhattan, long Brooklyn! Short 2-bedroom apartments, long single-family homes! Short BAYC, long Cryptopunks!)

Dive Deeper

- Beginner: Tracer’s Perpetual Pools ELI5`

- Beginner: Tracer DAO: The Future of Derivatives 📄

- Beginner: Why [Ryan & David] are Bullish Tracer 📺

- Intermediate: Introducing Tracer Perpetual Pools V2 📄

- Advanced: Tracer Research papers 📚

Get involved by joining the DAO!

5. Blocknative

Real-Time Infrastructure for the Pre-Chain Layer

🌐 Website: Blocknative.com

Before transactions are executed in a blockchain, they live in this weird limbo-state called the ‘mempool’, aka the ‘pre-chain’. Validators select transactions out of the mempool, order them inside a block, and then add the block to blockchain.

The mempool is a crazy, chaotic, and highly adversarial place. It’s a dark forest.

Blocknative is working to illuminate the dark forest of the mempool. The easiest product to explain is their Gas Estimator, which has become the new industry standard. Previous gas explorers looked at the average gas price of most recent blocks, in order to estimate what gas is needed to get your transaction executed. The problem is this is looking at historical data to predict future gas prices, so it’s always a best guess.

The Blocknative gas estimator looks at the gas fees of transactions in the mempool, which is basically reading the future, from the perspective of the blockchain. The pre-chain layer is also the future-block layer, so if you want to predict what future blocks will look like, you need to be looking at the pre-chain layer.

Blocknative’s Gas Estimator is merely a cute byproduct (with convenient illustrative qualities) for what Blocknatives true potential is: infrastructure for block producers to front-run the opportunities

Mempool Explorer

Etherscan is a block explorer. Once blocks are added to the chain, Etherscan can view them.

Blocknative is a Mempool Explorer, allowing people to parse through the much more complex and convoluted world of the pre-chain layer.

These things don’t look the same. Block explorers have the luxury of only looking at data that the entire globe has already come to consensus on. Mempool explorers have to listen to and report every possible future transaction,

You can use it to monitor smart contracts, watch whales on your favorite DeFi protocol, or watch your own wallets.

You can take it for a spin at blocknative.com/explorer, to visualize the mempool and compose queries.

Transaction Simulation and Bundle Preview

The Simulation Platform lets someone generate real-time simulations of bundles of transactions against the current state of the chain. It feeds transactors information about what the output of their transaction is (likely) going to be before they even execute it.

For on-chain trades, the Simulation Platform helps ensure you leak the minimum amount of value to bots and front-runners, and for DeFi protocols, they can load preventative transactions when an incoming malicious transaction is detected. For example, a protocol can use BlockNative to scan the mempool for any transaction that drains a specific contract address of its assets. If the simulation sees a transaction that will drain an address, the protocol can automatically trigger a front-running transaction to prevent it.

Here’s an actual GIF of DeFi apps frontrunning malicious transactions using BlockNative:

For those that have seen the movie Minority Report, BlockNative is like the precogs that can see things before they occur:

How Blocknative Wins Transparency:

- The mempool blockchain infrastructure becomes as sophisticated as the actual blockchain explorer infrastructure.

- The Searcher → Builder → Proposer sequence becomes highly optimized and lucrative (ultimately benefiting ETH-stakers the most)

Dive Deeper

- Beginner: Why the Mempool Matters 📄

- Intermediate: An Introduction to the Web3 Transaction Cycle 📄

- Advanced: Beginner’s Guide to an MEV Bot: Creating an Arbitrage Bot on Ethereum Mainnet 📄

Get Hired:

6. Euler

Governance-Minimized Money Market

🌐 Website: Euler.finance

Euler is a money market protocol like Aave, Compound, or Rari, which is a pretty competitive market to try and penetrate!

While Euler has some steep competition, it’s also got a few tricks up its sleeve to differentiate itself from other apps.

Euler combines the asset availability of Rari Fuse pools, with the capital efficiency of the single shared liquidity pool model of Aave or Compound.

Permissionless Asset Borrowing/Lending

Euler allows any asset with an ETH Uniswap V3 pair to be available for borrowing or lending. Euler uses Uniswap V3 as an oracle for asset prices, with a time-weighted average price algorithm.

Permissionless asset listing is extremely risky for money markets; we don’t want good collateral with bad debt.

EUL governance controls this risk with fee tiers, and governance can elevate assets up the tier list (which is a desirable place for tokens to be).

- 🔴 Isolation-Tier assets require their own specific collateral deposits. If a user wants to borrow isolation-token XYZ, they need to put up collateral (ETH, DAI, etc), and this deposit can only be collateral for token XYZ.

- 🟡 Cross-Tier assets can share collateral between them. Both tokens ABC and XYZ and be borrowed against ETH, DAI, etc.

- 🟢 Collateral-Tier can be used as collateral to borrow against any asset from any tier.

🧠 The properties that makeup good Collateral-Tier assets are the same as the properties of good money. Liquid, demanded, decentralized, with a high market-cap. Some non-money DeFi assets can even access these properties; we label those ‘Blue Chips’.

Control-Theory Interest Rates

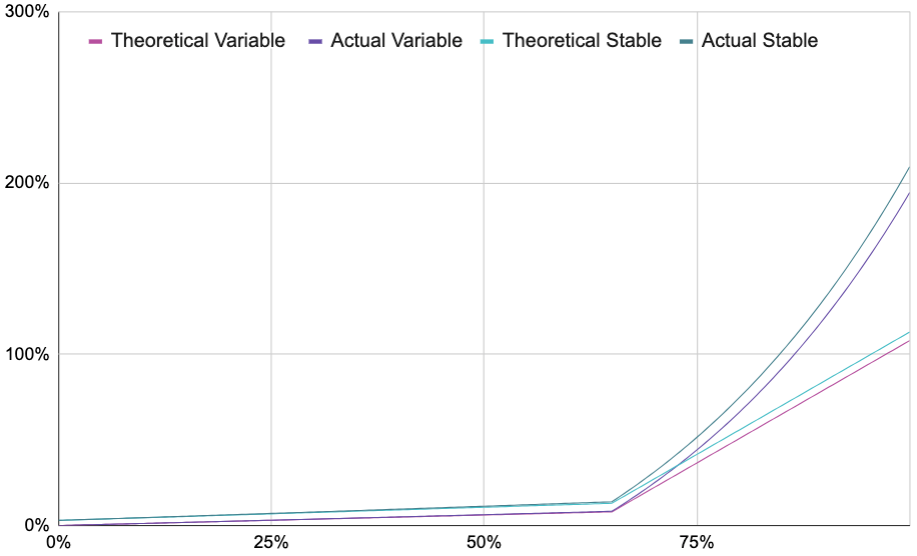

Typical money markets have interest rates that are set by a rigid, one-dimensional algorithm. As the utilization of an asset increases (the percentage of deposits that are borrowed by borrowers), interest rates increase according to a fixed curve.

For example, here’s the ETH curve inside of Aave:

The rigid line creates a yo-yoing effect of ETH utilization around the true market-desired utilization of an asset. The market is constantly under and over utilizing ETH, creating inefficient overall utilization of the asset by the market.

You can see a simulation for a fixed-algo interest rate model here:

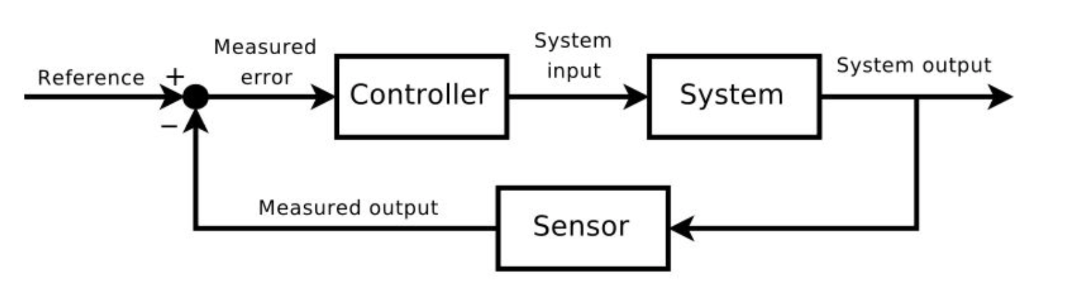

In contrast, Euler uses a PID Controller for setting market interest rates.

A proportional–integral–derivative controller (PID controller) is a control loop mechanism, using its own feedback signal to establish an equlibrium.

An everyday example is the cruise control on a car, where ascending a hill would lower speed if constant engine power were applied. The controller's PID algorithm restores the measured speed to the desired speed with minimal delay and overshoot by increasing the power output of the engine in a controlled manner.

Wikipedia: PID Controller

Euler sets interest rates using a self-referential algorithm to produce its interest rates, similar to how RAI from Reflexer sets its own price.

This enables a bottom-up, market-established equilibrium for interest rates, rather than a top-down human-determined fixed algorithm.

Notice what happens when the set-point is allowed to break free from a fixed line:

Euler’s model is making huge optimizations to both asset availability and capital efficiency in the borrowing and lending space.

Improved Liquidation Mechanism

Euler employs a dutch auction-styled liquidation mechanism. On Compound and Aave, liquidators are awarded a percentage of the collateral, which for extremely large positions can produce massive rewards for liquidators, but penalizes large depositors.

The costs of liquidation are mostly fixed; the gas cost to liquidate a 100m position is the same as a $1,000 position. In Euler, the reward for liquidations starts at $0, and slowly increases upwards until a liquidator steps in and accepts the offer.

This should reduce the amount of over-collateralization required by depositors, since the liquidation penalty is minimized, improving the capital efficiency of the system.

How Euler wins lending:

- New assets are uniquely enabled by Euler to access borrowing and lending opportunities not previously offered by previous alternatives.

- Even assets that already have borrowing and lending opportunities can find higher ultilization (and therefore fees) in Euler

- Generally, more assets are capable of accessing more opportunities in DeFi, increasing the net utility of the entire DeFi landscape.

Dive Deeper

- Beginner: Euler’s Approach to Disrupting the Incumbents

- Intermediate: Euler Whitepaper

7. Aztec Network

Privacy-focused Layer 2

🌐 Website: Aztec.Network

Aztec Network is a L2 Rollup with a very unique flavor.

A simple, overly-reductive explanation is: Zcash, but as an Ethereum L2.

The Aztec network acts as a privacy shield for ERC20 Token transfers and other DeFi Interactions. You submit your tokens to Aztec the same way you do for any other L2, but once a deposit is included in a rollup block, the user has minted a set of UTXO notes representing the number of deposited tokens.

UTXO = Unspent Transaction Output

Bitcoin and other blockchains use the UTXOs model. Simply, UTXOs are like arbitrarily-denominated cash notes which are owned by a set of private keys.

Account models are more like bank account where your balance increases or decreases

Once the tokens are inside the Aztec network, all subsequent transfers are confidential and anonymous. Sender and recipient identities are hidden, transaction amounts are encrypted, and network observers can’t even see which asset or service a transaction belongs to.

Aztec Connect

Aztec Connect allows users to bring privacy-shielded zk-assets on Aztec to the public DeFi protocols on Ethereum.

Aztec Connect is essentially a virtual proxy network (VPN) for Ethereum users: when users interact with DeFi services like Lido and Element, Etherscan shows “Aztec Private Bridge Contract” as the originating address. Like a VPN, Aztec Connect hides the originator of the transaction and fully preserves user privacy, while also building in gas cost reductions by batch processing user actions.

Users with zk-assets on Aztec cause use the Aztec Bridge Contract to engage with DeFi apps on their behalf. Aztec Connect then goes and engages with DeFi on users behalf, and returns the output of a transaction with a DeFi app back to the bridge contract.

Because a user lives on an L2 while engaging with L1 DeFi apps, users are able to gain scalability and privacy at the same time🤯

You can access private DeFi soon with services like Lido and Element using Aztec’s first-party private DeFi aggregator, zk.money.

You can send ETH privately using Aztec here.

Dive Deeper

- Beginner: Meet the Nation video w/ Founders 📺👀

- Intermediate: Epicenter Podcast - Bringing Scalable Privacy to DeFi

- Intermediate: Cheap Privacy with Aztec 📄

Get Hired:

8. Disco.xyz

The Off-Chain Internet

🌐 Website: Disco.xyz

Disco is a project unlike any other. It’s going to open up an entirely new dimension in Web3 that people don’t even know exists yet.

It’s going to turn the Metaverse of finance (where we currently are) into the Metaverse of fun (where we want to go).

Disco is your data backpack for the Metaverse. It’s where you can store credentials of your participation in DAOs, engagement with DeFi apps, or completion certificates of educational courses. Anything that is a verifiable credential of something, can go in your Disco backpack.

Your Disco Data Backpack is where you store your social capital. All the achievements, awards, certifications, attestations other otherwise identifying bits of data, can go into your data backpack and become objects that the metaverse can interact with.

Don’t issue my college diploma on a blockchain; give it to me as a verifiable credential. That way, I can choose to disclose it at my own will, rather than forcibly disclosing it by hosting it on a public, transparent, global ledger. Plus, let’s not waste gas fees on things we don’t need.

With our Disco Data Backpack, we can start collecting attestations about the things we’ve done and the identities we represent.

I’ve probably listened to The Sheepdogs more than anyone reading this sentence. It would be awesome to have that status issued to me as a credential, so when I go to my next Sheepdogs concert, they could treat me like the world’s greatest fan that I am.

Or maybe as a DAO worker, I’d like to have my verifiable contributions in one DAO be recognized by a different DAO. I can collect a verifiable credentials like how Ash Ketchum collects gym badges, and verify my actions, behaviors, achievements, and identity to the world.

Your Disco Data Backpack isn’t beholden to any one set of private keys. You can freely swap out the private keys to your data backpack, relinquishing your identity from being tied to one single Ethereum address, and uprooting it from a maximally transparent, global ledger.

Your public Ethereum address is your body. It’s where you put on clothes, jewelry, tattoos, or other publicly identifying information.

But your decentralized identifier is your soul. Your soul is hidden from everyone, and the only thing that has the power to disclose what’s in your soul is you.

Don’t put my health records on a blockchain. Blegh.

Give it to me as a Verifiable Credential, so I can keep that shit private and off of public ledgers.

While everyone is focusing on building public blockchain infrastructure for shared protocols, Disco is helping color in the space between the chains in a way that appeals directly to people.

The Data Layer Between Web2 and Web3

VCs and DiDs are decentralized technologies. There is no central host. While Disco is a service provider for VCs and DiDs, Disco is just one player in the stack.

VCs and DiDs are just merely a standard. Disco is the first platform to leverage these standards in a Web3 identity play. The more people that adhere to that standard, the larger the network becomes — kinda like ERC-20s and crypto tokens.

And check this out: VCs and DiDs are not locked inside the Web3 universe; Web2 protocols can use them too!

These technology standards are simply rooted in cryptography, and since VCs and DiDs are not rooted to the chain, they can interoperate across the entire internet stack.

Through this technology, we can finally shift the power-structures of our Web2 apps to be more user-centric, rather than being Zuck-centric!

Dive Deeper

- Beginner: The Off-Chain Internet: Verifiable Credentials and Decentralized Identifiers 📺

- Beginner: The Social Web3 📺

- Intermediate: Soulbound: On or off Chain? | Vitalik B. and Evin McMullen 📺

📚 Action Items

- Form your own opinion on the above projects (DYOR!)

- Consider which app is most likely to have an airdrop & use it!

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

POLYGON STUDIOS

Polygon Studios is on a mission to help build digital culture, play-to-earn gaming, NFTs, and the Metaverse ecosystem on Polygon. Some of the key projects supported by Polygon Studios include The Sandbox, Skyweaver, Big Time, Crypto Unicorns, and Decentraland—among others. Polygon Studios also helps fundraising & onboarding. Check it out here.

Stay updated on the latest amazing gaming, NFT, and metaverse projects:

👉 Join the Polygon Studios Discord

👉 Follow Polygon Studios on Twitter

Want to get featured on Bankless? Send your article to [email protected]

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

David Hoffman

David Hoffman

.png-a616dc52961c1edd72b0c1fdf5f47e7a.png-8359976fdb0656215e306b0de9208da8.png)